Mortgage pre-approval: Will it be really worth the challenge to possess homebuyers?

- Lauren Jones

Very, you’ve found your ideal home-usually the one you simply envisioned-and have now confidently filed a look at here deal. You might be believing that the regular jobs and you can prime credit history have a tendency to pull you as a consequence of, even with bypassing the fresh pre-recognition procedure. Yet not, when the property’s seller obtains several offers and leans into the individuals which have pre-approvals available, your dreams is quicker to help you rubble at the legs.

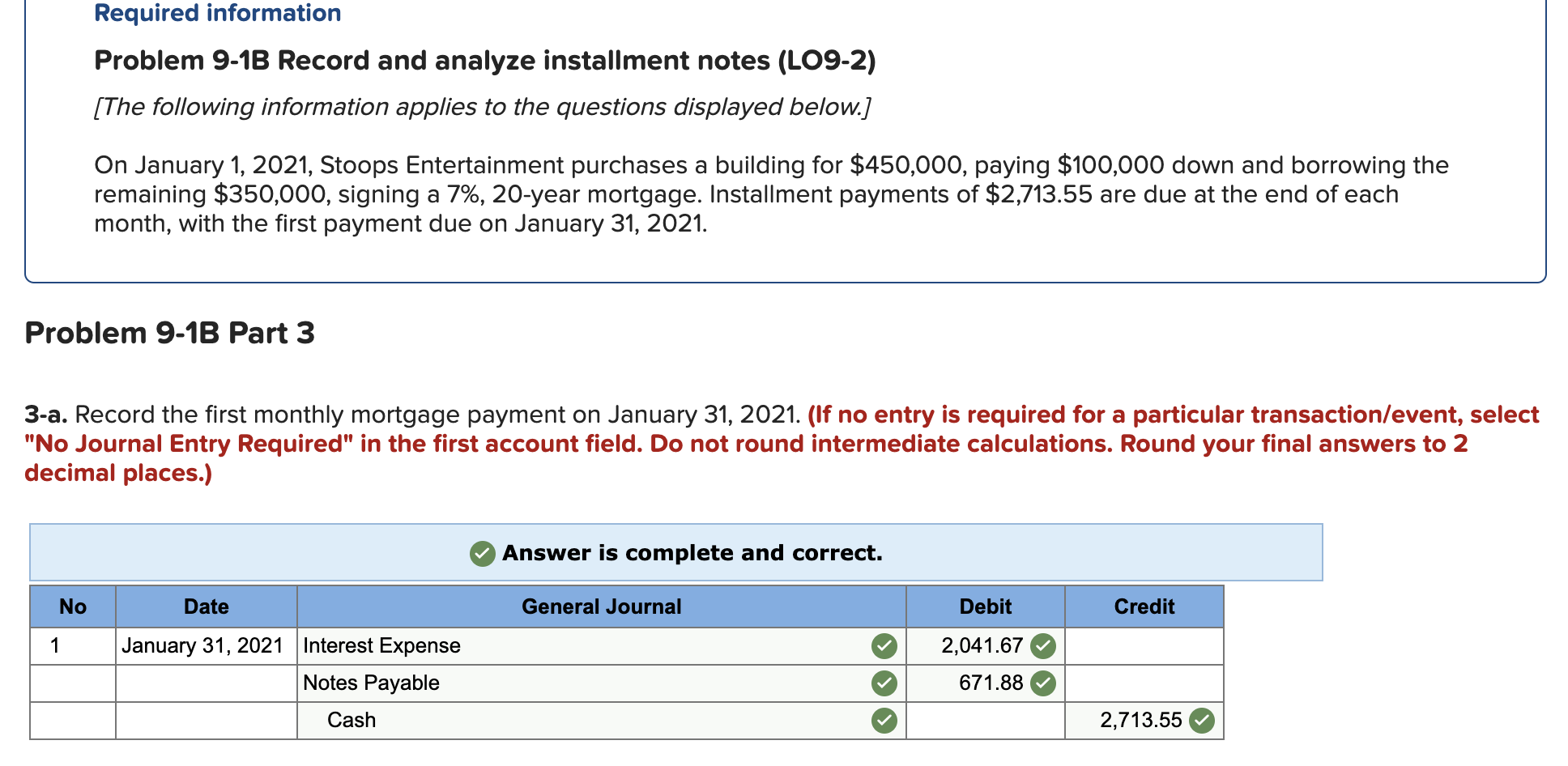

What is home financing pre-recognition?

