Can it be best to acquire regarding my personal 401(k) otherwise have fun with my personal household equity?

Being unsure of whether or not to use from your 401(k) otherwise tap into your property guarantee? Inside side-by-side analysis, speak about the pros and drawbacks out-of a HELOC against. 401k mortgage.

Domestic equity versus. 401(k): Knowing the advantages and disadvantages regarding tapping into family equity rather than 401(k) if you want bucks.

Up against the difficulty of comparing a way to availability bucks? Many people are considering its monetary selection, but it is important to learn factors for every single.

Many American employees participate in 401(k) retirement savings accounts in order to prepare for retirement and save money on taxes. When searching for bucks, whether for an emergency, home improvement, college tuition or to combine debt, it can be tempting to take a loan out against your 401(k) to meet your needs.

Alternatively, homeowners have the option of accessing cash in the form of a home equity loan, domestic guarantee credit line (HELOC), or cash-out refinance mortgage. Home equity lending allows you to either replace your existing mortgage (a cash-out refi) or take a second mortgage (traditional home equity loan or HELOC). These loans are secured by your home, and therefore offer low interest rates and favorable repayment options, without risking your retirement.

Generally speaking, it certainly is a much better option to play with a good HELOC or domestic security loan over an excellent 401(k) mortgage, although not, most of the problem need another type of solution. HELOCs tend to be more versatile in terms of borrowing and you will repayment.

Key Review

Home equity fund, home collateral lines of credit (HELOCs), and 401(k) loans are typical financial options for opening cash without the chance of utilizing a charge card otherwise personal bank loan.

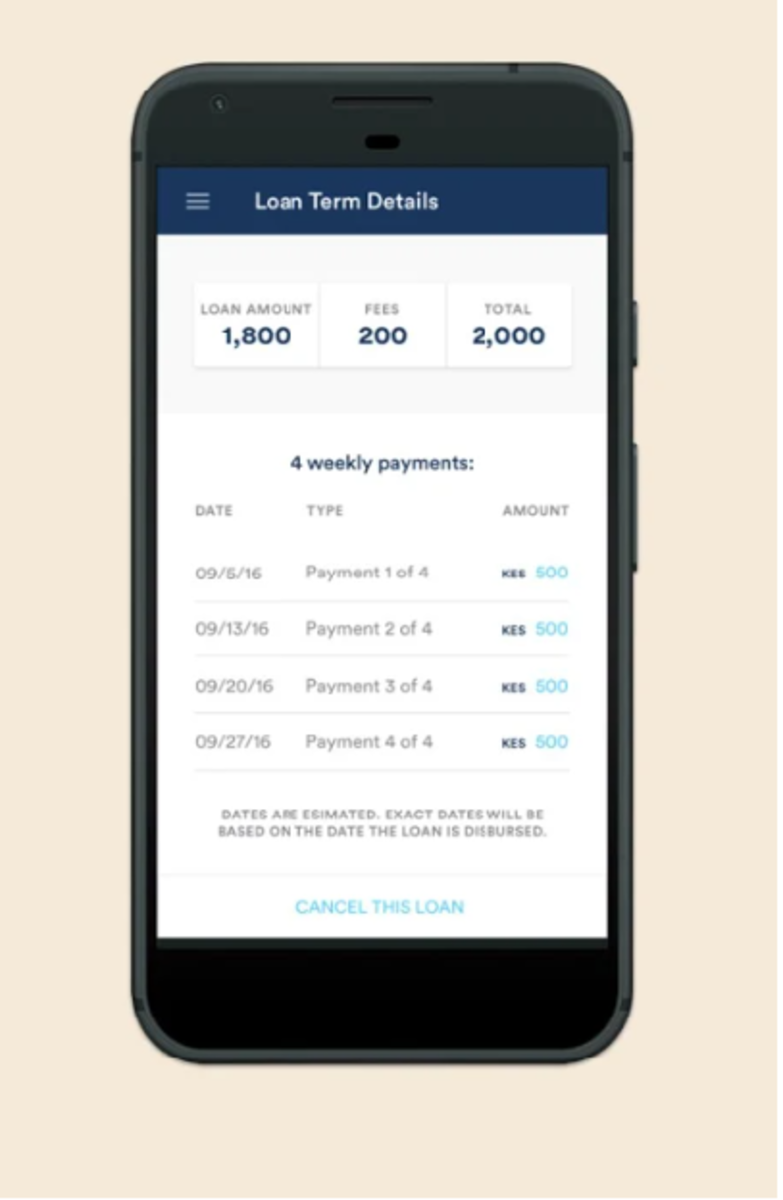

401(k) fund allow you to borrow secured on retirement discounts however, been having punishment, costs, quick fees episodes (five years), and extra terms and conditions established by the company.

Household collateral personal lines of credit (HELOCs) enables you to borrow on new equity you may have accrued when you look at the your house with an increase of independency during the credit limit and installment than simply having a beneficial 401(k), but not, it does tend to be closing costs or any other charge.

Borrowers is examine the costs off credit (costs, punishment, and you may charges), the eye costs, and you may installment conditions to choose which kind of financing is the best due to their demands.

Borrowing from your own 401(k)

Because that money is intended for old age, withdrawals try annoyed before you get to many years 59 ?. There clearly was an excellent ten% punishment with the amount borrowed, and you’ll need to pay federal income tax into matter withdrawn if you choose to withdraw money before one to many years.

Exceptions to that particular were: you happen to be by using the currency to spend medical costs, you’ve end up being handicapped, you may be needed to manage military duty; and/or you are needed to follow a court buy. The other exception to this rule is when you happen to be 55 and you can a member of staff whom are let go, discharged, or exactly who quits a career between the chronilogical age of 55 and 59 ?, it is possible to availableness the bucks on your 401(k) package without punishment, according to Irs.

Certain 401(k) plans allow people to acquire from their old age savings. If you’ve gathered some funds during the a retirement account, which is often a supply of financing to own merging your debt. It could be more straightforward to borrow from the 401(k) than simply bringing recognized for a financial loan off an outside bank. Preparations have a tendency to need teams to settle as a result of payroll deductions, which means your monthly just take-domestic shell out could be shorter of the mortgage commission.

401(k) agreements typically want you to finance be paid off within this five years, definition the monthly premiums could be greater than finance having good longer term. Some agreements do not let participants to help you contribute to the master plan while they has that loan an excellent. You will lose out on people coordinating efforts from your own employer at that moment.