For some people, taking out fully a cash-away refinance having a financial investment could be extremely winning

Which have a finances-away re-finance, you could take out 80 per cent of your residence’s really worth for the bucks. For a lot of, taking out fully a cash-aside re-finance to own an investment can be very winning.

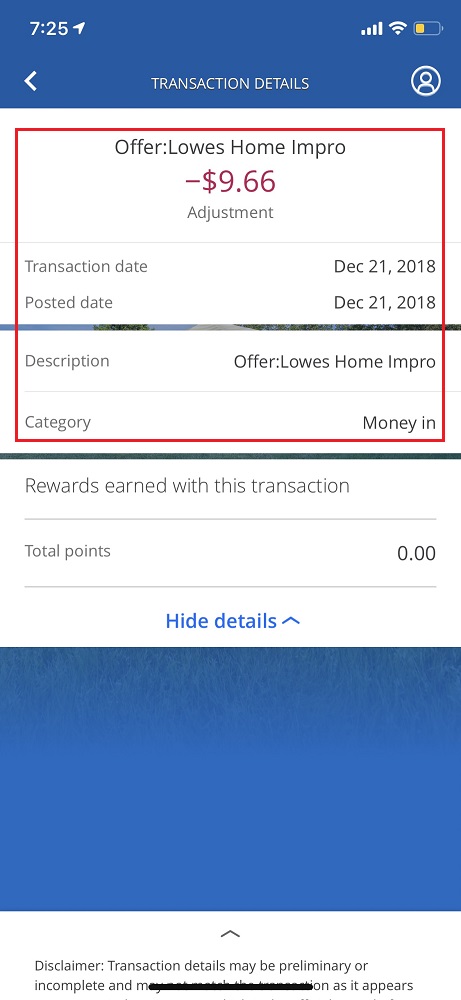

Cash-out is suitable getting do-it-yourself plus credit card or other debt consolidation. Right here you could potentially re-finance large amount than just your existing mortgage. You can keep the cash differences to you.

Can you imagine you are taking out INR100,000 (Dh4,825) bucks of an effective re-finance and invest they to the starting even more possessions. For people who put straight back more exactly what it charge you, up coming great.

Opposite mortgage loans may help earlier people with things such as medical expenses.

Particularly Asia, extremely governments does not enable you to just take more than 50 % away within the a good refinance compared to the worth of the house or property. The owners of the home normally live-in their house this new rest of its lives with this particular types of loan.

Reverse mortgages is going to be an affordable option for older people one to lets these to have the lifestyle they require including the element traveling and take care of their property.

Regardless of if enticing, consider when you get another type of home loan you take towards the far more exposure. You’re including an alternative payment per month on the funds.

And, you are going from underwriting processes together with the verifications and you can documents necessary that you did when you bought your property.

Summary? Make certain an earnings-out re-finance is best economic option for your role – there could be most other resource possibilities to complete your aims.

Points to consider whenever refinancing?

In case your home guarantee credit line is going to be made use of for domestic home improvements so you can improve value of brand new house, you can also consider this to be increased funds abreast of the deals of your own family is precisely how might pay off the fresh new loan.

The initial thing you have to do regarding refinancing is always to consider how might pay off the borrowed funds.

In addition, if the borrowing from the bank are useful for something else entirely, instance an alternate automobile, education, or perhaps to pay down credit card debt, it’s always best to sit back and set so you can report exactly how you would pay off the mortgage.

Plus, just be sure to speak to your financial and you may discuss the selection available to choose from, plus sharing together with other loan providers the options they would make available. It can be that there’s perhaps not a recently available deal and that will be satisfied due to refinancing who help you during the second.

In the event that’s possible, about you now know exactly what you should manage when you look at the purchase so that an excellent refinancing opportunity best benefit you.

Whenever refinancing, it may benefit you to hire legal counsel in order to understand this is of a few of your own harder documentation.

By refinancing the home loan to pay off loans otherwise borrowing against your home, you can notably reduce the interest rate with the several of your other highest-attract personal debt.

When you have credit debt during the 20 per cent, instance, you could reduce Redding Center loans the interest way-down if you’re able to qualify for a mortgage in the 4.twenty-five percent.

Might you re-finance the loan even before it is reduced?

Yes, and this refers to a separate common assortment of refinancing. Bringing a different sort of financial otherwise financial to change the first loan, or, going a preexisting mortgage to a different bank is also a new means from refinancing.

This kind of refinancing is usually completed to help you to get top rates of interest and more simpler terms of fees.