Three straight ways to apply for the fresh COE

Certified solution people, pros, in addition to their partners can acquire a house with this mortgage system. There are not any advance payment otherwise financial insurance rates standards, and you will get an aggressive interest.

Va dollars-away re-finance

Are you looking so you’re able to upgrade your home? Up coming a cash-aside re-finance is worth exploring. Certified individuals can change several of their security to your dollars, which they can then have fun with for developments and you will fixes.

Va streamline refinance

Imagine if you have a changeable-rates home loan. Rather than chance having a top payment in the future, you can change so you can a predetermined-speed financing playing with a streamline refinance americash loans Uniontown. You will find an entire article serious about the brand new Va IRRRL Family Re-finance Program.

Qualification to possess good Va mortgage

Getting qualified, you otherwise your spouse have to have supported among adopting the requirements below and start to become released accordingly.

Domestic occupancy requirements

Centered on Va Financing and you can Guarantee guidelines, „the law needs a veteran acquiring an effective Va-protected financing to help you approve that she or he plans to undertake the house or property as his or her domestic really.“ Hence, home buyers bringing an effective Virtual assistant loan have to live-in the house since their primary quarters.

Although not, after a specific time, the fresh Virtual assistant lets a borrower’s previous first house to-be hired aside. In this case, consumers might not have to help you refinance outside of the Va mortgage when they feel implemented or provides a long-term change off route to some other channel.

Oftentimes, family occupancy should be satisfied within this 60 days of the home loan closing. Proof no. 1 home is as well as called for.

Exceptions on the rules

Military members can real time harder lives than simply very, so are there casual situations where household occupancy legislation is going to be curved.

Deployed provider user: Provider professionals who happen to be deployed from their obligation route are allowed to order a house within host to permanent quarters.

Mate and you will/or created child: Particular effective military professionals try Virtual assistant loan eligible but are on the productive duty and you may away from the long lasting house. If this sounds like the actual situation, the fresh new partner or created youngster of your services representative can reside the home and match the occupancy criteria.

In addition to, in case your Virtual assistant home visitors has stopped being in the military but is temporarily aside to have works-related factors, a partner or situated child can be fulfill the house occupancy needs.

Retiring solution user: In the event the a support affiliate plans towards the retiring inside 1 year shortly after making an application for a great Virtual assistant financing, they could discuss for an afterwards move-into the big date. A beneficial retiring veteran need certainly to tend to be a copy of its old-age software and you will old age income to own Virtual assistant lenders to consider this new demand.

Do it yourself: Specific house funded with Virtual assistant fund need fixes otherwise developments. Should this be the way it is, brand new realistic lifetime of asked domestic occupancy is prolonged. not, Virtual assistant home buyers have to approve the purpose in order to invade otherwise reoccupy on achievement of the improvements.

Unusual situations: In case your condition doesn’t matches among the many over activities, you could fill in a reason of your case towards the Va getting acceptance.

Even though the Virtual assistant also provides such exceptions, lenders have her conditions that may affect family occupancy requirements. Schedule an appointment which have an experienced Virtual assistant financial eg American Financial support to be sure.

Underwriting standards

Lenders tend to have internal standards with respect to Virtual assistant mortgage fico scores. Very mortgage lenders wanted a candidate with a credit score of 620 or higher.*

People plus need certainly to tell you sufficient money to settle the house loan and you may shouldn’t enjoys much obligations weight. Va financing recommendations are much more flexible than other financing versions to support qualification. For example, veterans may use their residence financing gurus a-year otherwise a few after bankruptcy otherwise property foreclosure.

Since 2020, there’s no limit into the Virtual assistant finance. Loan restrictions in the past varied by the state and have been considering average home prices.

Va mortgage Certificate of Qualification

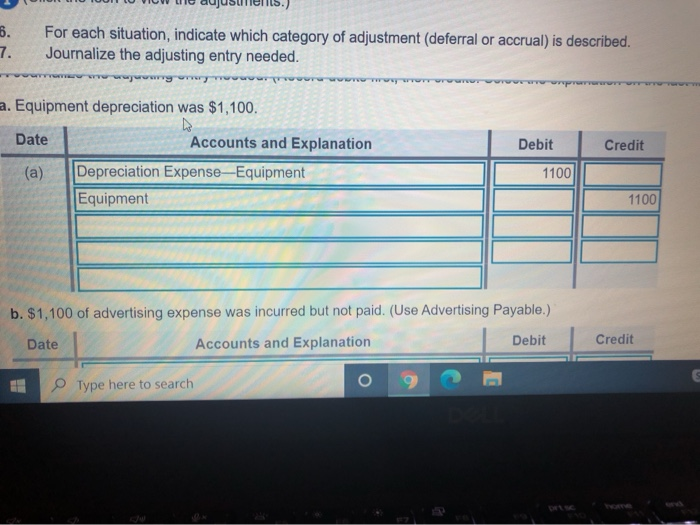

Loan providers require proof of qualifications before you apply to own an effective Virtual assistant mortgage. People need to get a certification of Eligibility (COE) and meet the eligibility conditions i touched with the earlier.

A unique advantageous asset of Virtual assistant financing ’s the guidance and you will guidance provided to help you troubled individuals. The fresh new Virtual assistant is negotiate into the lender on the part of brand new borrower in case of adversity and gives monetary recommendations. Their counselors may help borrowers discuss fee agreements, loan adjustment, or other choices so you can foreclosures.

How do i use?

Once you have their certificate of qualification (COE), you could potentially sign up for the newest Va mortgage. The program procedure is straightforward having American Resource. We have been a growing person in the latest VA’s list of greatest three hundred mortgage lenders and invested in bringing reasonable property for our military members. Get the most out of your Virtual assistant loan experts that have Western Funding and make contact with you now!

*Va mortgage criteria is actually subject to change. Right down to COVID-19, home loan people can’t service as many loans, meaning underwriting direction having government financing are becoming stricter.