To acquire property having Assumable Financial – To visualize Or perhaps not

Because people discover imaginative and you will proper approaches to visited its homeownership requires, you to choice that can develop are to buy a home that have a keen assumable home loan. If you are searching at the property available in Portland where a keen assumable home loan is an alternative, there’s something you need to know to assist show you from inside the a confident home buying sense.

First, need a genuine house class you can trust. Call us when more resources for purchasing property into the Portland, and keep training more resources for assumable mortgage loans and you can whether or not they are best fit for your. Less than we’ve got indexed a number of the Faqs in the assumable mortgage loans and you will to shop for an assumable house inside the Portland, and a few of the pros and cons of getting with this specific type of financial support.

What exactly is an enthusiastic assumable mortgage?

An enthusiastic assumable mortgage is a kind of financial which enables good homebuyer to take more, or „suppose,“ current home loan of the vendor when purchasing property. Thus the customer essentially procedures into sneakers out of the original debtor and you will gets control of the brand new small print away from current home loan agreement.

In today’s market standards, of several suppliers has a much better rate of interest than even the ideal customers could possibly get, very an assumable financial would be an approach to progress mortgage criteria. While it is definitely not an alternative in some cases, you might find a vendor prepared to bring that it provider and you can it simply might be the perfect treatment for build your homeownership requires possible.

What about the fresh Owed-on-Business Clause?

If you currently own property otherwise were comparing mortgages, you can ask yourself the way the owed-on-marketing condition perform apply at an assumable financial. Of several mortgage loans include a due-on-selling clause, which provides the lender the authority to request full installment out-of the mortgage in the event the home is offered or relocated to a great the holder. not, assumable mortgages particularly allow for the import of your own mortgage to a special borrower in place of triggering the latest owed-on-profit term.

What kinds of homes can be purchased with an assumable financial?

The brand new quick response is almost any family are going to be ended up selling that have an assumable financial! It has got significantly more regarding brand new seller’s money compared to household alone. There’s assumable virginia homes into the Portland within the an excellent number of looks and you can price activities, to ensure any sort of you are interested in you may be able to view it which have an assumable home loan choice.

Who’ll be eligible for an enthusiastic assumable home loan?

