Here’s how Louisiana instructors, very first responders will get help to order house during the difficult market

Andrea Gallo

- Text messages

Taylor and you can Kelsey Montney, with regards to puppy, Stanley, pose to have a photo from the their brand new house in the Metairie, Friday, . (Photo by Scott Threlkeld, The days-Picayune | NOLA)

- Texting

- Printing Backup article hook up

Given that ascending interest levels, home values and you may insurance costs keeps put the American fantasy out regarding take of numerous possible customers, yet another Louisiana system is enabling instructors, basic responders or other societal servants to acquire land.

The latest Louisiana Houses Corp.is the reason Techniques to own Solution program gives them 4% of the loan amount to utilize for the its deposit otherwise closing costs. The brand new initiative is actually accessible to educators, the police, firefighters, paramedics, personal safeguards telecommunication pros and you will healthcare group exactly who secure under $125,000 a year.

This type of first responders, fire fighters, teachers, members of medical career, they give you a whole lot into neighborhood, said Brenda Evans, LHC’s home ownership and you will chief durability manager. We wanted to manage to give back on them.

Taylor and Kelsey Montney, employing dog, Stanley, angle to have a photograph during the their brand new house when you look at the Metairie, Friday, . (Images because of the Scott Threlkeld, The times-Picayune | NOLA)

He instructs 7th grade research from the Slidell Junior Twelfth grade. Once the Montney and his awesome wife spent weeks seeking the earliest household, the bank advised all of them that he you certainly will qualify for Tips to own Service.

It assisted you having having some extra to have down-payment or settlement costs, Montney said. They put somewhat simple attention; there is a little bit of assist.

They gone which week using their rental into the Bayou St. John so you can a white-bluish, three-bed room, two-shower house when you look at the Metairie. The guy said they certainly were attracted to our home by the big window, this new oak tree aside top as well as the discover floors plan for the kitchen, dinner and you can areas. Plus, it has a roomy lawn where the cocker spaniel, Stanley, is also frolic.

The way it operates

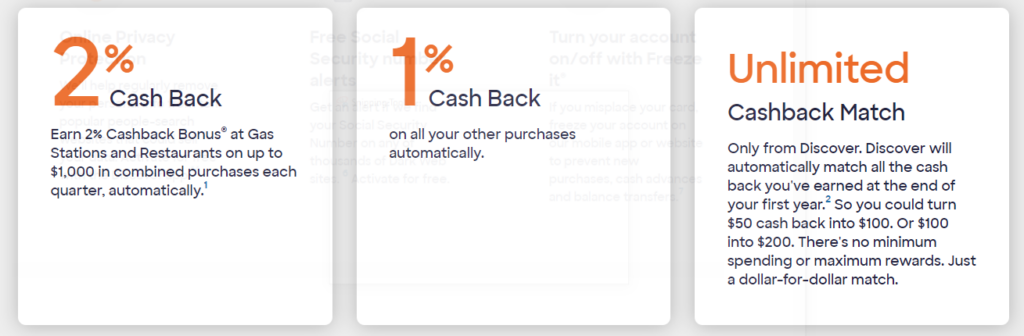

Evans said, using the exemplory instance of a house that costs $100,000. If a borrower invested $20,000 on an advance payment right after which had an $80,000 mortgage to pay off, they had located 4% of loan commission – otherwise $3,two hundred. The bucks might have to go with the a bigger advance payment otherwise closing will cost you.

People aren’t needed to pay back the fresh 4% should they stay in your house for 5 decades, she told you.

As well as the earnings cover and jobs criteria, the applying need homebuyers for a credit rating of on least 640 and to fool around with a playing financial, who are listed on LHC’s website.

Taylor Rogers, a loan provider having Crucial Financial in Baton Rouge, told you it is one of the better equipment in the repertoire.

A giant commission score a significant amaze while i let them know, great news, you be eligible for X level of cash, Rogers said. Hardly any money that the debtor already had planned regarding offer – we have been supplementing one.

The money brand new 4% infusion frees up may go towards a more impressive downpayment and you can lower monthly notes, Rogers informed me. It also helps the customer generate guarantee quicker.

Up to now, 93 household took benefit of the program as it circulated later this past year, LHC said. Even so they nevertheless discover of several qualified folks have yet , so you’re able to tune in to of it.

Home OWNERSHP Obstacles

Interest rates reach the large part of over a couple of decades: on average eight.31% for a 30-seasons financial. Its a brutal hurdle for these yourself-to shop for business; lower inventory has actually added to the situation.

In Louisiana, individuals try competing with a different frustration: skyrocketing insurance premiums. As the county currently have a dearth off sensible property, the insurance advanced increases has actually put off the development out-of reasonable casing methods.

The latest median family rates inside the Orleans Parish was $347,000, this new average speed inside the Baton Rouge was $261,000 and also the median price into the Lafayette was $270,000.

Evans told you she expectations programs such as for instance Tips to own Solution helps to keep social servants and you will very first responders regarding housing market, despite the issues.

Frequently, the greatest obstacle so you can homeownership has sufficient money on downpayment and you will settlement costs, Evans told you.

LHC has an alternative program designed to very first-time homebuyers that isn’t occupations-specific called the home loan cash thread, or MRB, system. To help you meet the requirements, individuals have to secure less than a particular endurance. In East Baton Rouge, the cash importance of children away from four is actually significantly less than $67,450.

This new MRB system – and that can’t be and Important factors to have Provider – together with gets home buyers 4% of its loan amount, but it addittionally has lower rates to the loan.