In the world of home, a beneficial pre-acceptance is the techniques where a quickly-to-feel homebuyer possess their economic and you will borrowing recommendations evaluated to decide the absolute most they are lent having a mortgage.

It’s important to note that an effective pre-approval is not a guarantee out-of an interest rate. The very last acceptance depends on products like the certain assets being bought, this new assessment of the home, and you may any alterations in this new buyer’s financial predicament.

Exactly who otherwise and therefore agencies is also grant pre-approvals?

A beneficial pre-acceptance getting home financing is normally granted of the a home loan company otherwise a lender which provides mortgages. Homebuyers can be means individuals loan providers, and additionally banks, credit unions, otherwise financial companies, to seek pre-approval.

How was residents benefitted off protecting good pre-recognition?

Most readily useful Comprehension of Budget: An excellent pre-acceptance assists homebuyers influence the finances by giving a very clear image of how much they could afford to obtain. It will help all of them run qualities inside their financial function and you may hinders wasting day towards the residential property that will be external its budget.

Honours Settlement Fuel: Sellers commonly view pre-accepted customers so much more favorably because they have displayed their ability so you’re able to safer funding. With good pre-recognition strengthens your situation throughout transactions and certainly will build your give more appealing as compared to buyers with not yet covered funding.

Quickens Closing: Given that much of the fresh new financial files is reviewed during the pre-approval processes, it does end in a faster closure process. Manufacturers will get choose consumers that will romantic the offer effectively, and you may a pre-acceptance reveals that youre a serious and you will wishing consumer.

Hinders Frustration: Instead of an effective pre-approval, people will discover the ideal house just to realize afterwards one to they cannot keep the required resource. This might be mentally and you will logistically difficult, whilst pressuring consumers to return in order to square one to that have lost hope. That have a pre-recognition facilitate people create offers confidently, with the knowledge that capital could be acknowledged.

Hinders Possible Crisis: Within the pre-recognition process, loan providers determine some economic circumstances, such as for instance credit rating and you may debt-to-income proportion. It will help choose people obstacles which can need to be tackled in advance of shifting which have property purchase.

Just how long does pre-recognition grab?

The amount of time it takes to obtain pre-acknowledged for a financial loan may vary, however it typically takes a few days so you can weekly. The procedure requires the homebuyer submission detailed financial advice, particularly money statements, a job verification, credit history, and you will information regarding property and expense, on bank. The financial institution following reviews this article to evaluate the newest borrower’s creditworthiness and you may economic balance. Predicated on it assessment, the lender decides the most he or she is happy to give to your homebuyer having a home loan.

Lenders determine pre-approvals by thoroughly comparing the brand new borrower’s financial situation, creditworthiness, or other related circumstances. They may choose to not agree financing for several explanations, the most used from which together with a debtor which have less than perfect credit records, shortage of income, a high obligations-to-money proportion, not enough security, incorrect software, and you may erratic employment record.

Carry out lenders work at your borrowing to have financial pre-recognition?

Most lenders do work on a credit score assessment as part of the home loan pre-acceptance techniques. This enables them to determine their creditworthiness and assists into the determining the newest terms and conditions of the prospective mortgage. Keep in mind that numerous credit concerns in this a brief period for the intended purpose of mortgage pre-approval are managed because the just one inquiry to minimize new affect your credit rating.