Subsidized Government Lead Financing are offered so you’re able to undergraduate students indicating economic you would like

Loan techniques procedures have to be done at the least two weeks earlier so you’re able to disbursement to ensure that you discovered their funds within the good fast trend, with the exception of the fresh Temporary Improve.

Government Direct Funds

These are accessible to undergraduate and scholar college students just who enter at least 50 % of-day. Youngsters are not guilty of focus accrued to your Paid Lead Funds whilst in school. Unsubsidized Federal Lead Fund are provided so you can pupils who do maybe not qualify for new Subsidized Direct Loan otherwise would meet the requirements consequently they are however needing more capital. Children are responsible for appeal accrued into Unsubsidized Direct Fund when you are at school. Yearly Direct Financing credit constraints to own dependent student pupils was $5,500 to have open bank account online no deposit bad credit freshmen, $6,500 for sophomores, and you will $seven,five-hundred for undergraduate students past Sophomore position. Separate undergraduate pupils may obtain extra unsubsidized financing outside the above mentioned restrictions (most matter hinges on academic status). Graduate pupils get borrow around $20,500 annually during the Unsubsidized Direct Financing. Repayment of dominant and you can accrued interest starts 6 months following the scholar graduates, withdraws, otherwise drops less than half-time enrollment. There’s absolutely no penalty to have taking a partial amount borrowed.

- Federal Financing Charge & Rates of interest

- Entry Counseling

- Children with Perhaps not received a federal Head Financing courtesy FAU since the 2002 need complete Entrance Guidance prior to disbursement

- Leave Counseling

- Students that received Federal Lead Finance need done Hop out Counseling in advance of leaving the new College or university

- Details about income-driven fees out-of Government Loans

- Master Promissory Notice

- (To access school funding history)

Older people in their Finally Session

Whenever an enthusiastic undergraduate borrower’s leftover age investigation try smaller than just the full academic 12 months, the latest Direct Mortgage must be prorated predicated on subscription. Inability to help you alert the brand new Student School funding Office ahead of the start of one last semester can result in quick installment away from a portion of the Head Loan. Children which owe an equilibrium to help you FAU doesn’t discover its diplomas.

Full and you may Long lasting Impairment Release

An online site could have been then followed to your Overall and you may Permanent Disability (TPD) Launch techniques. Borrowers seeking a handicap release of the FFEL System finance, Direct Loan System finance, and you can Professor Education Guidelines to have School and better Knowledge (TEACH) Offer services financial obligation will find done recommendations within the fresh new TPD Launch Site.

Federal As well as Finance

The Government Lead Also Mortgage is a low interest loan offered to simply help the mother and father of founded college students accepted and subscribed to an enthusiastic undergraduate degree program or graduate people admitted and you may subscribed to a graduate degree system. To get eligible for the new Lead And Loan, the new moms and dad borrower and/or graduate pupil borrower should have zero adverse credit history. Limitation qualifications is equivalent to price of degree without other help. Installment regarding prominent and you may attract begins within two months after the financing try completely disbursed. The brand new consumers is entitled to put off cost up to pupil graduates or stops become enlisted at least half of-big date. To help you discover a primary Including Mortgage, people must earliest file a free of charge Software having Government Beginner Assistance (FAFSA).

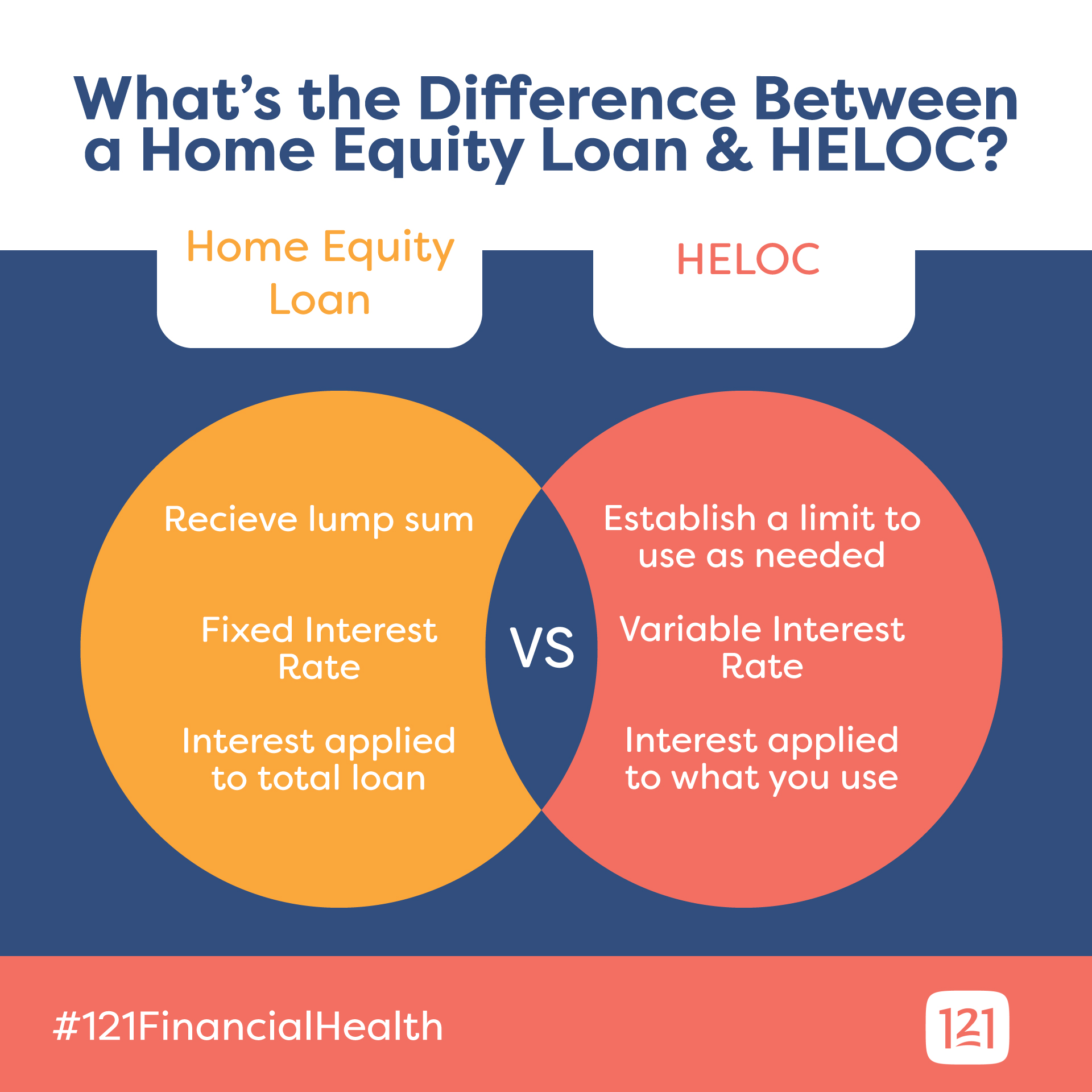

Individual Financing

Private student education loans (known as option finance) are low-government fund, created by a lender eg a bank, borrowing partnership or condition agencies. Government figuratively speaking is advantages (particularly fixed prices, income-founded cost plans, and you may mortgage forgiveness arrangements) perhaps not generally provided by private loans. In many cases, private financing is costly than Federal student loans. A student shouldn’t think credit away from a personal loan program up to he has got fatigued almost all their Government Mortgage selection first.