Non-bank lenders will often have lower overheads and certainly will pass on these types of offers so you can individuals thanks to more appealing mortgage terms

Interest-Only symptoms

Interest-simply attacks will likely be very theraputic for specific borrowers, while they briefly clean out month-to-month payments of the demanding just desire money toward loan. This feature offer individuals having small-title monetary rescue or permit them to head money towards almost every other opportunities or expenditures. Yet not, interest-merely symptoms can also produce higher total mortgage can cost you, as the prominent payments is deferred, and financing balance stays intact. From the concentrating only to your interest rates, borrowers will get neglect to check out the much time-label implications of interest-simply episodes as well as their affect its total monetary requirements and financial costs.

Counterbalance levels

A counterbalance membership is actually an invaluable home loan ability that allows individuals to attenuate their attention money because of the offsetting its loan balance towards the money in the a connected deal otherwise savings account. This can lead to good attract offers that assist individuals spend off their mortgage faster.

Because of the paying attention solely with the rates of interest, consumers could possibly get overlook the key benefits of a counterbalance account, that could provide them with additional control more its loan and you will assist them to get to its financial goals more easily.

Because of the supply and terms of a counterbalance account when choosing home financing can result in long-title coupons and you may increased financial liberty.

Non-Lender lenders versus. old-fashioned banking institutions

Considering each other low-lender lenders and you may old-fashioned banks when searching for a home loan also provide consumers that have a larger range of mortgage products and potentially alot more aggressive rates.

Of the paying attention solely on rates of interest, individuals will get miss out on the advantages of coping with non-financial loan providers, including custom customer service, faster mortgage running, and you can imaginative loan issues.

Researching mortgage solutions regarding one another type of lenders will help consumers find a very good home loan to fit their needs and you may monetary specifications.

Household members verify loans

Family make certain finance can be an invaluable option for individuals whom may not have an adequate put and/or needed credit score so you’re able to secure a vintage financial. Such funds make it a family member to make use of their residence since the shelter towards borrower’s financial, possibly enabling the borrower to access alot more good mortgage terminology and you can end pricey financial insurance costs.

Try not to overlook the prospective benefits associated with a household verify loan, that will enable them to go into the possessions business fundamentally and with much more investment.

Repaired speed home loans

Repaired speed attacks provide borrowers the fresh certainty out of repaired repayments and you will safety facing potential interest rate motion to own a specified term. This stability might help borrowers funds and you can plan the earnings significantly more effectively, especially in times of financial uncertainty.

Of a lot individuals could possibly get are not able to check out the advantages of fixed speed home loans, which could give them financial predictability and you can peace of mind. Evaluating the suitability off a fixed rate months inside their financial might help consumers harmony their economic needs and you may chance endurance which have the opportunity of interest rate savings.

A proper Currency financial also can merge the flexibleness regarding a counterbalance membership on surety of a fixed price household loan, a component not of numerous loan providers render.

Debt consolidation choice

Debt consolidating solutions may help consumers improve its cash by merging several highest-focus expense, such as credit cards and personal finance, on the an individual mortgage which have a diminished interest. This may end in down monthly costs, faster notice will set you back, and you can a in check finances.

You will find possible advantages of debt consolidation alternatives, which could boost their monetary health insurance and make mortgage much more reasonable. Contrasting debt consolidation reduction choices in conjunction with interest levels may help consumers reach most readily useful economic outcomes and you will a lot of time-term coupons.

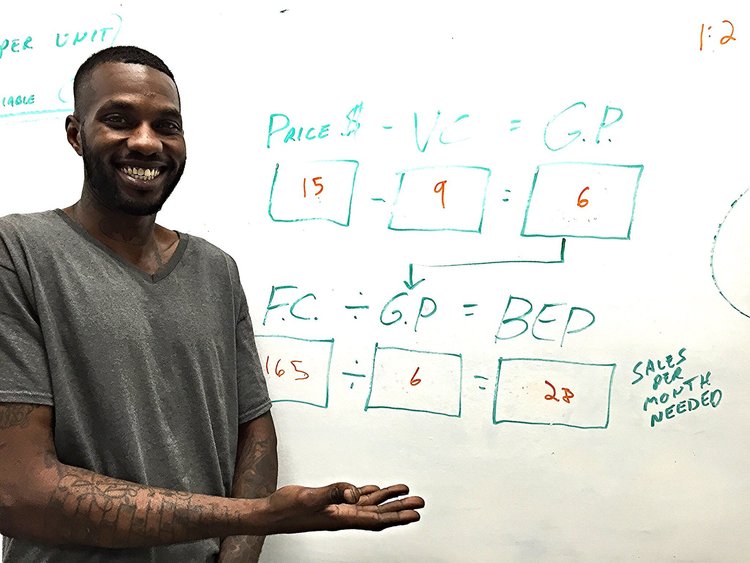

Insights financing terminology

In addition, the mortgage application procedure includes the fresh new lender’s analysis of your economic situation additionally the devotion of your own amount borrowed and you can words they are willing to bring. A lender which have an intensive and you may successful evaluation processes can help be sure to try paired having home financing product that better suits your circumstances and you may economic capabilities.

For folks who pay only focus on the pace when selecting a home loan, you could accidentally discover a loan with a high hop out charges or punishment. This could allow it to be more challenging for you to change your financing otherwise pay it off very early, and may also find yourself charging your extra money in the much time run.

Borrowers could possibly get neglect the importance of LVR within total credit will set you back and you can fail to improve their loan build, that will end in higher full expenditures and limited credit strength.