Precisely what do You need to Qualify in order to Re-finance a HELOC otherwise Household Guarantee Mortgage?

Once you re-finance you have to pay off of the home loan and you may replace it with a brand new mortgage. When you re-finance a home equity financing, youre settling the initial home loan equilibrium otherwise domestic equity line and replacement it with a new next home loan or HELOC. When you’re refinancing a HELOC, you are reducing the fresh new varying focus merely repayments and converting it on a fixed rate of interest mortgage which have a predetermined monthly commission.

Before you could aim for a special domestic guarantee loan which have a lowered price, you should know exactly what the possible criteria try.

This is the straight back-stop ratio, that is a way of measuring all your month-to-month obligations money compared to the their disgusting month-to-month money.

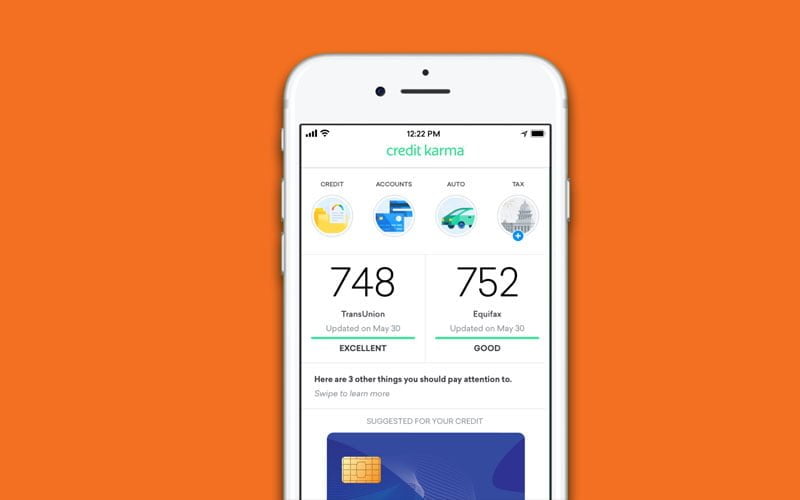

If you’d like to re-finance when planning on taking benefit of lower prices, this will help to increase your credit score up to you’ll be able to.

If the credit score are less than 700, you will get difficulties being qualified for the best cost. Sometime the credit score conditions to possess HELOCs are different than just repaired rate security funds, thus be certain that towards the bank when you shop next mortgage selection.

How do i Reduce steadily the Home loan Speed on my Domestic Guarantee Mortgage?

Refinancing a home equity financing involves replacing your loan having another one, perhaps to locate less rate of interest, modify the installment identity, or accessibility a lot more equity due to your own residence’s enjoyed worth.

- Compare the current cost towards established household guarantee financing speed.

- Cause of closing costs as if your roll them your loan amount increase.

- Examine your current monthly premiums to your proposed the loan.

- Envision re-finance family guarantee mortgage cost that have fixed speed terminology.

Sooner, nobody can correctly assume whenever home loan cost will begin to get rid of. If the prices quoted by the household guarantee loan companies try unsustainable for your requirements, it’s wise to not proceed with the expectation that one can refinance later. The fresh new timing is not sure, and also in the newest meantime, you exposure shedding your property if you cannot keep up with the newest monthly payments. So it is sensible in order to re-finance your home security mortgage in the event the you’ve got the capacity to save money that have all the way down monthly obligations and even replace your terms. Seek out an educated family collateral mortgage prices online.

Ought i Refinance a house Security Loan for a much better Words?

An alternative choice is always to refinance in order to a home equity loan with a different name length, either offered or less, dependent on if for example the aim is always to reduce your monthly premiums otherwise facilitate financing repayment. On the other hand, for people who keeps excess collateral in your home, you’ve got the possibility to refinance towards a more impressive family collateral amount https://www.clickcashadvance.com/payday-loans-sd/ borrowed, enabling use of most bucks.

For-instance, if you are refinancing a beneficial HELOC or equity mortgage with an equilibrium of $50,000, expect to pay ranging from $750 and you may $2,500.

Therefore if the fresh new fees was $750, you would need to borrow at the least $fifty,750 if you’d like to roll your house security mortgage closing will cost you to your this new financing.

Benefits and drawbacks out-of Refinancing a house Equity Mortgage

Like most economic choice, deciding to refinance a home security mortgage is highly recommended meticulously prior to the past name. Here are the advantages and disadvantages away from refinancing your home guarantee loan:

Experts Very first, you might potentially reduce your monthly payment, of course, if you qualify for a lowered rate of interest. Having a reduced rate you will will let you save considerably towards the focus usually.

2nd, you could re-finance the loan with the an extended or quicker payment identity. Switching to a lengthier term wil dramatically reduce the fresh new percentage but usually boost focus payments. In addition you can expect to pick a smaller label, and therefore grows monthly obligations however, reduces desire.