How much Are Individual Mortgage Insurance policies for the Connecticut?

Faster conditions, such as for example fifteen years, normally have large monthly premiums but result in smaller focus paid back across the lifetime of the loan. However, a thirty-seasons identity usually has lower monthly premiums but accrues more notice over the years. Deciding on the best title relies on your debts and you can goals.

Making use of the financial calculator inside Connecticut, you can view the payment per month for a thirty-12 months fixed speed home loan towards the an excellent $275,000 home shortly after good 20% down-payment try $step one,376. So it figure is dependant on the average Apr off six.4% and does not tend to be extra will set you back eg HOA fees otherwise possessions taxation.

Going for a fifteen-season installment label for your house mortgage alters your own monthly home loan percentage in order to $step 1,833. That it adjustment increases your own small-label expenditures but decreases www.cashadvancecompass.com/personal-loans-az the total focus paid off over the life of your loan from the $165,497, making it a strategic economic decision for long-title deals.

Influence Their Mortgage’s Value

To order a home is among the largest expenditures it is possible to face, along with your mortgage payments might eat a massive portion of your month-to-month income. Focusing on how affordable your own mortgage is might have a long-term perception on the profit. MoneyGeek’s mortgage calculator to have value makes it possible to determine so it by simply inputting the month-to-month money or any other month-to-month costs, particularly car loans otherwise college loans.

New calculator in addition to reveals your debt-to-earnings proportion, a critical metric for anybody gonna secure home financing. Which ratio suggests simply how much of your earnings is seriously interested in loans money. Experian accounts the average financial obligation during the Connecticut are $110,034, converting to help you the common month-to-month obligations off $nine,170. Understanding so it ratio can be make suggestions for the dealing with your money better.

See your Amortization Agenda

- Principal: The mortgage number your obtain. Facts it will help the thing is how much cash you borrowed.

- Interest: The price of credit the principal. Knowing this proves the full price of your loan.

MoneyGeek’s financial calculator enables you to see your amortization plan and you can estimate the complete notice you can shell out across the longevity of their financing when you look at the Connecticut. You could pick in the event the monthly payments beginning to go alot more into the dominant against. your attract, that helps you are sure that your percentage allotment through the years.

Even more Home loan Charges inside Connecticut

Homebuyers into the Connecticut have to thought almost every other charge when figuring monthly mortgage repayments as these make a difference your financial budget. Such as for example, financial insurance rates and you may HOA fees increases their payment per month. Property fees and home insurance are other financial charges to store in your mind.

Home insurance

Home insurance handles your home and private home out-of wreck or thieves. In addition it will bring liability publicity if someone is damage on your possessions. The common homeowners insurance in Connecticut costs $2,289 per year.

Assets Tax

Assets taxation try a good levy to your a residential property one people need to pay into the local government. They finance personal features for example schools and you may structure. Depending on the Income tax Foundation, Connecticut’s effective possessions income tax price are step one.79%, positions they fifth in the united states.

HOA Fees

HOA charge is actually money in order to homeowners contacts to have assets government, repair, and people amenities. These types of charge are usually repaid monthly otherwise per year.

Personal Mortgage Insurance coverage

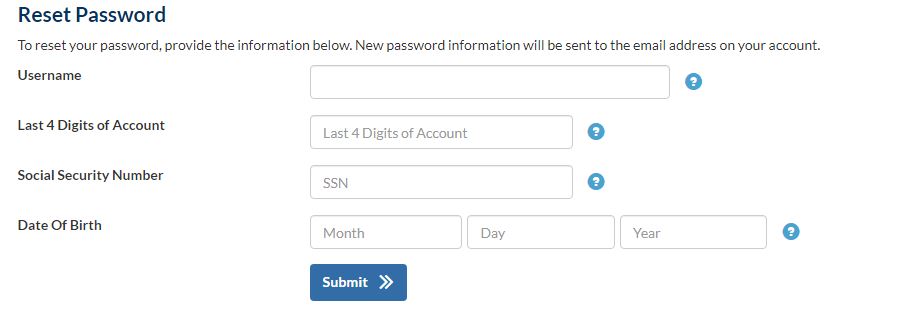

Individual home loan insurance policies (PMI) covers lenders in the event that a borrower defaults toward a loan. They applies to antique mortgage loans if deposit try quicker than 20%. Borrowers need to request cancellation once they started to 20% guarantee, otherwise it will simply be immediately got rid of within 22%.

The average Apr for a 30-seasons repaired loan inside Connecticut are 6.4%. Getting an effective 15-12 months repaired mortgage, its 5.8%. Having fun with MoneyGeek’s PMI calculator, you can see you to definitely to have a beneficial $275,000 house with a beneficial ten% deposit, consumers having a credit history ranging from 680 and you can 719 pay PMI well worth $117 once they rating a 30-12 months financing. The quantity becomes $115 whenever they decide for a fifteen-12 months financing rather.