How do you Score A normal Financing?

First-big date home buyers will find brand new (and you can complicated) jargon when they are making an application for a mortgage. „Compliant loan,“ „fixed-price,“ and you can „financing percentage“ are just a number of to-name. Although not, the essential perplexing identity by far try „antique mortgage.“

What’s a conventional home loan? When the there are conventional mortgages, what exactly are bizarre mortgage loans? What’s the difference in these two types of home loans? We’re going to address this type of issues and a lot more inside blog post.

Preciselywhat are Traditional Mortgages?

A normal home loan, called a normal loan, is actually a house buyer’s financing one funds 80% or less of the price of the home. As financing maximum was 80%, buyers have to have an effective 20% downpayment secured and accessible to them to be eligible for a normal loan.

While you are protecting anywhere near this much can be easy for many people, of a lot very first-date homeowners features a difficult time saving right up for example a big deposit amount because they keeps obligations (age.grams., outstanding student education loans).

Because the maximum loan amount is 80% of one’s mortgage, traditional mortgage loans have a tendency to have no type of large-ratio otherwise financial insurance fees. We are going to contact more about one to later on.

Just what are Unconventional Mortgage loans?

Strange, non-traditional, or higher ratio mortgage loans could be the appropriate contrary off old-fashioned mortgage loans. Bizarre mortgages cover more than 80% of your own complete closing costs.

- A negative debt so you’re able to money ratio (the amount of money one spends paying down loans compared on their monthly money)

- An unstable income source

- Quicker down-payment protected

- Straight down credit scores

In such cases, a client’s financing choice feel really restricted because the finance companies and financial businesses are wary of financing their cash to individuals with these kind of monetary portfolios. Thus, consumers need certainly to like mortgage loans supported by the federal government.

Fun facts: Non-antique mortgages must be backed by an authorities department. This type of mortgages help protect the lender, not the fresh borrower.

Is actually Conventional Mortgage loans The product quality?

You will need to remember that traditional finance commonly the standard; customers have to has actually the very least deposit of 5% for a first household or 20% to possess an investment property. You can however buy property with no a 20% advance payment secured, it have most financing limits and you can rules need to follow along with.

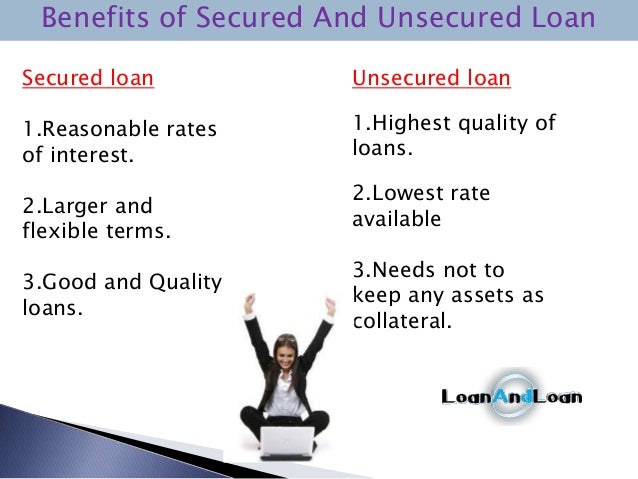

The benefits of Traditional Funds

Antique money have numerous masters to see. We’ll enter into depth toward some of the pros you might delight in for many who conserve adequate to discover a normal loan.

A conventional mortgage is far more very theraputic for homeowners while they keeps more equity right at the beginning of the mortgage.

As customers with a conventional loan enjoys reduced a bigger down percentage because of their assets, he has got far more collateral within their home. More collateral can be hugely beneficial as it provides customers that have use of a more impressive household collateral mortgage otherwise domestic guarantee line from credit.

2. You should never Spend Financial Insurance rates

Financial insurance rates protects loan providers when your debtor non-payments to their mortgage repayments. Insurance policies generally will set you back dos.8% so you can 4.0% of one’s complete home loan amount. After you spend personal mortgage insurance rates (PMI) towards the top of the mortgages, they sets a-strain on your own power to make your monthly repayments.

Fortunately, mortgage insurance is usually simply necessary for any mortgage that’s more than 80% of home’s purchase price otherwise market value. Ergo, home owners having conventional financing won’t need to get financial insurance coverage.

3. More enjoyable Credit Criteria

The mortgage business features conditions you to definitely consumers must meet and you may go after. Such requirements tend to be demonstrating your credit score, source of income, and a lot more. When you find yourself such words are often an equivalent, they could differ according to whether you’re receiving a conventional or highest proportion mortgage.

Unconventional mortgages are given so you can customers who have a reduced down commission, less than perfect credit score, an such like. Since customers don’t have exactly what lenders consider an effective ’stable financial portfolio,‘ they located more strict credit requirements. Thus, they may have to go apart from to show that they are responsible consumers.

4. All the way down Mortgage Pricing

Usually, individuals is discover lower interest levels when they’ve a conventional mortgage in place of an unconventional you to definitely. The pace that you will get is a vital determinant out-of your bank account. Interest rate has an effect on the amount of their month-to-month mortgage repayment and, thus, the cost of your own complete mortgage.

Such as for instance, if you secure a twenty five-season mortgage to possess $400,000 that have an excellent step three% rate of interest, you will pay $146, in interest in the latest 25 years. You are going to need to pay $253, in the desire for individuals who receive the exact same loan with a great 5% rate of interest.

Borrowers always merely discovered all the way down costs when they’ve good credit score and you can a decreased personal debt so you can money ratio. We recommend bringing your credit score to help you loan providers to understand just what rates they’re able to offer.

First of all you need to do will be to assemble all materials necessary for lending attributes. You will have a copy of credit history, proof of a position and you will people economic information to show so you’re able to potential lenders.

After you have that information gathered, visit personal loan providers including banking companies, borrowing from the bank unions, and mortgage people to inquire about an interest rate. I suggest speaking to a large financial company as they commonly support you in finding the best cost.

Faq’s (FAQs): Strange Mortgage loans

Strange mortgages are non-conventional lenders that range from simple repaired-rate or variable-price mortgage loans. They frequently provides unique has actually, such as choice certification requirements otherwise repayment structures.

Traditional mortgage loans follow standard lending recommendations, if you find yourself unconventional mortgage loans deflect from the norms. Strange mortgage loans have all the way down credit history conditions, interest-just money, otherwise balloon costs.

An interest-only home loan lets individuals to expend just the notice percentage of the borrowed funds for a selected period, generally speaking 5-ten years. After that initially months, they must begin paying down each other prominent and attract.

Possession begin by a predetermined interest rate having a flat months, then the rate adjusts periodically based on market requirements. They’re experienced unconventional as a result of the uncertainty of coming interest changes.

Subprime mortgage loans try loans available to borrowers having straight down credit ratings or reduced antique borrowing from the bank histories. They frequently have highest interest levels to compensate to your enhanced exposure to help you loan providers.

Consumers get go for strange mortgage loans if they have unique economic activities, such as unpredictable earnings, limited credit score, or perhaps the need for short-label capital https://speedycashloan.net/payday-loans-mo/.

The fresh viability out of a non-traditional financial hinges on your unique monetary issues and you will desires. Its necessary to very carefully check what you can do to manage threats and you will speak with a mortgage top-notch and also make the best choice.