Listed here are GOSM to own student education loans given that future social

They might rotate to help you originating a lot more low-company financing at some point and hold particular with the equilibrium layer, but so far who’s got maybe not become the actual situation

Over the years, SoFi becomes acquire-on-purchases margins (GOSM) of around cuatro% on the student loans, that is not dramatically reduced than just their PL GOSM since those individuals dollars circulates are incredibly reliable that people are able to pay in their eyes. See that there are numerous openings in the middle residence while the there are many different residence in which they did not promote people scholar loans.

Why would advantage professionals shell out $104 to have $100 away from finance having such as for instance low interest rates? SoFi student loans can differ out of 5-fifteen season conditions. To phrase it differently, individuals who purchase the financing make their initial investment into just more than one year and have now really credible payouts after that for a long time. Select recently offered the entire $ten.1B student loan book a lot more than prominent. Reports reported that maximum well worth would be $ten.8B, whether or not at this time the chance-free rate try over 5%, that’d be a beneficial eight% GOSM. People money features similar APRs due to the fact SoFi’s dated money because so many of them was in fact originated while in the most reduced-rate environment. Given that price precipitates and you can thread production get smaller, student education loans is simply be more glamorous. In my opinion student education loans is a typically financial support-light business. In my opinion the missed and will surprise some one progressing.

Home loans and you can HELOCs

SoFi’s mortgage organization is capital white as they years the publication almost always inside 3 months out of origination. SoFi centers around agencies money eg FHA fund and you will Va money that are going to be bought of the government-sponsored organizations such as for instance Federal national mortgage association and you may Freddie Mac. Whilst amounts rise which have prices dropping, this can only be a good tailwind in order to noninterest money in the lending portion.

Family collateral personal lines of credit, otherwise HELOCs, is a new product one to only has just come on offer because of the SoFi. I am happy observe how it expands. Anthony Noto spoke about this regarding the Goldman Sachs Appointment past week:

We possess the features now of performing family collateral money just like the a concept. It is a secured tool. We had underwrite as often of the as we you are going to offered it’s safer, therefore have quite little covered financing towards the our balance layer. Additionally [you’ll find] re-finance home loans who would work with meaningfully away from less rate environment.

It seems that SoFi really wants to keep HELOCs into balance sheet. This dovetails really employing key competencies as many individuals commonly want to faucet the brand new equity of their home in place of getting, such as, increased interest personal bank loan to do debt consolidation reduction. Because it’s secured, the risk weighting is only fifty%, meaning in the event that a customer enjoys good $100k HELOC, the danger-weighted funding it takes is only $50k. This means that while they can be down interest fund, brand new leveraged productivity would be comparable to if you don’t go beyond personal fund.

We went to my personal SoFi account to take a glance at the new HELOC prices they had bring me personally. Having a great $100k HELOC, my 29-season rate was 9.125%-9.375%. A 20-12 months rate could be 8.75%-8.875%. My latest credit score are 815, and this will provide you with an example of what type of yields SoFi may get.

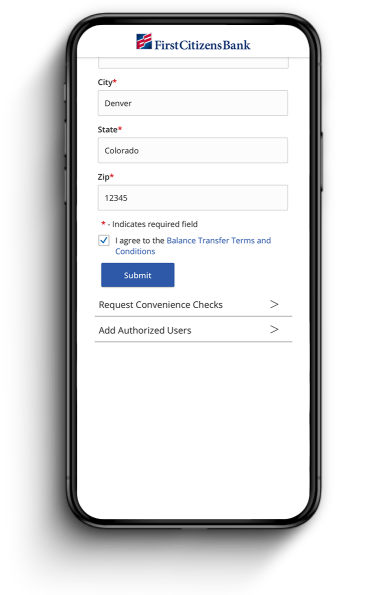

As the an away, getting rates to own an effective HELOC is super easy. It took on step 3 clicks, in the event Used to do have to fill in my details such as title and you can address, which they will be have. They also implemented upwards most rapidly. I got an email, telephone call, and you can a book away click here to read from financing officer inside from the ten minutes of examining the interest rate to ask how we you will definitely move ahead.