Really does Ally Lender Promote Home loans in my own Urban area?

It’s been a great roller coaster to possess Ally’s financial choices. Friend Bank began given that a department off GM for the 1919, growing auto loan investment in order to a wider assortment away from people. Friend circulated its first-mortgage choices regarding mid-eighties. But not, inside latest construction crisis, the firm grabbed large attacks so you can its mortgage business. The new losings was indeed so significant you to Friend . By the , they had prevented providing people the fresh new financial activities. But in later 2015, Ally announced the propose to re-go into the financial world. Friend House, the business’s direct-to-user home loan offering released during the .

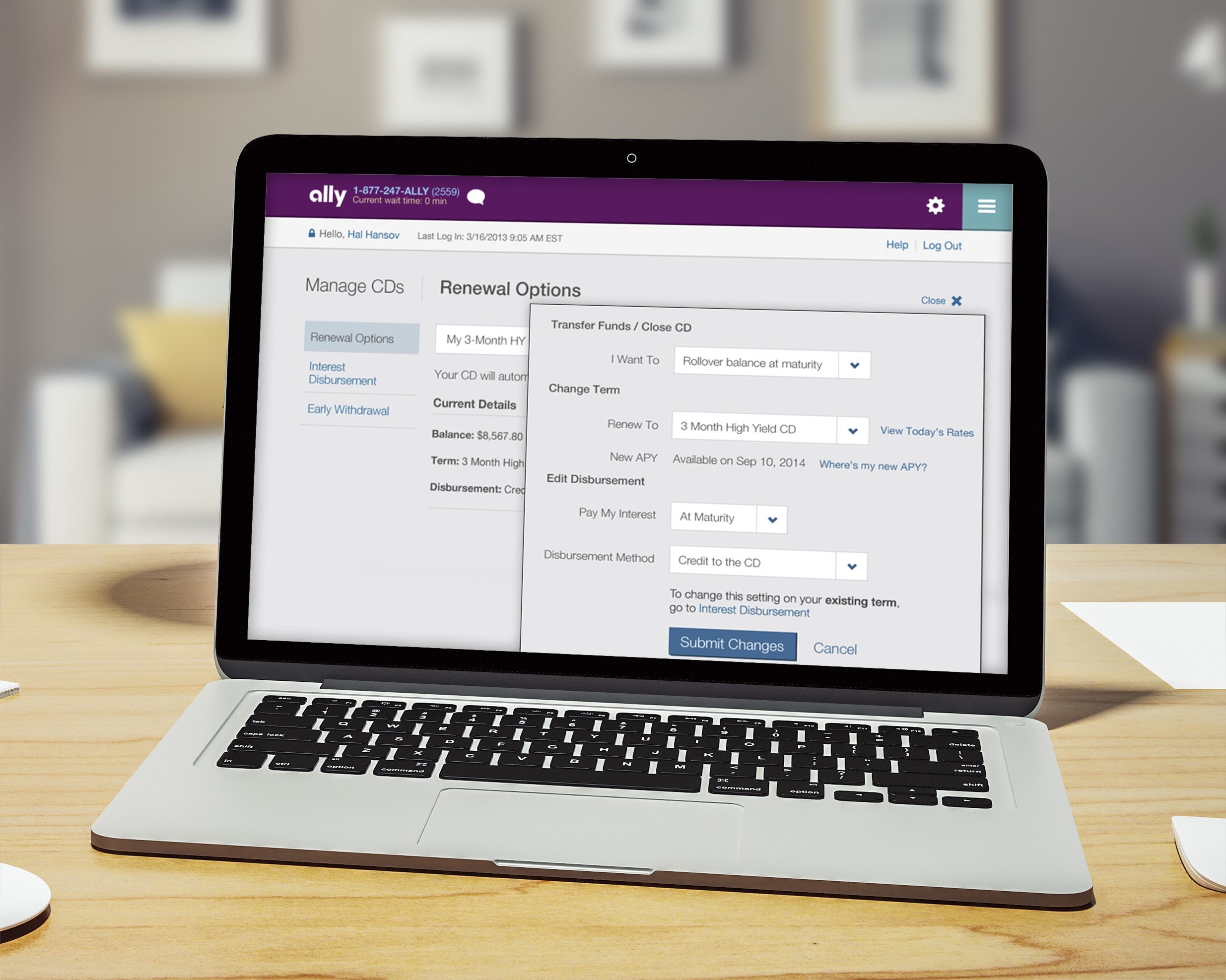

Plus Friend Domestic, the company also provides a great deal of almost every other financial products and you will services across the financial, handmade cards and assets. Ally Lender works completely on the internet, meaning there are not any physical locations where you can visit. Although not, without having any branches requiring servicing, Friend is able to provide some of the finest costs and you can things.

Countries Served by Ally Bank Home loan

Ally Lender also provides mortgages during the forty claims, plus the Section from Columbia. The organization will not originate mortgage brokers when you look at the Hawaii, Massachusetts, pshire, Ny, Las vegas, Virginia, North carolina and you can Wyoming.

not payday loan Chester Center, since an internet-merely lender, Ally doesn’t have actual towns. And then make right up for this, Friend enjoys a quickly navigable web site and you may nearly twenty-four/eight support service supply over the telephone. That being said, whenever you are a person who strongly would rather meet with financing mentor or lender member in person, Ally Financial is likely maybe not the mortgage bank for you.

What sort of Financial Ought i Rating That have Ally?

Fixed-price home loan: A predetermined-price mortgage work how it may sound: the interest rate remains the same in the life of the mortgage. Typically the most popular choices are the fifteen-year and you may 29-season terminology. Ally also offers those people identity lengths, together with terms of 10, 20 and you can 25 years, for every with their very own rates and you will annual fee prices. A fixed-rate mortgage will bring recommended for all those seeking stay in their residential property for a longer time of time with regular mortgage repayments.

Adjustable-speed financial: An adjustable-rates mortgage, otherwise Case, normally starts with a comparatively low interest getting a flat number of years. Following this introductory period, the rate will vary based on their list. Because of this will ultimately via your home loan, you can make the most of an extremely low-rate. However, the exact opposite is also real, where you are able to end up getting a higher rate. Fingers have a tendency to work best for individuals who propose to flow or re-finance within this many years.

When you have a look at Fingers, it is not as simple as discovering the fresh new mortgage’s name duration. Instead, a couple numbers will be given. The original number claims along the latest introductory period when you are next signifies how often the interest rate will be different. The most famous Arms title is the 5/step 1 Arm. It means the latest basic interest resides in location for four age thereafter, the speed often readjust each year. Friend Financial offers 5/1, 7/step 1 and you can ten/1 Palms, per featuring its individual interest rate and Annual percentage rate.

Jumbo mortgage: An excellent jumbo financing is actually that loan greater than the fresh conforming financing restrict to own unmarried-family unit members homes inside the a specific county. In the most common of the country one limitation was $548,250. Here is the restriction matter you to a great Freddie Mac otherwise Fannie Mae financing normally straight back. Although not which matter can transform depending on the county and you will condition you are looking to buy property during the. In a few highest-rates counties, the fresh restrict is higher. By taking away home financing that is higher than the brand new restriction, you will find an effective jumbo loan. That have Friend Lender, you can purchase all fixed-rate otherwise adjustable-speed mortgages because the a jumbo loan.