Alaska Us Government Credit Relationship Home loan Calculator from

Alaska United states of america Federal Borrowing Commitment Financial Calculator in the us within the 2024. How exactly to determine home financing yourself? Tips focus on a mortgage calculator? Financial costs. Exactly what do I have found out using a mortgage calculator? A mortgage calculator regarding the You.S. is actually a hack always assist possible home buyers imagine their monthly mortgage payments. So it calculator considers the degree of the loan, along the mortgage identity, the pace, and you may any extra costs otherwise situations from the loan. The fresh calculator next produces an estimate of the payment per month count and you may total mortgage cost.

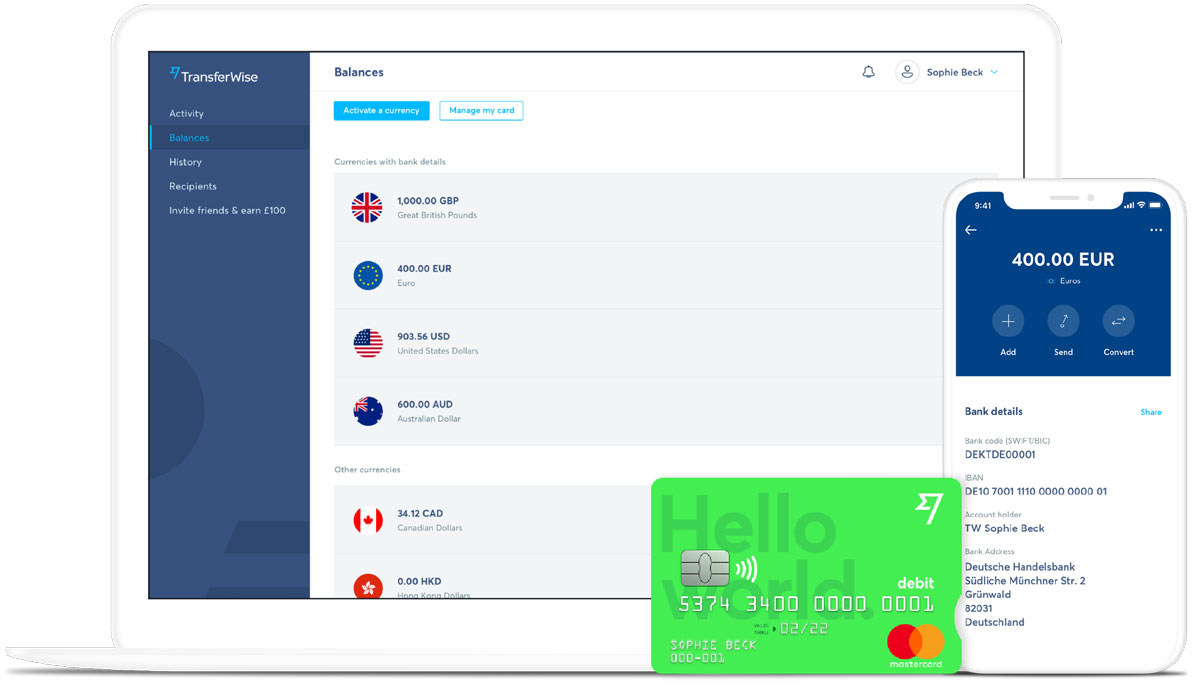

Home loan Even offers from

Before applying to have home financing, calculate the newest monthly installments. This will help one to make sure to can afford this new mortgage. We wishing a convenient home loan calculator suitable for really purposes: insurance premiums so you can tax write-offs.

Look at the financial offers from Alaska United states Government Credit Commitment for sale in brand new U.S. inside the . The device usually suits you on most readily useful even offers for the need according to calculations you make.

To evaluate the potential for the financial app being qualified, look at your credit history on the the site. Its free. Consider that finance companies accept mortgage applicants which have a credit score away from more 620. If the credit history is lower, we will recommend a mortgage broker you could potentially incorporate that have.

A home loan is a significant economic contribution, so you must make sure everything is managed. Look at your credit history free-of-charge to make sure you perform n’t have a fantastic expenses. Banking institutions might be unwilling to accept the financial app in the event the the debt-to-income proportion is lower. So, once you see Clicking Here delinquent costs on your credit file, security all of them before you apply.

Whether your credit history is higher than 620 and you have a decreased debt-to-money ratio, you could start the program processes. In order to submit the borrowed funds application, you might go to the bank’s web site by pressing the fresh new Apply key otherwise using all of our home loan form.

The lending company usually comment your credit history and money lending risk. Following the credit score assessment and you will records remark, the financial institution often notify you of your own decision.

Shortly after your own home loan application is recognized, you could start trying to find a property. You can use the characteristics to get compatible a house otherwise stick to the provides you with have found.

When you discover home and you may complete the appraisal, you could potentially signal the borrowed funds loan arrangement. The lending company have a tendency to disburse finance on the savings account or even the seller’s membership. New solicitor tend to check in the house import from the Homes Registry.

If you get a mortgage, i encourage your take a look at stuff contained in this point. That it lowest level of pointers makes it possible to fit everything in best.

Simple tips to determine Alaska Us FCU home loan

Figuring their Alaska U . s . FCU financial is a straightforward process that are going to be split to your several measures. The loan commission formula relates to determining the mortgage matter, the interest rate, the borrowed funds identity, and payment volume.

- Determine the mortgage number. The loan number ’s the overall amount of money you are borrowing from the bank on borrowing from the bank commitment order your home. You can get so it matter from the deducting the down payment out of the price of the property.

- Dictate the pace. The interest rate ’s the apr that borrowing relationship costs one borrow cash. It rate could be fixed otherwise changeable, depending on the kind of financial you’ve selected.

- Dictate the mortgage term. The loan name is the period of time you have to pay-off the borrowed funds. Alaska United states of america FCU also offers various loan terminology ranging from fifteen so you can 30 years.