The new economy together with benefited regarding the building and you will financing growth you to got the newest homeownership rates in order to checklist profile

Boom-and-bust. The fresh Construction device begins (unmarried and you may multi-family) hit 2,068,000 systems in the 2005, versus an annual mediocre of approximately 1.cuatro billion starts from inside the 1990s. In the 1972, big federal subsidies powered industry so you’re able to unsustainable profile as well as the all-big date checklist from almost dos.cuatro million brand new products.

Even in the event full initiate in 2005 decrease in short supply of the fresh 1972 listing, the latest affect subprime mortgage loans appears significantly more obviously regarding single-home ily land achieved 1.six mil devices in 2004 and you can step 1.eight billion units inside the 2005, as compared to step 1.step three mil in the 1972 and an annual average of approximately step one.1 million when you look at the 1990’s. Not surprisingly, conversion of the latest homes reached checklist membership when you look at the 2005, since the performed conversion process out of current homes.

Still, 2005 are the fresh top amount of activity in the Housing industry

Through so it Casing increase, construction workers, mortgage brokers, real estate professionals, landscapers, surveyors, appraisers, producers and services of making materials, and many more procedures and you may organizations spotted checklist levels of pastime and you may profits. This passion, consequently, flowed through the remaining economy within the earliest half of of .

Escalating home prices in several areas having rigorous homes-fool around with laws and regulations made Construction unaffordable, for even those people having fun with even more risky mortgage loans to invest in the greater amount of expensive land. Very early defaults in certain subprime mortgages started to arise-commonly just after just one or two payments-sharing a routine from swindle in lots of instance purchases. Since problems worsened, Housing begins and you may new house conversion process decrease greatly when you look at the 2006, and weakening sector finished the price rise in of numerous regional Homes markets.

That it resulted in extra non-payments in the recently originated subprime mortgage loans from inside the that your borrowers had assumed one to perpetual home price develops carry out permit them to re-finance the way-out out-of onerous financing terminology, like the planned „resets“ to better month-to-month home loan repayments. A growing number of borrowers who’d utilized subprime mortgages and you can/or moments purchasing during the level of the market with 100 % financing discover by themselves holding loans lots one to exceeded the newest beliefs of its land, and also make refinancing hopeless. What’s more, it generated promoting brand new land largely hopeless because proceeds create are unsuccessful of outstanding obligations, pushing proprietors to pay for variations from almost every other economic info, hence of a lot did not have.

Property foreclosure plus sprang of lower than 4 percent away https://cashadvanceamerica.net/title-loans-ma/ from an excellent subprime money in 2000 to simply more than nine percent at the beginning of 2002

Because of these financial erica’s Housing and you will mortgage marketplace is sense a catastrophic decline. Shortly after getting together with more than step 1.eight million tools in 2005, single-friends construction begins for the dropped in order to 707,000 gadgets at the a great seasonally modified annual speed-not even half the production quantity of .

Conversion process of brand new land including dropped precipitously across the same months. Immediately following reaching 1,283,000 equipment when you look at the 2005, brand new home conversion decrease to good seasonally adjusted annual price out-of 590,000 inside level and you may off 30.8 per cent out of . For existing homes, sales peaked on eight,076,000 devices from inside the 2005, decrease so you can 6.cuatro billion gadgets in the 2006, and fell to help you a great seasonally adjusted annual rate of five mil units because of the top profile.

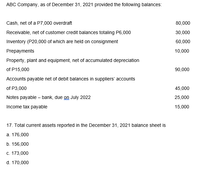

Financial default and you will foreclosure cost and began to rise, and you can non-payments in the near future strike the high membership noticed in the past several years. Pursuing the start of progressive subprime market inside 1995, default costs on subprime mortgage loans rose continuously, from around 10 percent into the 1998 to almost 15 percent when you look at the early 2002, considering the economy’s weakening at the beginning of the fresh new years pursuing the mark-com stock-exchange bubble collapse together with nine/eleven attacks. In the years you to implemented, interest rates dropped, the discount increased quicker, and you will Homes starts and you will transformation boomed.