If you desire a business checking account or perhaps not hinges on the type of organization

Receive money

If you find yourself employed in an innovative community, be suspicious regarding whoever wishes one to performs in place of shell out, and provides exposure in exchange, or obscure claims out of upcoming performs. By the accepting this type of offers was devaluing work.

Lay your percentage terms first asking to be paid off within this thirty days is practical plus don’t be afraid to pursue unpaid invoices of the phone otherwise current email address.

In case your communications is neglected, a legal page in advance of step are installed on line, particularly through the website Rocket Attorney, or a risk to include attract and compensation toward amount due can often encourage account divisions toward action.

Play with a keen accountant

James Shaw, of one’s bookkeeping enterprise Sapphire, says: Employing a keen accountant enables you to focus on powering your organization because they keep up with the cutting-edge, time-consuming details.

Lenders come across proof steady money, and you will skillfully prepared levels reveal that your business is financially sound, giving you a knowledgeable threat of securing a loan, states Shaw.

Rescue into a retirement

Self-employed workers are eligible to the state your retirement in identical way as other people, of course, if an adequate NIC record. However, a major downside out-of mind-a career isnt which have a manager to subscribe a workplace your retirement.

You are on your own, so be sure to created a personal retirement. Brand new merchant tend to claim tax recovery from the very first rates regarding tax on your behalf and you will include it with your retirement deals. While you are a high-rate otherwise most rates taxpayer, you could potentially allege extra taxation relief throughout your mind-investigations mode.

Instead, specific pension techniques utilize the internet shell out arrangement strategy, where income tax recovery are instead offered by deducting this new disgusting pension share out of your income before you pay tax. Taxation save is provided there and by removing your taxable income.

Organise your finances

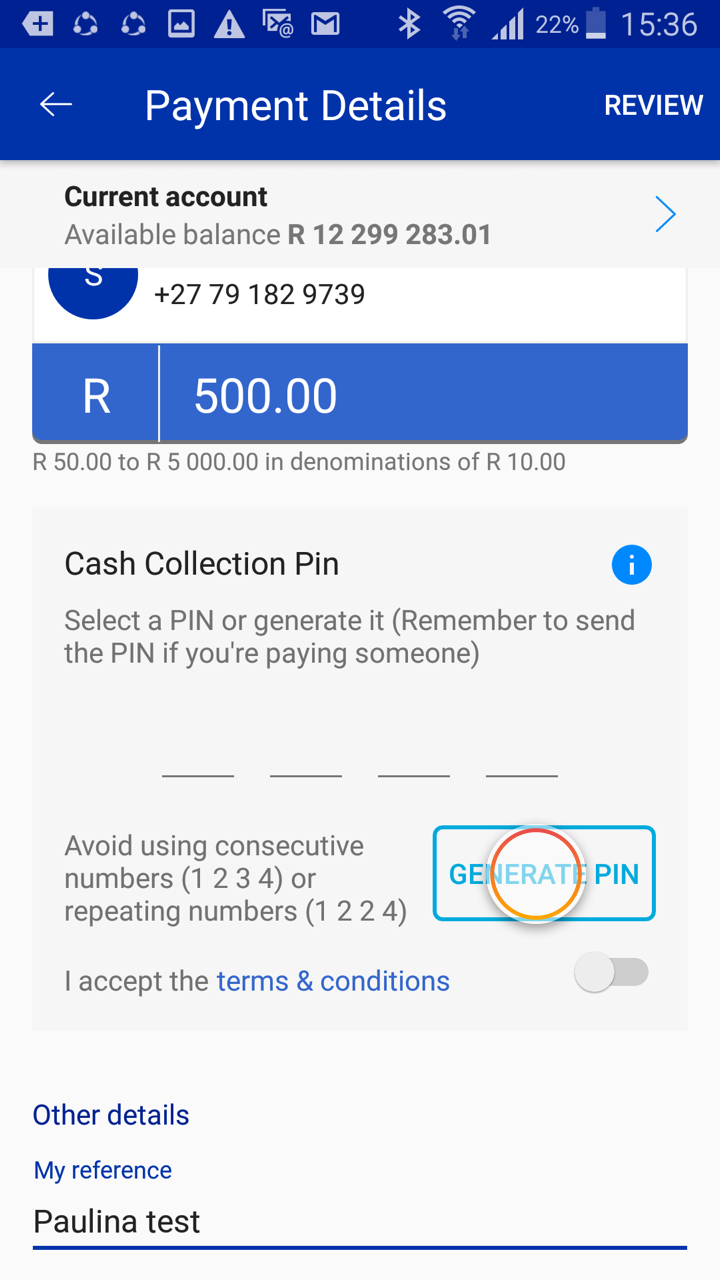

If you have many expenditures to track, it will make experience. Really organization account charges often a monthly fee otherwise an installment for each exchange.

A less expensive set-upwards would-be for one to most recent account toward which your own income are reduced, then spend your self a paycheck towards the a different current membership monthly.

A changing money helps make monetary considered difficult, as most cost management techniques think that you really have a reliable earnings. In the event your income varies, created the absolute minimum month-to-month finances which covers your entire very important expense. Your own lower monthly earnings can defense that it. If you don’t, attempt to have a look at where you could scale back or earn more.

Andrew Hagger, on site MoneyComms, says: Essentially, set aside the utmost you really can payday loans Hazardville afford when you initiate away because the a beneficial freelancer to try and make a boundary to have those days where performs could possibly get run dry having a week or a couple of.

I think you to while the at least I’d strongly recommend targeting an emergency pot‘ adequate to defense a couple of months‘ worth of their extremely important expenses internet explorer, utilities, transportation will cost you, dinner, rent/mortgage and you can, although maybe not recognized as crucial, maybe a little while a lot more to fund products/products out, because you still need to alive.

A number of the new banking applications are great for breaking up your own everyday dollars from your own survival finance; the newest Spaces solution of Starling Financial is a good analogy.

Remember that and rescuing getting quiet symptoms, given that an excellent freelancer you will not score getaway shell out otherwise unwell pay, so that you will require currency to fund people, also.

Look at the positives entitlement

If you can’t work on account of illness, you might qualify for the latest style a position and help allocation for those who have generated enough NICs.