3. Reputation of resource flooring when you look at the Canada

1. Inclusion

Just like the a follow-up with the regulatory observe put-out into , that it technology notice gifts facts towards Basel III resource floors. That it notice suits to your adopting the key points:

- Funding floor are not the newest within the 2017 Basel III reforms – actually, resource floor was in fact found in before Basel financial support structures;

- Capital flooring possess numerous purposes, including: (i) cutting procyclicality regarding investment conditions; (ii) cutting excess variability when you look at the risk-adjusted assets (RWA) across banking institutions; and (iii) generating battle around Canadian finance companies.

- Basel III reforms are a suite regarding changes, some of which contributed to RWA refuses (shorter funding required) while cash advance Prichard reviews others – for instance the adoption of the phased-during the resource floors – ultimately causing RWA grows (much more financing necessary).

- The changes you to definitely lead to RWA ) since the transform causing RWA increases are now being phased-inside throughout the years. The overall perception regarding 2017 Basel III reforms to possess Canadian banks in the totality was, for every our very own data, generally financial support neutral. We present details of the fresh new expanding and decreasing elements of Basel III less than.

2. Records

All of our mandate comes with producing financial balances from the protecting depositors and other loan providers off undue loss. This is done by, amongst anything else, ensuring that finance companies keep enough capital to withstand loss. The administrative centre requirements for banks is actually outlined on the Money Adequacy Criteria (CAR) Tip. These types of standards is mostly in accordance with the globally arranged build set up of the Basel Committee with the Financial Oversight (BCBS), known as the latest Basel Build, having customizations made to mirror the newest Canadian context. Beneath the Basel Build, risk-mainly based money requirements are ready since the a share from RWA.

The most recent posting into the Basel Construction is sometimes called to because 2017 Basel III reforms. Use of one’s 2017 Basel III reforms might have been rough across the regions and has now made significant attract off bank experts, economists, in addition to financial news.

The capital floors (also referred to as the Basel III returns floor within its current means) which was incorporated within our very own implementation of brand new 2017 Basel III reforms inside the Q2 2023 try a continuation of similar floors predicated on Standardized Tips (SAs) that have been in position given that 2008 whenever we began providing banking companies to use interior activities to choose financial support criteria. The latest desk throughout the Annex A measures up the various iterations out of the administrative centre floors, its parts, additionally the peak from which they were put.

4. Function of the administrative centre flooring

- to attenuate expert-cyclicality of model-established funding requirements

- to reduce excessive RWA variability and protect against model risk, and you can

- to promote race around Canadian finance companies.

(i) Reducing expert-cyclicality out of model-centered financing conditions

Modelled standards, calculated making use of the inner studies-founded (IRB) approach, make use of a great bank’s very own historic genuine losings because the an option basis during the deciding RWA. Using historical analysis, however, injects an element of specialist-cyclicality to the IRB RWA data; in essence, holding everything else equivalent, episodes away from lowest mortgage loss produce lower RWA and you can episodes off large loss push exposure loads (RWs) higher.

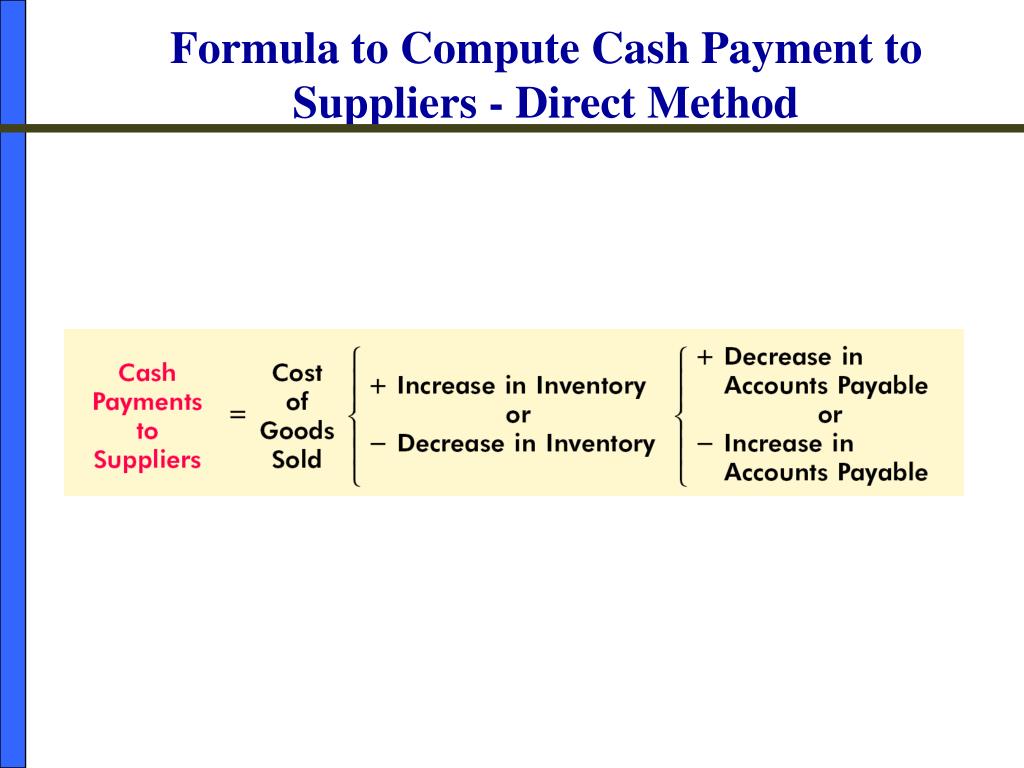

Inside the an extreme recession, IRB requirements manage go up, which, whenever together with greater fears throughout the credit quality and you will economic uncertainty, could cause banks constraining financing. A binding floors decreases this expert-cyclicality, lessening the increase during the financial support standards when you look at the a great downturn, hence increases banks‘ capability to lend relative to its lack of the floor. Chart step 1 below gift ideas a typical example of just how expert-cyclicality are less which have a binding financing floor.

Range graph exhibiting the way the efficiency flooring decrease procyclicality inside RWA criteria. The alteration from inside the RWA requirements is plotted towards the Y-axis against big date for the X-axis. Within this conventionalized analogy, RWA standards vary over time. The latest pit between the top and you can trough of your RWA conditions try demonstrated to cure off 4 devices without having any productivity flooring in order to below dos.5 tools in the event that yields flooring are binding.