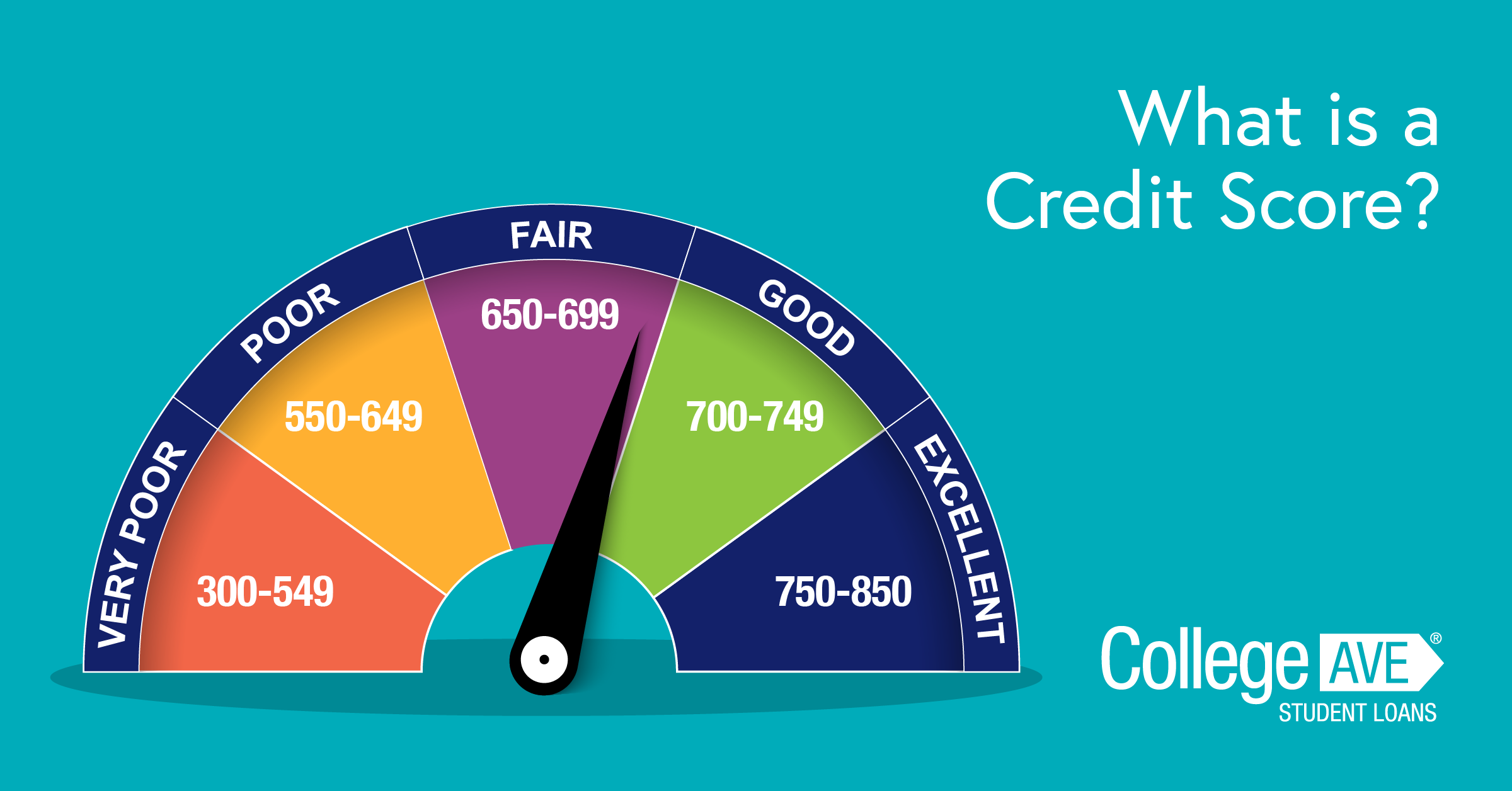

Make an effort to be eligible for the new assumable home loan similarly to how you would qualify for another home loan. Per circumstance can get its own requirements, therefore it is better to be ready with all of their papers and you can guidance so you’re able payday loans Sanford to easily find out if you are going to meet the requirements. Overall, lenders away from assumable mortgages are thinking about credit worthiness and you may economic balance during the equivalent a means to any other bank.

FHA (Federal Construction Administration) and you can Virtual assistant (Company off Pros Factors) fund normally have assumable enjoys. Traditional financing, in addition, are typically maybe not assumable, otherwise they may convey more restrictive assumability terms.

Do you know the great things about to get an assumable family?

One of the primary advantages of of course, if a home loan ’s the prospective entry to a favorable interest rate. In the event the seller’s financial have a lesser interest than just latest industry costs, the buyer will benefit away from down monthly installments and you may less total appeal will set you back. This is the situation for the majority providers in the industry best today.

And in case a home loan may include straight down closing costs compared to protecting another type of financial. Antique financial procedure tend to are costs getting mortgage origination, appraisal, and other attributes. With a keen assumable home loan, the consumer could easily save well on some of these will set you back.

It’s also a more effective procedure. The belief out of a preexisting home loan can lead to a more quickly closure procedure than the getting a unique financial. Traditional mortgage applications involve comprehensive underwriting, that may devote some time. And when a home loan, at the same time, line the method, allowing you to close to your property even more expeditiously.

What are the threats otherwise prospective drawbacks to purchasing a home which have an enthusiastic assumable mortgage?

Usually, to purchase a keen assumable residence is perhaps not a risky alternatives. Just like the process may differ, it is not so much more economically risky. A few of the simply downsides are availability and you will undetectable conditions.

Not absolutely all mortgages are assumable, and also those types of that will be, particular standards and needs must be satisfied. The availability of assumable mortgage loans is limited, and you may consumers may prefer to choose attributes where that one try feasible.

It is quite important to very carefully see all of the terms. Some assumable mortgages is a precise transfer of your sellers‘ fine print, this isn’t constantly the situation. Specific assumable mortgages could have terminology allowing the lending company to adjust the interest rate in the course of assumption. Customers have to very carefully review the fresh new terms of the present home loan to know any potential customizations that can affect the overall cost of your own financing.

Let’s say the brand new assumable mortgage is not a premier sufficient amount?

In some instances, the price of the home will meet or exceed the degree of the new assumable home loan. If you don’t have the bucks making within the differences, there’s likely nonetheless an effective way to purchase the assumable home.

You to option would be to get an extra mortgage. In this situation, the customer takes on the current financial along with its most recent conditions and you can up coming removes an additional mortgage to cover the even more finance necessary to meet with the high conversion price. This strategy allows the buyer to influence the fresh assumable mortgage’s favorable terminology when you are protecting extra funding toward remaining count.

Oftentimes, the vendor may be accessible to taking investment straight to the latest visitors towards number above the assumable home loan That it arrangement, labeled as seller financial support, requires the provider becoming the lender additionally the client while making money on vendor through the years. Vendor financing conditions will have to become negotiated and you can formal as a result of courtroom arrangements.

It is important to observe that the popularity and you can way to obtain assumable mortgage loans may differ, therefore the certain terms of assumption confidence the financial institution and you will the sort of home loan concerned. While you are in search of in search of a home which have an assumable mortgage choice on the Portland city, we could help! Contact us anytime.