Offered Borrowing from the 401K? Accomplish that as an alternative

Either new unexpected happen. If you are needing instant money, of numerous people’s earliest mind is of utilizing their 401Ks so you’re able to borrow money. That cash is sitting truth be told there, proper? Surely it can help. Incorrect. Whilst impulse so you can obtain from your 401K makes sense, it does come with an array of bad outcomes. Such downsides will notably provide more benefits than the benefits whenever borrowing against their 401k. As an alternative, benefit from the security you have and use you superb or luxury observe to get a jewellery-supported financing off Diamond Banc.

As the 2008 houses drama, an increasing number of Us citizens is actually turning to their 401Ks as the a loan source. House equity money are not any offered a choice for we and private financing are difficult if you don’t impossible to get. Which leaving the majority of people who need money to own an urgent situation that have couple options. Yet not, utilizing your 401k to help you borrow cash shall be absolutely stopped.

1. It does put their after that back in your retirement desires

. A projected 22% regarding People in the us have only $5,000 spared because of their senior years. Individuals are currently less than-rescuing having retirement. Credit facing your 401K simply substances this issue. A good 401K senior years money lets the interest out of your savings to help you compound over the years. On a basic level, this is certainly mainly the point of good 401k. By firmly taking the money aside for a loan, it efficiently suppress the material attract out of accruing.

dos. With your 401K so you’re able to borrow cash can lead to your account so you’re able to cure worth

As you pay back the borrowed funds you’ll end up re also-purchasing the shares you in the past marketed, always in the a high rate. And thus your cure the majority of the latest guarantee you have got achieved on the account.

step 3. Look at the charges that accompanies borrowing from the 401k

Even although you is only borrowing from yourself you will find charge with the acquiring the mortgage, always a running percentage one visits the officer.

cuatro. Using your 401k to borrow funds can indicate you will have faster deals eventually

According to your own 401K package, you can get rid of the capacity to donate to the brand new money while you are you really have an excellent mortgage facing they. Some money can take ages to expend straight back, which means that numerous years of zero efforts from you or the fits sum from the company. Because best practice getting later years profile is normally to keep doing you could potentially as soon as possible, given the role out-of compounding notice, this can enjoys good snowball effect on your overall deals. Effortlessly lowering your discounts off significantly when you reach the ages out of advancing years.

5. Credit from your 401k can indicate straight down earnings when you really need money really

Really 401K loan installment agreements need one to payments to your financing become subtracted instantly from the salary, so that your get-home spend have a tendency to disappear. Along with the payment isn’t income tax deferred, and that means you might be taxed in it. It indicates you can owe over asked by the time taxes come due.

six. Taxes Fees Taxation.

You are taxed on a single money double. You are settling the loan that have currency that was taxed and if you withdraw from your 401K throughout your advancing years you’ll be able to be taxed involved once more.

seven. Credit from your 401K can indicate low levels of defense

For individuals who stop or is discharged from you work, you need to pay back the mortgage in this sixty so you’re https://elitecashadvance.com/installment-loans-nv/ able to 90 months, depending on the package. When you’re incapable of afford the loan right back during the repayment months, then the Internal revenue service takes into account the loan a shipment. The total amount you owe is actually exposed to tax, plus a great 10% punishment if you’re 59.five years of age otherwise young.

Rating a precious jewelry-backed mortgage instead of borrowing from your own 401K.

Do not slip target on the pitfall out-of borrowing from the 401K when there are better possibilities. Making use of your jewelry since guarantee to help you borrow funds is a wonderful treatment for maintain your 401K intact, borrow money without adversely inside your credit rating, and have currency rapidly.

Diamond Banc focuses on delivering finance to prospects who possess good diamonds and you will wedding rings, high-avoid deluxe watches and you may precious jewelry out of better musicians and artists eg Cartier, Bulgari, Tiffany & Co. plus. These items are used because the equity in order to support the mortgage. The mortgage number is determined by brand new liquids general market price of the goods. While the mortgage is in repayment, the object is stored in our very own safer container. After you’ve reduced the loan, we’re going to come back the thing to you. For individuals who standard towards the mortgage, i hold the item market they to recoup the total amount you borrowed from.

Diamond Banc’s unique loan techniques

While the loan amount hinges on new drinking water property value the thing are pledged, we do not manage one credit monitors, a career confirmation otherwise wanted a fees make certain. I together with dont statement the borrowed funds so you’re able to a card bureau; it will not affect your credit score, even though you default with the loan.

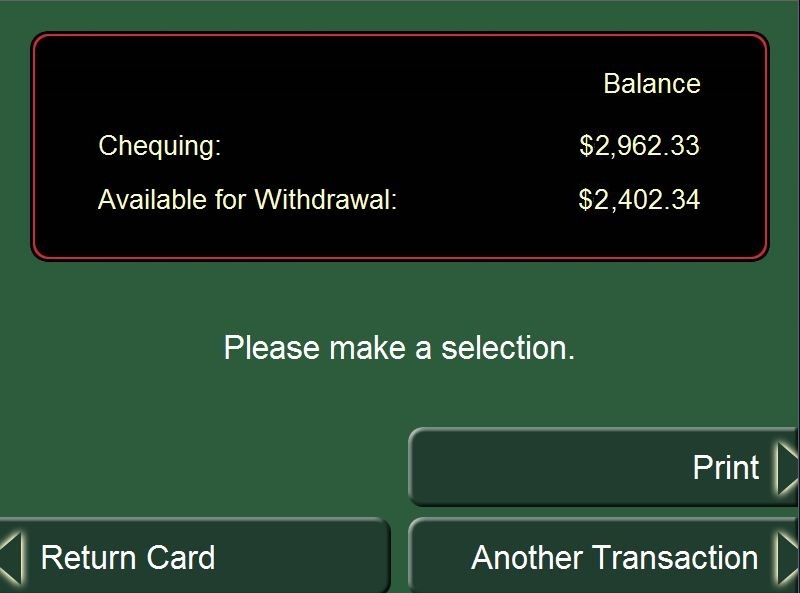

The mortgage processes which have Diamond Banc is fast and easy. We are able to will often have fund on your account in as little once the two days. Simply fill in a zero chance, no obligation financing offer function with the our very own web site. In 24 hours or less out-of researching their submitting we’ll send you all of our very first give. Since very first give are decideded upon, we will give you a shipping name and rules, or you can carry it with the place nearest you. As soon as we receive your bundle we shall ensure your product. When you undertake the final offer and conditions, we are going to cable import fund to your account or send your a beneficial look at immediately.

Check out the Diamond Banc webpages to find out more and fill out our internet-based forms. Or, see one of our locations here.