Less than perfect credit makes securing property guarantee line of credit (HELOC) more difficult

Erin Kinkade, CFP, ChFC, work since the an economic planner during the AAFMAA Wide range Administration & Trust. Erin makes complete financial preparations to possess military pros as well as their group.

Also the amount of collateral you’ve got at your home, lenders consider your credit score when making approval behavior. Less than perfect credit is slim all of the financing solutions you’ve got to pick from.

If you are seeking tapping your residence security, there is build a listing of loan providers that offer good HELOC to have bad credit. We’re going to and strongly recommend possibilities so you can HELOCs if you wish to obtain.

How dreadful borrowing impacts a HELOC

A HELOC is an excellent rotating credit line covered by the domestic equity. Collateral is the difference in your balance in your house and you will what it’s well worth. Immediately following recognized for a beneficial HELOC, you could mark on your credit line as needed, and you also pay only attract towards the piece you utilize.

One of other factors, loan providers thought credit ratings once you make an application for an effective HELOC. FICO credit ratings, starting from 3 hundred so you’re able to 850, are definitely the most well known. Into the FICO level, an effective bad or poor credit rating could be some thing lower than 580.

- Investing a higher rate of interest, which could make your line of credit more costly.

- Investing a yearly fee or any other fees the lending company means.

- Being tasked a lower life expectancy borrowing limit or less good cost words.

You pay interest with respect to the HELOC your explore, however, a higher rate can increase the cost of credit. Based on how far your use, the difference between good credit and you may an adverse one to you may imply purchasing thousands a great deal more when you look at the appeal.

HELOC loan providers having poor credit

Looking around is very important when you want a beneficial HELOC but i have less than perfect credit. It’s a chance to get rid of lenders you may not qualify to possess considering its lowest credit score requirementsparing HELOCs can also leave you angle toward kind of https://clickcashadvance.com/payday-loans-ri/ prices and you may terms and conditions you might be able to rating.

- Just how much you will be capable acquire

- Exactly what rates of interest you could potentially spend

- Whether or not cost is actually repaired otherwise varying

- What charges, or no, can get use

- Just how in the future you have access to your line of credit if approved

- Just how long you can draw out of your credit line and just how enough time the fresh cost period continues

You can even want to consider if or not an effective HELOC financial even offers any unique gurus, particularly a keen autopay rate disregard. Even hook reduced their price will save you extreme number fundamentally.

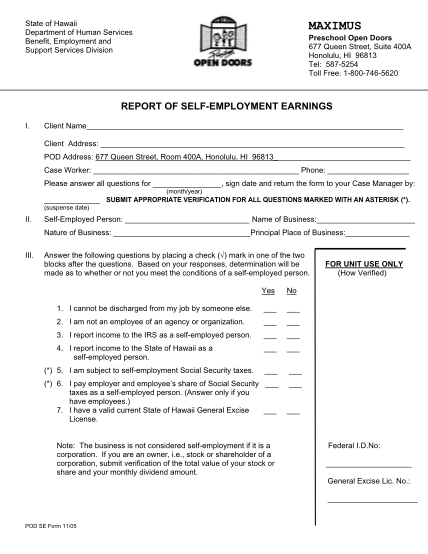

Listed here is a simple look at the top loan providers that provide HELOCs getting bad credit. Click the lender’s term regarding the table to see a little more about the accept the HELOC getting individuals having less than perfect credit or zero credit history.

As you you are going to see, the minimum credit rating having good HELOC seems to be high than for of a lot personal loans or any other kind of borrowing.

Overall, credit happens to be stronger just like the 2021, due to the fact interest rates enjoys risen considering the Federal Reserve elevating prices. In an effort to stop a host just like the 2007 so you can 2009 Higher Credit crunch and you can casing crisis, lenders-like with very first and second mortgage loans-need to make sure they might be loaning in order to legitimate borrowers.

Shape Most useful full

Figure also offers HELOCs as much as $eight hundred,000 in order to individuals that have credit scores out of 640 otherwise finest, which is felt fair borrowing from the bank for the FICO level. You can check their pricing instead of affecting your credit scores, but entry a complete app can lead to a painful borrowing eliminate. This can lower your credit rating and you may apply to your credit history, you is to visit your score recover in about six months otherwise immediately following and make toward-date repayments in the event that repayment months initiate.