Home loan Choice Liberty Saver and you may Flex has

Because you pay the loan and get rid of to a higher LVR level into the an appropriate variable financing, your own interest rate level may also miss.

Need even more options? We provide Liberty Fixed, and Designed selection for extra borrowing from the bank without LMI or more self-reliance with option earnings paperwork

Talk to your regional agent

Your Mortgage Possibilities agent often examine financing away from more than thirty-five loan providers in order to get the provider that is true to you personally.

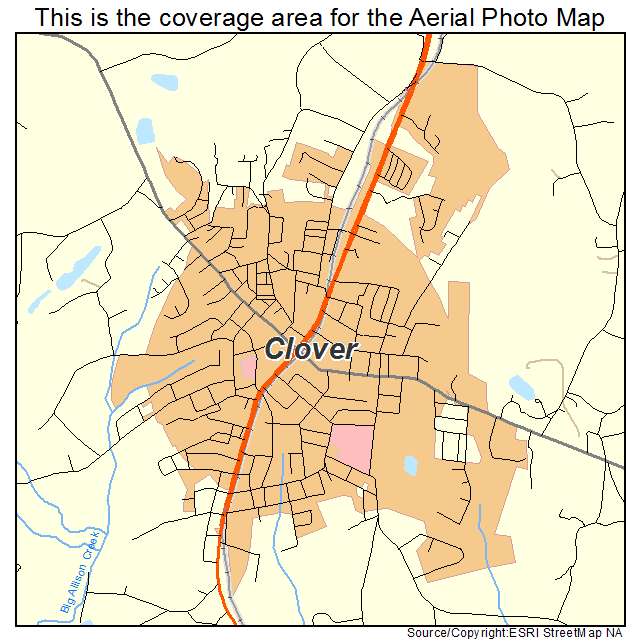

Come across a mortgage broker in order to

In search of home financing large financial company? Select a community pro on your suburb in order to buy you to fantasy home now.

- Place

- Agent term

Mortgage Alternatives Liberty app

Build limitless extra costs towards the varying funds, and extra money all the way to 5% of one’s fixed loan harmony every year from your mortgage wedding

Financial Choices Liberty was powered by Athena

Home loan Choice have hitched having Athena Lenders to take you the mortgage Selection Liberty range of products. Because of the consolidating the help of the agents that have Athena’s leading edge household mortgage possess, you want to help a lot more Australians pay their residence finance ultimately and you may safe their financial upcoming.

Athena is actually an award-profitable and you will innovative digital lender that has assisted more 12,000 Australians save yourself more $668 mil on the lenders (as the at the ).

Launched in 2019, Athena are supported by some of the biggest names on her latest blog industry, and additionally Australian Extremely, Hostplus, Macquarie Bank and you may Sunsuper.

- Bing

- See a broker

- Select a large financial company when you look at the Questionnaire

- Come across a mortgage broker in Melbourne

- Come across a mortgage broker inside Brisbane

- Look for a large financial company during the Adelaide

- Select a large financial company into the Perth

Copyright laws 2024 Mortgage Options Pty Restricted (ABN 57 009 161 979, Australian Credit License 382869) and you may Smartline Surgery Pty Limited (ABN 86 086 467 727 Australian Borrowing Permit 385325) are owned by REA Classification Limited. Your agent commonly indicates whether or not they try a cards affiliate from Mortgage Possibilities otherwise Smartline.?

step 1. An appreciate-for-like variable mortgage means that the merchandise because stated to brand new people is equivalent to the merchandise offered to an existing buyers. For complete information about Automatic Rate Matches, please look for our Words & Requirements.dos. According to your role, you might be charged bodies costs otherwise charge from third parties.

All the info provided on this site is actually for standard training intentions simply that is maybe not meant to form specialist or private advice. This website might have been waiting instead looking at their expectations, finances otherwise needs. For that reason, you need to know the fresh new appropriateness of recommendations towards individual condition and needs prior to taking one step. It should not be relied on to the reason for entering into one courtroom or monetary commitments. Particular capital recommendations can be obtained from a suitably accredited professional ahead of following people funding approach. If any monetary product has been mentioned, you can purchase and study a duplicate of your own related Unit Revelation Report and you may take into account the guidance consisted of in this you to Report with regard to your personal things, before you make any choice regarding the whether to find the equipment. You might see a duplicate of the PDS of the emailing or from the contacting thirteen 77 62. * Note: your house mortgage into reasonable newest interest is not necessarily the best option for the situations, you do not qualify for that particular unit, the product will most likely not tend to be all the features highly relevant to you, and not all items are in the claims and regions.# The fresh new comparison price considering is dependent on a loan amount off $150,000 and you can a term out-of twenty five years. WARNING: This Evaluation Speed can be applied in order to the brand new analogy or advice considering. Different number and you will terms and conditions can lead to additional Analysis Pricing. Will cost you such redraw charge otherwise early payment charges, and cost savings like percentage waivers, are not within the Review Rate but can determine the new price of the mortgage.