Virtual assistant money try popular with folks who are qualified because of one’s reasonable bucks must personal

Even in the event you may have read the definition of no closure cost financing, the fact is that every mortgage loans come with closing costs. There is certainly simply no way up to it. There are bank closing costs and you can non-lender settlement costs had a need to would some features and you will access records away from individuals businesses. A loan provider fee was an enthusiastic underwriting otherwise assessment percentage when you find yourself a non-financial costs might be something similar to name insurance or lawyer fees.

There’s no currency off called for that have good Virtual assistant mortgage, which certainly assists in maintaining bucks to close off down. Concurrently, experts are minimal regarding spending certain types of costs. An experienced dont pay for legal counsel percentage or escrow costs but can pay for anyone else. Exactly what charge can this new seasoned pay?

Next, having a keen $8,one hundred thousand credit to the buyers, there can be a problem with the fresh new assessment

Veterans are able to afford an appraisal, credit history, label loans Ramah insurance policies, and you can associated identity charges, an enthusiastic origination commission if the expressed while the a share of your own mortgage amount and a tracking payment. During the states in which a study is needed, an experienced is additionally permitted to pay money for a study. All else have to be taken care of from the anybody else. Loan providers tend to make reference to this new acronym Stars whenever estimating settlement costs. Who will pay?

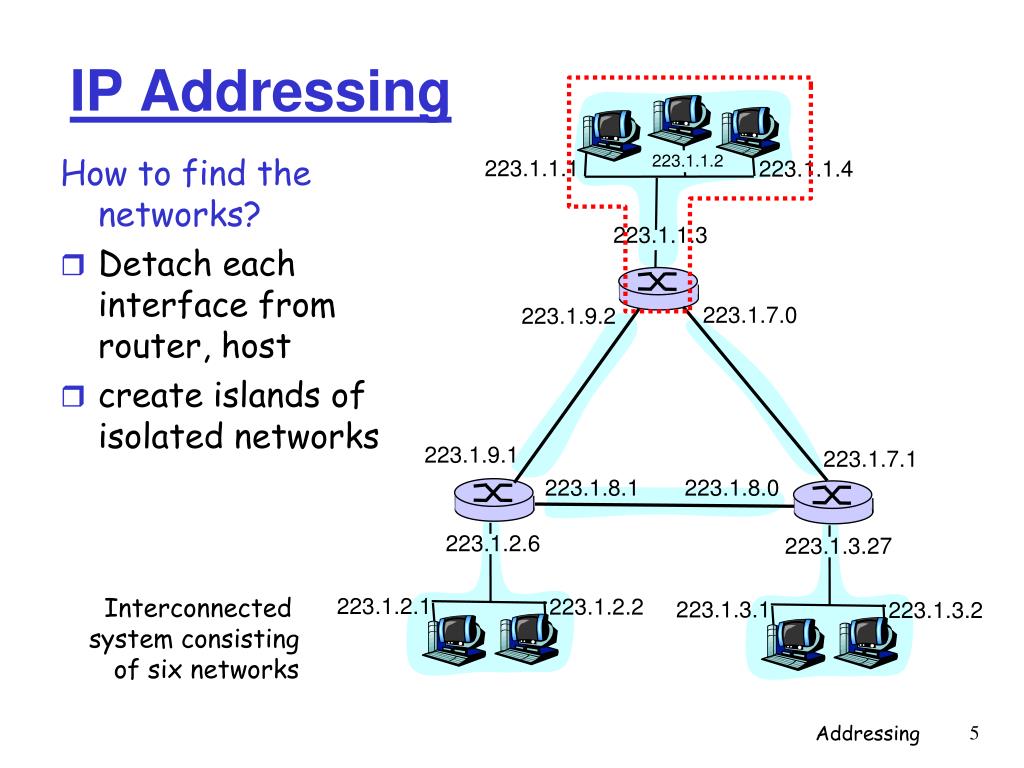

Such closing costs will be indexed while the a lender and non-bank charges

Sellers are requested to pay for certain settlement costs this new experienced is not allowed to shell out. Whenever a realtor helps make a deal therefore the bargain states Va financial support would-be used, the latest manufacturers should be conscious of exactly what costs they are able to anticipate paying. This new manufacturers can invariably refuse to pay for a lot more settlement costs, however with an approved Va promote, providers covers settlement costs both known as unallowable costs. These fees try from-constraints to possess consumers but nevertheless recharged so you can offered expected characteristics.

Both customers increases an offer above precisely what the vendors are inquiring. If the property are detailed at the $two hundred,one hundred thousand and you can settlement costs towards client was projected becoming $3,100, an offer of $203,100 can be produced toward suppliers using the more continues to cover the latest customer’s settlement costs. Having Va money, providers can pay money for specific or all of the client’s will cost you. Virtual assistant finance let the vendors so you can contribute up to 4.0 per cent of your own conversion process cost of your house.

In this example, that will be $8,100000 but settlement costs towards a $two hundred,000 generally may not be some you to definitely highest. Your loan costs guess gets you to profile. Whether it requires a keen $8,100000 bonus so you can a purchaser, what’s the home worthy of inside the an open markets? The latest assessment will also county in the event providers when you look at the good sort of field assist consumers out which have closing costs.

Whenever very first obtaining an effective Virtual assistant loan, brand new customers discovered a closing rates estimate in the financial. In addition, the cost estimate will show that happen to be responsible for investing him or her. Yet in various parts of the country what the providers and consumers spend might be various other. Instance, it could be traditional in a single condition towards suppliers in order to buy a title insurance the financial institution requires however in almost every other claims, it is far from traditional. Further, particular areas may have their decided pricing sharing.

In the end, there is a means to provides neither the consumer nor the new vendor pay for version of costs. Instead, the lender also have an ending prices borrowing from the bank on payment table. This is when the definition of zero closure prices financing will come in. Identical to buyers pays a discount point to reduce the speed on the a mortgage, the lending company increases the rate and gives a card so you’re able to the latest consumers.

Having fun with that exact same $200,100 example, investing some point, or $dos,100, to reduce a 30 year repaired rates of the 0.25 percent. The lender may also increase the rate because of the same count and give brand new $2,one hundred thousand borrowing from the bank to the consumers becoming used on the closing will cost you. As you care able to see, you’ll find settlement costs that have a zero-closing-costs financing, it’s simply which will pay for her or him. It can be this new buyers, providers, the lender otherwise one mix of the 3.

Possess issues? Delight affect us seven days a week by contacting the brand new amount above, or maybe just fill in the new brief function on this page.