That is Bad for the FICO Get: Bankruptcy, Foreclosures, Quick Sales, or Loan modification?

Foreclosures and its solutions may cause your credit scores to decrease-the quantity relies on your credit report or any other circumstances.

Whenever you are incapable of build your mortgage payments, certainly about inside them, otherwise already up against foreclosure, you’re wondering concerning the impression from a foreclosures or foreclosure choices in your borrowing from the bank. The thing is, if you seek bankruptcy relief, let your home proceed through property foreclosure, done a preliminary business, otherwise workout that loan amendment on lender, the credit ratings will likely experience.

However, have a tendency to one alternatives perception their fico scores so much more than simply an alternative? Foreclosure, brief conversion, and case of bankruptcy are all bad for your borrowing. Bankruptcy proceeding payday loans online North Carolina ’s the terrible of your own bunch. Financing modification might not be so incredibly bad, depending on how the lender account the latest modification on borrowing from the bank bureaus.

How FICO Fico scores Work

A beneficial „credit rating“ is a number allotted to your because of the a credit reporting business that forecasts the right which you yourself can default on your own percentage personal debt. Credit reporting people explore different facets and you can data to come upwards together with your ratings (you may have several), but for the most part, all the details they use is actually contained in their credit history.

Of numerous credit scoring organizations can be found, however, Credit ratings can be used into the 90% of all of the home mortgage applications (considering FICO).

Exactly what Points Does FICO Have fun with?

- Percentage history (35%). Their ratings is negatively affected if you have paid off expense late, got a free account sent to collection, otherwise proclaimed bankruptcy proceeding-the greater number of recent the trouble, the reduced their scores.

- The financial obligation (30%). FICO takes into account the amount of debt you have got compared to the amount of borrowing available to you; in the event your number you borrowed is close to your credit limit, which is planning to harm the score. And, carrying a balance on numerous membership you are going to decrease your scores due to the fact it looks like you are overextended.

- Amount of your credit score (15%). This new prolonged your membership have been open, the better.

- The fresh new borrowing from the bank (10%). If you have recently applied for new membership, which could negatively apply to the scores. Promotional issues do not amount, in the event.

- Sort of borrowing from the bank active (10%). FICO claims it’s in search of a „healthy merge“ various types of borrowing, both rotating and cost account.

What exactly is good FICO Financial Score?

One of the fico scores FICO produces is named a beneficial „FICO Home loan Rating.“ Also the significantly more than factors, so it rating may also take into account:

- child assistance repayments

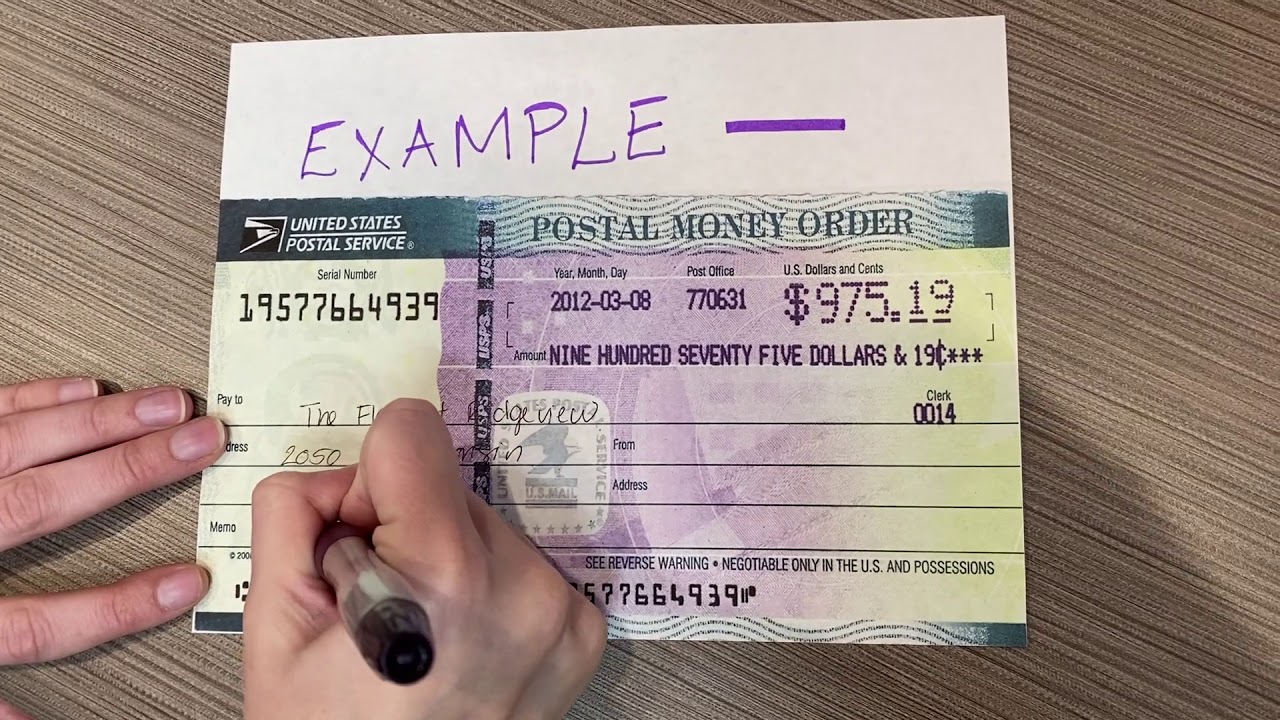

- cash advance

- public records, and you can

- leasing repayments.

Credit scores are based on all the details in your credit reports. Bankruptcies show up on your credit score having eight or ten years, according to the state. Most other bad recommendations, also foreclosure, short transformation, and you will mortgage changes (when they stated negatively), will remain on the credit history to have seven ages.

Just how a foreclosures, Case of bankruptcy, otherwise Quick Marketing Affects The Credit scores

A foreclosure otherwise short sale, plus a deed instead of foreclosures, are common rather comparable with respect to impacting your own credit. They are all of the bad. But case of bankruptcy is worse.

How does a foreclosure Connect with Your Fico scores?

Experiencing a foreclosures tends to lower your results from the in the least 100 circumstances or so. Exactly how much their score will slide all hangs to help you a huge degree in your scores until the foreclosures. While you are among the many few people that have highest credit scores in advance of property foreclosure, you’ll cure more situations than just anybody which have lower credit ratings.

For instance, according to FICO, individuals that have a credit rating out-of 680 before foreclosures will lose 85 so you can 105 items, however, some one with a credit rating of 780 in advance of property foreclosure have a tendency to reduce 140 to 160 items. Predicated on pros, late payments cause a large dip on your credit scores, which means that a following foreclosure doesn’t amount as much (your own borrowing from the bank is damaged).