How to Access Your residence Guarantee (Despite a credit check)

Trick takeaways

A credit assessment was a fundamental a portion of the software processes to own domestic guarantee financing (HELs) and you may domestic guarantee lines of credit (HELOCs).

Consumers having straight down fico scores may qualify for a beneficial HEL otherwise HELOC, but on high rates of interest or other smaller-positive words.

Property guarantee agreement (HEA) is generally the ideal alternative for consumers which have fico scores that dont meet conditions to have HELs or HELOCs.

Applications for household equity fund (HELs) or house guarantee personal lines of credit (HELOCs) without borrowing from the bank checks is actually uncommon. Because this article teaches you, loan providers or any other organizations heavily trust your credit score when you are looking at mortgage decisions.

Even if you normally be eligible for an HEL otherwise HELOC with a lowered credit score, it might been during the an increased pricing. Here, we shall guide you a choice you to exists to these money possibilities security finance that will provide even more independence.

Exactly what are household guarantee financing and family security personal lines of credit?

For most Americans, its primary supply of wealth ’s the worth of their residence, that is an enthusiastic illiquid advantage. This might carry out challenges for people whom end up small with the the bucks wanted to satisfy living expenses and other financial obligations.

To help, people can get make an application for a property guarantee loan or home collateral credit line through their home loan company or some other financial institution.

A home collateral financing (HEL) lets you borrow cash from the security in your home. The lending company offers a lump sum payment upfront, you upcoming repay inside equivalent monthly installments on a predetermined interest over a-flat title, constantly between 5 and you will 15 years. Meanwhile, your property serves as security.

Property security credit line (HELOC) is like a house equity mortgage where it allows you to borrow secured on their home’s collateral, plus in you risk property foreclosure for those who default.

Unlike house security finance, HELOCs don’t come into the type of lump amounts. Instead, you earn a running line of credit that you could tap towards the once you you desire money. This is exactly a great choice if you’re not yes exactly how far needed otherwise whenever you may need they.

A different trick distinction would be the fact as opposed to household collateral finance, having repaired interest rates, very HELOCs keeps adjustable cost. This is why the speed and, of the expansion, your monthly premiums, get alter and you can rise over time.

Credit monitors are almost always required which have HELs and you may HELOCs

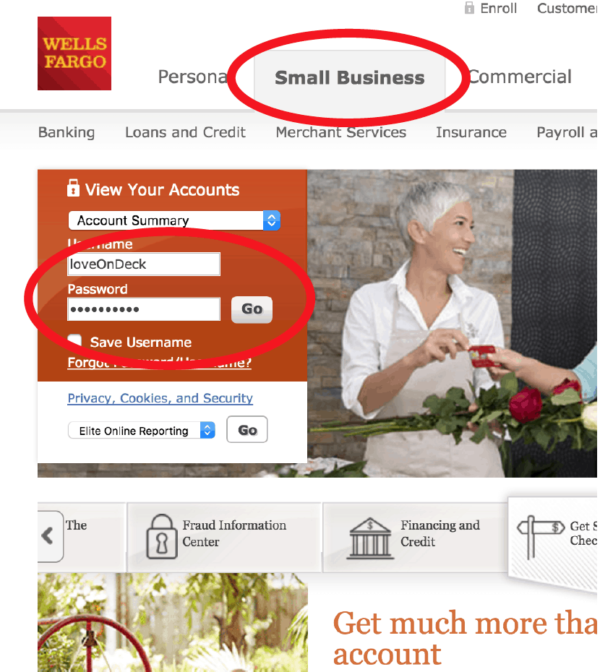

As with a mortgage, obtaining an excellent HEL otherwise HELOC basically requires the financial to https://paydayloancolorado.net/grand-junction/ get into your credit rating. A credit rating are several you to stands for your overall creditworthiness based on your credit report, money, full loans or any other factors. A loan provider often trust this information to help you agree a borrower for a financial loan and also to new borrower’s being qualified conditions (amount borrowed, interest, readiness big date).

Some loan providers may offer a HEL otherwise HELOC so you can a debtor without a credit assessment, but this would be an exception to this rule. This may happen in times when a debtor normally fill in research from homeownership without almost every other liens, safeguards hobbies or any other encumbrances. The new borrower should be happy to bring their home since guarantee in return for the loan.

Significantly more realistically, a lender usually nonetheless require a credit check of a few method of before agreeing to often a great HEL or HELOC, to check out the very least qualifying get around 620. The reason is that the lender needs to comprehend the financial exposure it’s also possible to otherwise might not establish when it comes to paying the loan.