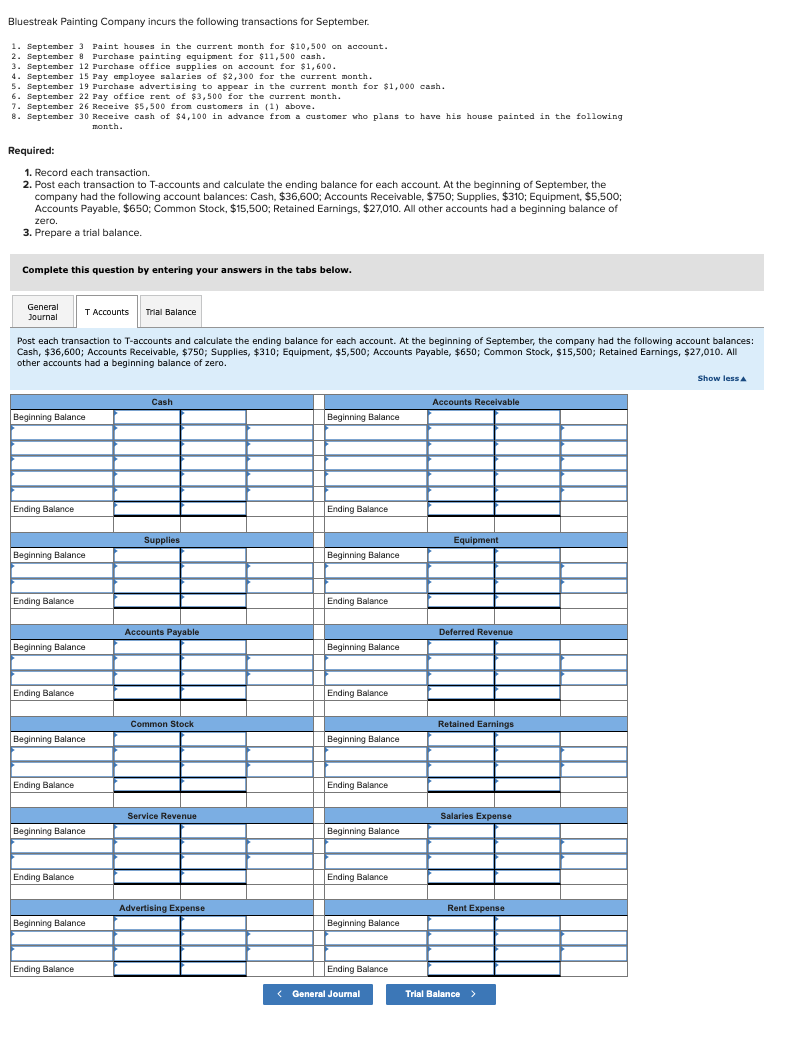

Personal Education loan App & Underwriting Procedure

Underwriting a student loan is a bit diverse from other types regarding obligations. Which have individual fund, you nonetheless still need to undergo an acceptance process, but with government financing you’ll find shorter strict standards.

Many or the businesses looked promote settlement so you’re able to LendEDU. Such income are how we manage our totally free provider having consumerspensation, plus circumstances out of inside the-depth editorial look, determines in which & how people show up on our webpages.

For the cost of university fees increasing from year to year throughout the United Claims, the majority of students find yourself having fun with college loans so you can help spend the money for will set you back.

Searching for grants and you can conserve to you’ll be able to, you might still has actually a funding gap. That is where applying for student loans are located in.

With individual student loans, even when, there was an enthusiastic underwriting techniques. This can be similar to financial underwriting or underwriting having an enthusiastic auto or personal loan, but there are variations also.

What exactly is Mortgage Underwriting?

Whenever lenders attempt to decide if youre an effective risk before making a final decision, it elevates because of an enthusiastic underwriting processes. This step is designed to influence the likelihood that you’ll be able to repay the loan.

Your credit score are drawn, along with your credit score, financial comments, earnings, and you may tax returns. This documentation is commonly considered to determine if you will end up equipped to handle monthly payments afterwards. On personal student loan underwriting techniques, their school options and you can biggest can also be considered, instead of a mortgage software.

See, even in the event, by using federal student loans, i don’t have an identical underwriting process. Backed and you may Unsubsidized Head Financing are around for student and scholar pupils, no matter what borrowing situation. Government Plus fund getting mothers and you can grad youngsters, in the event, do wanted a finite credit assessment.

When providing personal figuratively speaking, you will be at the mercy of this new underwriting procedure, just like would certainly be for people who wanted to acquire playing with other sorts of debt. This is actually the step-by-step process of the mortgage software and you can underwriting procedure having good personal education loan.

Information you need to submit

Because you get a personal education loan, you will want to gather particular documentation and possess determining suggestions available to the underwriting process. Before you over an application to have a student-based loan, make sure you have the following the guidance readily available:

- Title

- Birthdate

- Social Coverage count

- License or any other county-granted ID count

- Most recent physical address

- Contact number

- Current email address

- Money

- Financial obligation repayments

You can also be required to publish even more papers, instance duplicates out of data files that establish your states. Instance, tax statements and you can spend stubs, and additionally financial statements, will help mortgage underwriters make sure your revenue. Their lender statements may additionally let underwriters observe how far you are obligated to pay and you will what you pay monthly on your own debt or put any potential red flags, hence makes reference to your debt-to-earnings ratio.

Whenever applying for individual college loans, be sure to talk about and that colleges you’re deciding on, exactly how much you plan to help you use, incase you would expect in order to graduate. Specific apps require the planned biggest as well.

In the end, most loan providers and will let you incorporate a great cosigner to the application for the loan. This individual offers the duty to own installment and his awesome or the lady borrowing from the bank might possibly be noticed about underwriting techniques.

The new Acceptance Choice

Personal financial institutions and you can lenders do the advice you provide on your loan file and decide when they need to offer you money. It pull your credit history and check out your credit score to see if you have got a great history having while making repayments on your loans. Might also look at your cosigner’s credit report, when you yourself have you to.