Va IRRRL (Rate of interest Protection Home mortgage refinance loan): The new Smooth Refinance getting Veterans

- What is actually a great Va IRRRL?

- Positives

- Eligibility conditions

- How to submit an application for an excellent Virtual assistant IRRRL

Associate links to the affairs in this post are from lovers that make up us (discover our very own advertiser disclosure with this range of partners for lots more details). But not, all of our feedback is actually our very own. Find out how we price mortgage loans to type unbiased reviews.

- An excellent Virtual assistant Interest rate Protection Refinance loan is for refinancing of you to definitely Va home loan to your a separate.

- You don’t need to proceed through an appraisal otherwise show your credit rating or financial obligation-to-earnings ratio.

- If you’ve achieved security in your home, a conventional or Virtual assistant dollars-away re-finance may be finest.

When you re-finance your own home loan, the amount of choice can feel overwhelming. However the best choice for some Virtual assistant mortgage individuals who want in order to re-finance is clear: an effective Va IRRRL.

Straight down interest rates and you can quicker monthly obligations

Very loan providers will simply let you get a Va IRRRL in the event the it might save you money. So you may protected a far greater speed and you may/or a reduced payment per month.

Key of an arm to help you a fixed rate

In case your latest Va financing have an adjustable interest rate, you are able to an IRRRL to locate a different sort of financing with a fixed rates. This should make sure that your speed and you can fee are unable to change over date.

Zero appraisal otherwise income verification

IRRRLs is actually a good Virtual assistant mortgage re-finance with no assessment, and that means you won’t need to have your domestic appraised or shell out an assessment percentage when obtaining one. And also this form you might qualify so you’re able to refinance whether or not your own property has shed worthy of or you haven’t attained much equity when you look at the your house. You are able to refinance regardless of if your financial situation is not as strong since after you had their very first financial, since you won’t need to show off your credit history otherwise obligations-to-income ratio now.

Minimal settlement costs

Closing costs try minimal to the Va IRRRL. Although it is possible to still have to pay the VA’s resource fee, it’s just 0.5% with good Virtual assistant IRRRL (instead of doing step three.3% on other Va funds).

Va IRRRL eligibility criteria

Not all active army affiliate otherwise experienced is eligible for a Virtual assistant IRRRL. You will have to meet with the following Va improve re-finance criteria:

Keeps a preexisting Va mortgage

An effective Va IRRRL is actually for people who have to re-finance out of you to definitely Va financial to your a separate Va financial. You can not use it so you’re able to re-finance away from a different financial towards the a great Va loan.

Meet occupancy criteria

The house doesn’t have to be the majority of your quarters immediately, however you must have lived there from the some point.

Pick a websites real benefit

Loan providers have a tendency to usually just accept good Virtual assistant IRRRL if this often give you a hand financially. This may imply a lowered home loan rate otherwise monthly payment. Or you might re-finance of a variable speed to help you a predetermined rate, that may make it easier to budget more effectively and then make money on the big date.

Comply with financing efficiency laws and regulations

At the least 210 months have to have enacted because your first-mortgage fee one which just re-finance which have an enthusiastic IRRRL. Additionally you need to have produced at least 6 months of repayments.

Tips get good Va IRRRL

When you have good Va financing and are generally wanting a straight down price and payment, this new IRRRL program may be the best choices. Here’s how to track down a good Va IRRRL:

Find good Va-approved financial

Only specific lenders are allowed to issue Virtual assistant financing, and so the starting point will be to find the one to you’d like to work alongside. Understand that you don’t have to refinance into exact same bank your utilized for the new home loan. Please check around on Va mortgage lender giving a knowledgeable rate of interest and you can lowest charges.

Gather needed data

You may need a current Certification away from Qualification discover good Va IRRRL. You can demand this throughout the Va yourself or, normally, the lender can be request it for you. Additionally must submit a few Va forms and you will worksheets, and that your bank offers for your requirements.

Quite often, don’t you prefer any extra records, such as tax statements otherwise pay stubs. These may be needed completely refinances, no http://paydayloanalabama.com/gordo/ matter if.

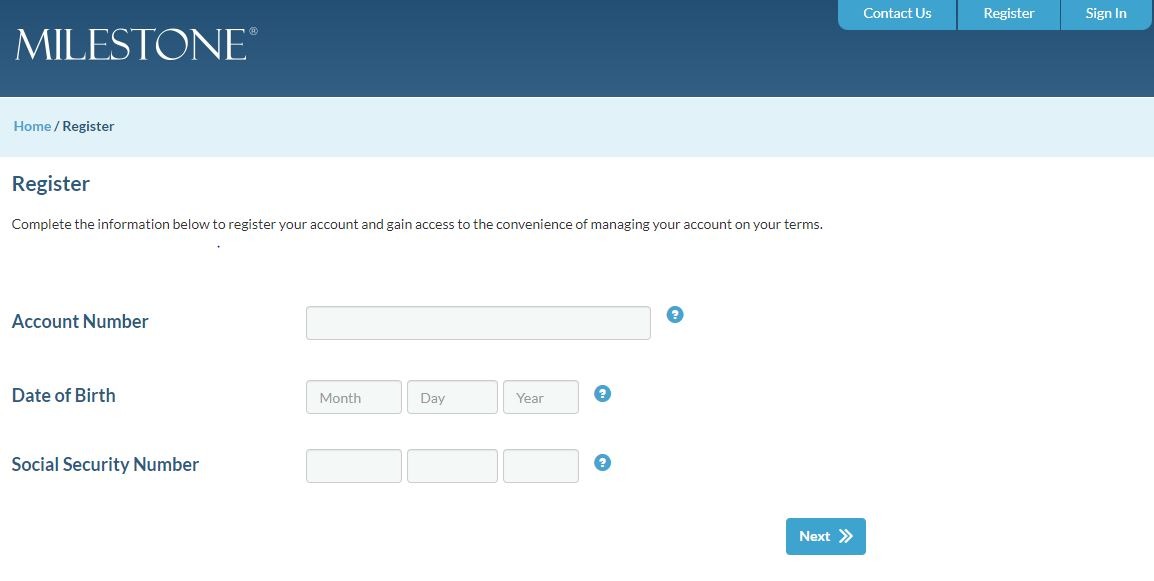

Finish the application

Next, you’ll have to fill out their lender’s loan application. This will require some details about your bank account, income, or any other personal stats.

Financing closure

Last, you will spend your resource percentage and you will personal on financing. When you signal your own records, your loan will alter your old you to, and you will start making costs for the this new financial shifting.

Virtual assistant IRRRL Faqs

Zero, Va IRRRLs are only able to be used to own refinancing your current Va loan balance and getting a diminished rate of interest and you will payment. If you would like cash out, you may need a beneficial Virtual assistant dollars-away refinance.

Sure, IRRRLs include settlement costs, however they are typically less than with other refinance options. This new Virtual assistant resource payment ’s the main rates, nevertheless are going to be funded towards the financing.

The latest IRRRL timeline may vary by the lender, but it’s generally shorter than many other refinances. It will require from a couple weeks for some days.