Sufficient reason for their Discover Home loans department, the firm is really worth a close look for the financial need

Look for https://paydayloanalabama.com/berlin/ is best noted for their line of credit notes, but it’s including an entire-provider bank and you may percentage properties organization.

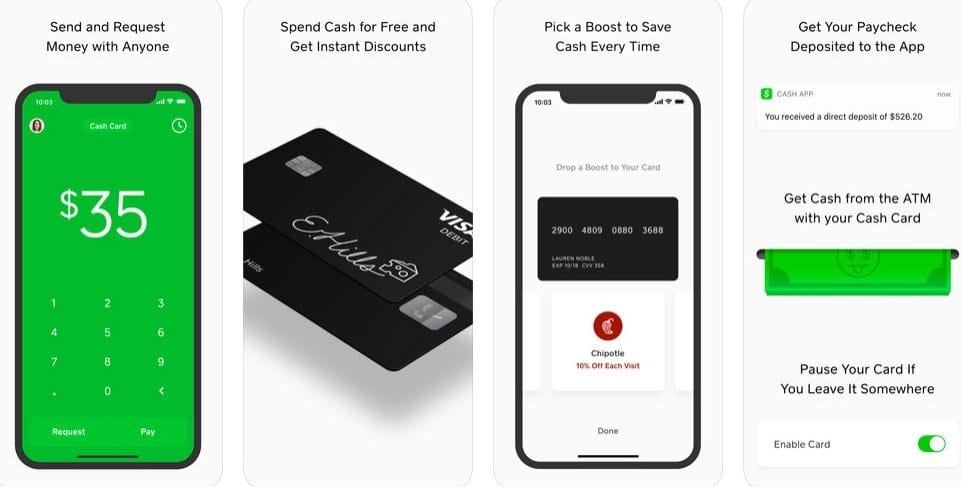

Ideal Has

- Easy on the internet software procedure

- Zero origination otherwise appraisal charge

- No money due within closing

Disadvantages

- No get finance otherwise HELOCs

- Household equity money begin in the $thirty five,000, which might be too much for the majority of consumers

- No branches to own into the-people interactions

Overview

The borrowed funds Account can be compensated because of the a few of the mortgage loan providers i comment. However, this doesn’t apply to the review procedure and/or product reviews loan providers found. All of the studies were created separately by our very own editorial team. We review services and products out of partner lenders including loan providers we do not focus on.

Look for was an electronic banking and payment characteristics team which have you to of the very most recognized labels when you look at the U.S. economic services.

When you find yourself thinking about a home loan re-finance or examining property equity mortgage, Find Home loans office also have a personalized solution to satisfy your circumstances.

Try to evaluate rates from a few various other lenders, so you can relax knowing from the acquiring the cheapest price toward your financial.

Plunge In order to Section.

- What is actually Pick?

- Pick lenders comment to possess 2024

- Dealing with See

Selecting the right mortgage lender can be lay the foundation for the monetary achievement. Thus naturally need a friends which can answer your concerns and you may assist you as a consequence of each step of the process. Whether you are seeking reduce your financial rates otherwise borrow against your equity having a repair enterprise, read on getting a call at-depth See Lenders remark.

What exactly is See?

Pick is a financial institution that gives a selection of factors and you will services, along with playing cards, individual and figuratively speaking, on line financial, and you can home loans.

The business try established in 1985 because a subsidiary out-of Sears Roebuck and you can Co., and has now due to the fact be a separate team.

Whenever you are Discover try really-noted for the handmade cards, Pick Mortgage brokers is among the most its latest situations. So it financial solution might popular with homeowners wanting refinancing otherwise credit up against their residence guarantee.

You to glamorous feature from Find Mortgage brokers ’s the capability to get money without origination fees, no appraisal fees, without dollars due within closure. Getting rid of this type of charges may help borrowers cut excessively currency.

Come across mortgage brokers remark to have 2024

Get a hold of Mortgage brokers try a lending company that provides home loan refinances and home equity funds. Unfortuitously, they won’t currently bring get funds otherwise domestic collateral traces away from credit (HELOC).

Using this bank so you’re able to refinance your current mortgage may help down their payment per month and relieve the mortgage label. You can also option regarding a varying-rate so you’re able to a predetermined-rates home loan. not, it is very important observe that See just offers old-fashioned refinancing and you will does not assistance regulators-supported money for example FHA or Virtual assistant financing. In order to qualify for refinancing you will want the very least credit history out of 620.

A key advantage of refinancing with Discover Mortgage brokers is their no-closing pricing option. This can potentially help you save several thousand dollars in initial fees. As an alternative, Find discusses settlement costs of your refinance (appraisal commission, term insurance, and loan origination charge).

Get a hold of allows consumers to help you refinance up to 95% of its home’s worthy of. But not, you could only use between $35,000 and $3 hundred,000, and repayment conditions range between 10 to thirty years.

Otherwise must re-finance, another option was making an application for a discover household guarantee loan. You could make use of the home’s collateral to finance do-it-yourself methods, consolidate personal debt, or safety almost every other biggest costs.