Simple tips to Dump Some one Of a home loan Instead Refinancing

To get rid of someone of a mortgage in the place of refinancing, options become a loan expectation where in fact the remaining borrower requires full responsibility, otherwise acquiring bank acceptance to modify the loan and remove the brand new individuals identity, usually during the divorce cases.

If you have home financing having a words but need alter who’s entitled with it, you could try to find solutions for how to eliminate anyone away from home financing as opposed to refinancing. The great reports is, you have got possibilities, though the best choice will vary predicated on your specific points. Learn the a means to run your financial to change the brand new someone entitled on your own financial.

- Would you Get rid of Somebody’s Name Of a home loan In the place of Refinancing?

- Five A way to Lose Some one From home financing Instead Refinancing

- 1. Safe Acceptance About Lender

- See The 15 Items

Can you Treat Another person’s Label Off a mortgage Instead of Refinancing?

There are numerous issues in which anybody look to get rid of an alternative personal off a mortgage, along with separation, a beneficial co-signer trying to be removed after you have based the borrowing from the bank, an such like. Based your loan’s words and you can cost, refinancing is unsightly. You could end up getting a higher rate and spend more along side financing title.

Residents and you may co-signers is also beat the labels out-of mortgage plans with no need to help you re-finance or help the loan amount.

Possible start with looking at the options. These will vary centered on your needs, such whether or not one of the called anybody wants to suppose the loan.

Then you’ll definitely talk to your bank observe what they promote as much as changing brand new labels toward that loan. You need the financial institution so you’re able to agree to the fresh words that you will be asking for.

As you commonly refinancing, there may remain big documents on it. You’ll want to complete which records to complete the loan amendment and make certain that most other class has stopped being named for the insurance policies or taxes to possess a completely simple process.

Five Ways to Beat Anyone Away from a mortgage Versus Refinancing

Know the choices for changing the mortgage to eliminate someone of it. Is a peek at four means of completing this course of action.

step one. Secure Recognition Throughout the Financial

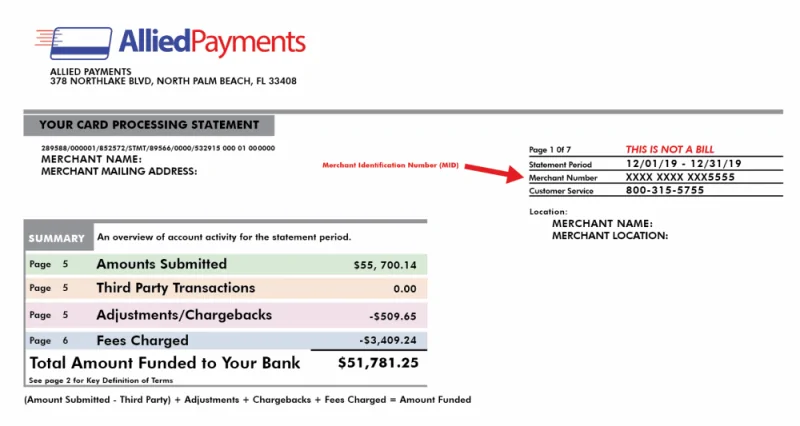

![]()

Their lender can also be eradicate a name out-of home financing versus refinancing. The hard spend the this is, it’s completely as much as the lending company to decide whether or not to make it this. The difficulty is the fact lenders are not motivated to bring loan amendment once the a lot fewer some one listed on financing setting less activities going immediately following to get financing should some thing make a mistake.

An advantage to this is that it is punctual and you may effortless if the financial approves they. A downside would be the fact you’ll nevertheless be dealing with monetary analysis observe if you might imagine the borrowed funds oneself and then have the necessary earnings to take action.

We prefer this 1 when they’ve done a divorce or separation and have now a splitting up decree that displays the new department off property. The lender understands it’s impossible they continue both sides on loan but you will still have to experience economic reviews.

2. Modify the Financing

Some loan providers are willing to change the mortgage loan terms without an effective refinance. The preferred have fun with circumstances having financing adjustment is actually altering attention rates or extending Lake View loans brand new payment period. These two factors tends to make the loan more affordable.

However, so you can qualify for these changes, your usually have to prove a financial hardship. Particular loan providers might think a divorce or separation otherwise court break up because a monetaray hardship. Only talk to your mortgage lender to find out if this really is an option.