A guide to Rv Investment having Complete Timers

If you have checked-out the costs regarding RVs recently, it’s no wonder of many have confidence in Rv financing. Having full-timers, high cost usually mean substitution its mortgage repayment having an enthusiastic Rv commission. Now we’re going to make you a guide to Rv funding to have full-timers to produce your next Camper pick quite simple.

Why is it Difficult to get Funded since the the full-Date RVer?

When banks financing large volumes of money, these are generally getting a large exposure. These are typically looking for balances and you can consistency to be certain you could pay right back the loan in full. These exact same banks also want a guarantee that in case consumers prevent making repayments, they could repossess the new Camper.

The full-go out RVer can take their Rv around the world, making it tough, maybe even hopeless, to your lender to track them down. Many complete-timers sell their homes just before showing up in street, which can be a primary warning sign getting a loans department.

RVs score classified because deluxe factors. When you find yourself trucks and land is actually basics, RVs are not. For this reason, banking companies often have alot more stringent conditions when it comes to approving financial support for RVs. But not, some preferred finance companies will loans complete-date RVers.

Who Cash Complete-Date RVers?

Of a lot RVers present matchmaking which have local borrowing from the bank unions into the expectation out of going complete-date. Borrowing from the bank unions is also approve you for an Rv loan at a beneficial great interest rate. For those who have a professional experience of a neighbor hood borrowing from the bank union, it might be better to talk with her or him basic.

Highest finance companies such as for example You Lender, Bank out of The usa, and 5th Third Financial are common preferred capital choice. These large agencies could have alot more hoops on exactly how to diving thanks to, however, they are great alternatives for Camper financial support for complete-timers. A few of the big banking companies is generally a lot more unwilling to accept your, however, they will deliver the reduced interest levels.

What exactly do You need to get a loan?

Earlier taking a trip Rv dealerships, there can be a handful of things you can do to increase your own recognition possibility. Let us search!

Good credit Get

Because the RVs was luxury affairs, the lowest credit history may bring about a denial. Thus, if you’re looking to track down a keen Rv loan soon, it is better not to submit an application for virtually any investment before the purchase of Camper.

When you yourself have a low credit history, start cleaning your own borrowing from the bank before applying for a financial loan. That loan denial can be hurt your chances of acceptance as it will need several difficult borrowing from the bank checksing on the funding techniques which have a credit rating can make getting a smoother money process.

Number out of Into-Time Payments

Tabs on for the-big date payments is important to own protecting Rv financial support getting full-timers. You don’t wish missed otherwise later money on the credit history. Financial institutions might be hesitant to financing money when they find an effective history of failure while making toward-go out payments.

If you find yourself there are some methods to boost your credit rating quickly, there’s absolutely no magic pill getting an eye on late repayments. A belated or skipped percentage may take doing 7 years to-fall regarding your credit score.

Evidence of Income

Finance companies want to know that you are not overextending oneself by purchasing an enthusiastic Camper. Make sure to can provide proof of income. Many financial institutions will need a career to have a year or higher, according to the variety of condition. Like, earnings from independent designers have a tendency to does not number while the money when it involves loan approvals. Ergo, you want an extended work history to display stable proof of earnings.

A deposit

Among the best an effective way to raise your likelihood of providing recognition getting an Rv loan is by placing off a huge down payment. Financial institutions like off costs, as they have been an indication of economic stability and you may obligation.

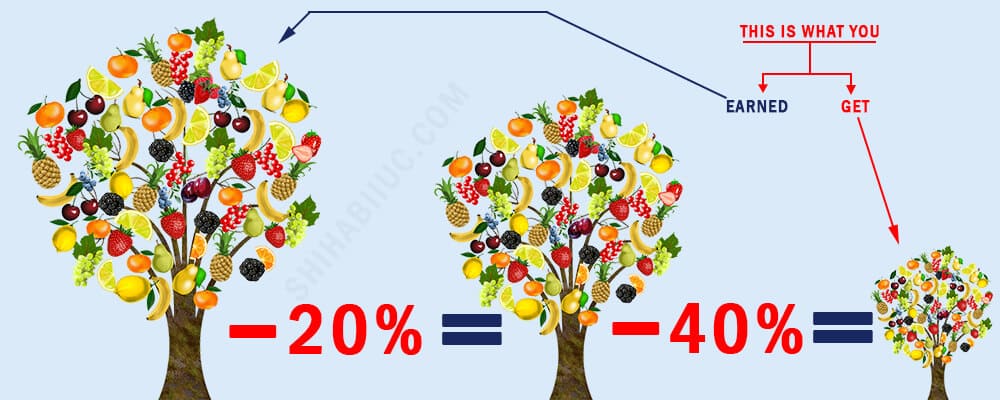

When you find yourself incapable of get approval, putting off a massive deposit normally considerably boost your chance. Off repayments are also beneficial for the fresh buyer since it assists beat negative collateral because RVs depreciate rapidly. edd loan Unfortunately, it’s not hard to are obligated to pay over an enthusiastic Camper will probably be worth immediately following the initial 12 months, particularly when there’s almost no down-payment.

Exactly what Credit score If you had to find Camper Capital?

As finance companies take a look at RVs since the luxury products, it may be much harder to locate an Camper financing. Investopedia indicates targeting a get regarding 700 or higher before obtaining an Rv loan. In case the credit history isnt significantly more than 700, you will find several steps you can take today to simply help easily enhance your get.

You should never get something that need a credit assessment about forseeable future. Numerous credit inspections on your own credit history is actually a red-flag so you’re able to lenders. It is going to reduce your get, and you also require every area you can buy in terms so you’re able to Camper resource.

Another great solution to alter your credit score should be to shell out of consumer debt. Huge amounts regarding consumer debt you are going to rule so you can banking institutions which you are able to has a tough time making costs.

It could take weeks to really get your credit score so you can an acceptable get to possess lenders, however it is really worth the energy. A better credit rating setting all the way down rates, and therefore saves your money eventually. If for example the credit rating was large, banking institutions are likely to agree your but only with a high-interest or big down-payment.

In the event that you Funds The Rv as the full-Timekeeper?

Of numerous full-timers imagine you really need to go into the full-time lifestyle that have as little loans that one can. But not, others say becoming responsible whenever capital makes the life-style you are able to for many more individuals.

Since the many complete-timers promote their homes prior to showing up in highway, they frequently use the collateral to settle its Camper loan. It means a lot fewer and lower costs while they are RVing.

Navigating the world of Rv financial support should be an adventure during the itself, it need not be. For people who dream about hitting the highway full-time in an Rv, initiate preparing now for the credit processes. Starting the tough performs now can make the procedure convenient when it comes time for you money your dream Camper. Exactly what info are you experiencing having other RVers in terms so you’re able to Rv financial support for full-timers?