Ideas on how to apply for home financing having Axis Financial

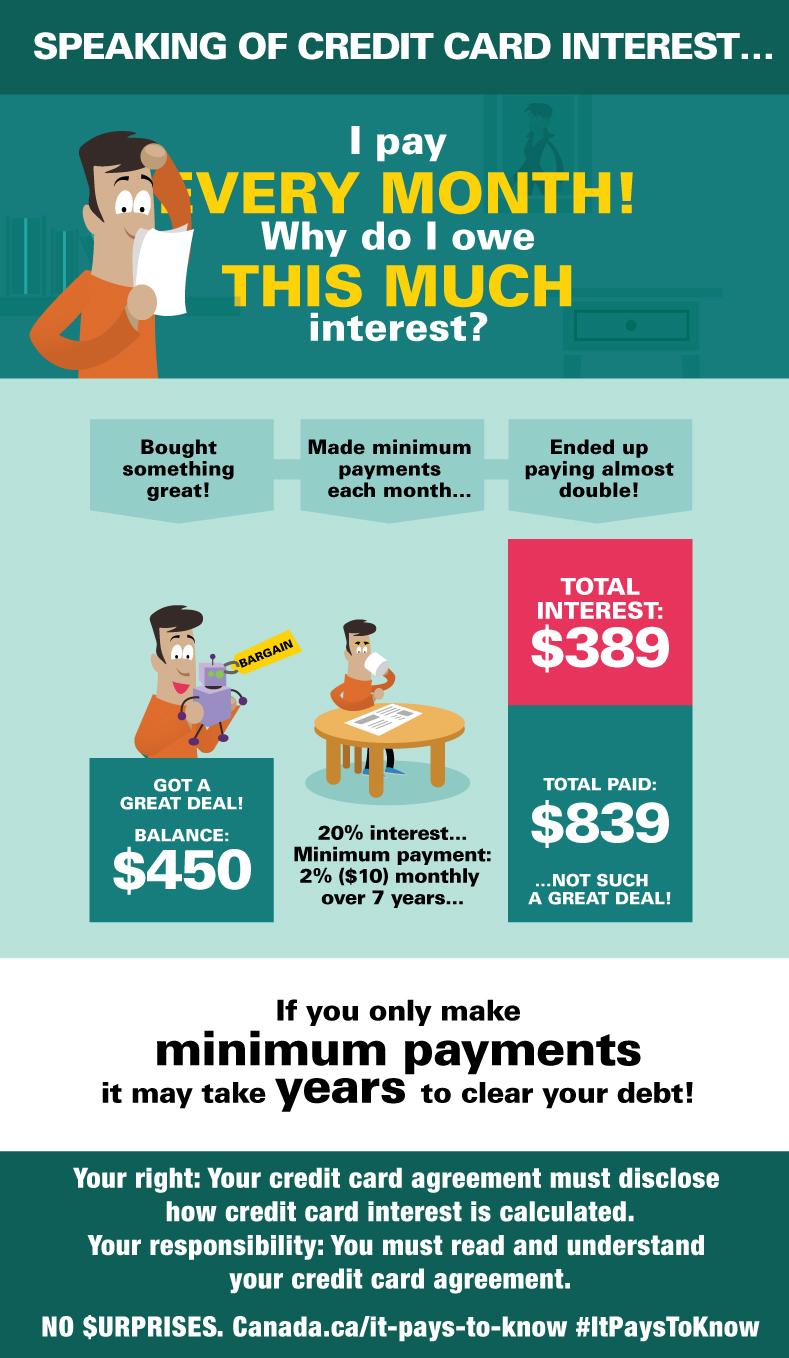

Take into account the following the example, that’ll give you a concept about precisely how far and just how enough time it will require to settle a home loan, so as to in the event the closing balance boils down to no, our home financing is regarded as signed.

Axis Bank Home loan

Towards the sector since it is the expense of homes was high as compared to income some one generate. You’ll find very few people that have enough money a home in full on their own and others need to have the help of mortgage brokers to buy the fantasy family.

Axis Lender among famous banks within the Asia provides family funds during the competitive interest levels making it possible for of several to manage to get thier house.

Taking home financing regarding Axis Financial is very simple where you need to simply go surfing see their website mouse click into home loan and you may fill in the facts questioned. Current customers get pre-approved funds predicated on the income and you may credit history.

Qualifications Conditions One to Determine the newest Approval of Axis Bank Home loan

The factual statements about our home mortgage that are included with interest rate, EMI matter, control charge etc. was informed beforehand and you may come to a decision to choose the mortgage. After, you really have acknowledged, the mortgage count might be disbursed towards checking account quickly.

While we have demostrated from the analogy more than following tenue has been complete and you’ve got reduced the eye and loan amount in full, you need to proceed to obtain a certification of the identical regarding the lending company, in this case Axis Financial.

The lending company could have stated your percentage across the tenor so you’re able to the fresh new four credit bureaus for the Asia and you can following completion regarding the loan an equivalent could well be advertised for the bureaus and you will do soon mirror on your own credit history. Brand new consent throughout the financial plus the reflection of the property financing since a closed membership is actually facts you have entirely compensated our home financing. Stay and don’t skip people payment, lenders generally are lasting money.

Brand new Axis Lender mortgage approval & verification processes is not difficult and far shorter to possess existing Axis Bank consumers. Capable pertain online and get pre-approved also offers on the home loans having glamorous rates. The loan count is in person paid on their account instantaneously.

The application process is different for brand new consumers. Brand new borrower should both pertain on the web or actually down load the new form from the formal webpages or look at the nearest financial branch. They are able to and call the Axis Financial financial support service in order to stick to the application processes.

Basically, bank’s user may come towards the work environment or your own where you can find assemble the latest filled inside application and all the fresh requisite data necessary for confirmation anytime your indicate. A back ground examine perform boost the lender discover the non-public, top-notch trustworthiness of the candidate If discover people discrepancies with what considering, the newest Axis Lender home loan software program is probably be declined. Immediately after passing owing to document confirmation and you can qualifications standards, the recognition process actions with the finally level. At finally stage and after deals, the brand new Axis Bank home loan rate of interest and you may period are fixed and you will delivered for the acknowledgement.

If your home loan application are rejected might located Axis Financial loan getting rejected letter that found a standing revision towards the payday loan Allgood mortgage getting rejected. Inform us see just what this new qualification otherwise qualifying criteria is actually since they are entitled when you look at the financial parlance for a mortgage.