Depreciation Causes, Methods of Calculating, and Examples

The expense amounts can then be used as a tax deduction, reducing the tax liability of the business. Given that amortization and depreciation are both deductible from taxes as business expenses, they can prove very beneficial for business clients. They can be especially beneficial for smaller businesses that are operating difference between accumulated depreciation and depreciation expense with limited budgets. While capitalization increases assets and equity, amortization is reflected as an expense on the income statement and reduces net income. The sum-of-the-years‘ digits (SYD) method also allows for accelerated depreciation. You start by combining all the digits of the expected life of the asset.

Physical Deterioration

Some companies don’t list accumulated depreciation separately on the balance sheet. Instead, the balance sheet might say “Property, plant, and equipment – net,” and show the book value of the company’s assets, net of accumulated depreciation. In this case, you may be able to find more details about the book value of the company’s assets and accumulated depreciation in the financial statement disclosures.

Importance of Understanding Depreciation in Accounting

She holds a Bachelor’s degree from UCLA and has served on the Board of the National Association of Women Business Owners. She also regularly writes about business for various consumer publications. Investors should pay close attention to ensure that management isn’t boosting book value through depreciation-calculating tactics. The guidance for determining scrap value and life expectancy can be ambiguous. Investors should be wary of overstated life expectancies and scrap values.

What is the difference between amortization and depreciation?

It is typically reported on the Balance Sheet, alongside the asset’s gross value, to provide a clear picture of the asset’s net book value. The Depreciation Disclosure, which includes Accumulated Depreciation, is essential for stakeholders to understand the asset’s value and the company’s financial position. Put another way, it implies that while there is a decrease in net income on the income statement, there is no actual cash outflow from the business.

Standard Journal Entry to Record Depreciation

- The yearly depreciation expense using straight-line depreciation would be $22,500 per year.

- Understanding accumulated depreciation is essential for accurately reporting an asset’s net book value on the balance sheet.

- Over the next few years, an extra $9,000 will be added to the accumulated depreciation account.

- Inaccurate depreciation calculations can have a significant depreciation impact on a company’s financial health and decision-making processes.

- Depreciation expense is consistently reported on a company’s income statement, serving as a vital non-cash charge that accounts for the systematic allocation of asset costs over their useful lives.

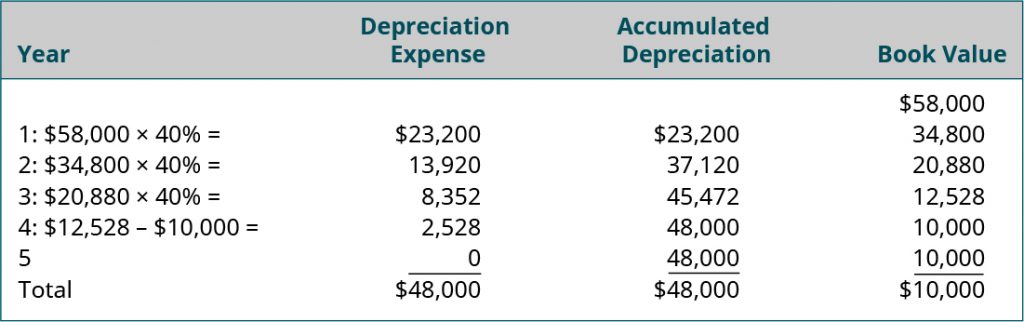

The amount of depreciation expense recorded depends on the asset’s cost, useful life, and depreciation method. Understanding depreciation basics is essential for accurate financial reporting, tax compliance, and informed decision-making. Effective asset management requires a thorough understanding of depreciation principles, as it enables companies to optimize asset utilization, minimize waste, and maximize returns on investment. Some of the standard methods usually include declining balance, straight-line depreciation, double-declining balance method, sum of the year’s digital method, and units of production. Accumulated depreciation refers to the cumulative depreciation expense recorded for an asset on a company’s balance sheet.

Get in Touch With a Financial Advisor

Based on the 60-month useful life of the machine, Quest will charge $12,000 of this cost to depreciation expense in each of the next five years. Depreciation expense is recorded on the income statement as an expense and reflects the amount of an asset’s value that has been consumed during the year. Tracking the depreciation expense of an asset is important for reporting purposes because it spreads the cost of the asset over the time it’s in use. Depreciation expense is recorded on the income statement as an expense, representing how much of an asset’s value has been used up for that year. For purposes of the units of production method, shown last here, the company’s estimate for units to be produced over the asset’s lifespan is 30,000 and actual units produced in year one equals 5,000. Accumulated depreciation is used to calculate an asset’s net book value, which is the value of an asset carried on the balance sheet.

This is the expected value of the asset in cash at the end of its useful life. The two main assumptions built into the depreciation amount are the expected useful life and the salvage value. It will have a book value of $100,000 at the end of its useful life in 10 years. Accurate depreciation calculations also facilitate better financial analysis and decision-making.

Depreciation is an accounting entry that reflects the gradual reduction of an asset’s cost over its useful life. The difference between an asset’s cost and its accumulated depreciation is the asset’s book value, also known as its carrying value. The asset’s cost is the amount the company paid to acquire or construct the asset. It includes all costs necessary to get the asset ready for its intended use. Accumulated depreciation is the total amount of depreciation expense that has been recognized and accumulated on the asset since its recognition.