Is it bad to get barrier financing and no credit assessment?

If the a loan provider offers zero credit check funding, just be careful. Though some lenders can create financing give without take borrowing from the bank, will ultimately ahead of funding the loan they’re going to probably need to pull your borrowing. If you think you have found legitimate zero credit check resource you should do the due diligence on lender and you can feedback words very carefully before signing up or revealing recommendations. In the event the anything looks too good to be real, it probably try.

However, once you deal with an offer and you may finish the process on financial that you choose, they will certainly want to remove your own borrowing from the bank

In some cases, builders otherwise brief mom and you will pop stores could possibly offer inside-home resource which they is able to render with no credit check. It is impractical locate such agreements, although not hopeless. In-house funding is frequently very expensive. You’re thrilled that exist the financing your need but when you can pay high rates, it has to assist you in some way except that providing a beneficial fence. If you are using resource that’ll not appear on your own credit history, you will likely never ever eliminate this new period off bad credit.

A different way to borrow cash without a credit check are to utilize a family financing. Children mortgage is really what it may sound including. For those who have a friend or partner that is happy to help you loan you currency, they could, and additionally they will most likely not eliminate your borrowing. If you utilize a household financing, you might still pay attention as well as the financing will not be to your your credit history. Once more, this could give you ways to borrow the money you you would like but may not assist in improving your credit score. Borrowing money from a legitimate bank which can remove the credit, may help change your credit score, if you make for the-big date money. It is best to attempt to be eligible for genuine money before going with an alternative means.

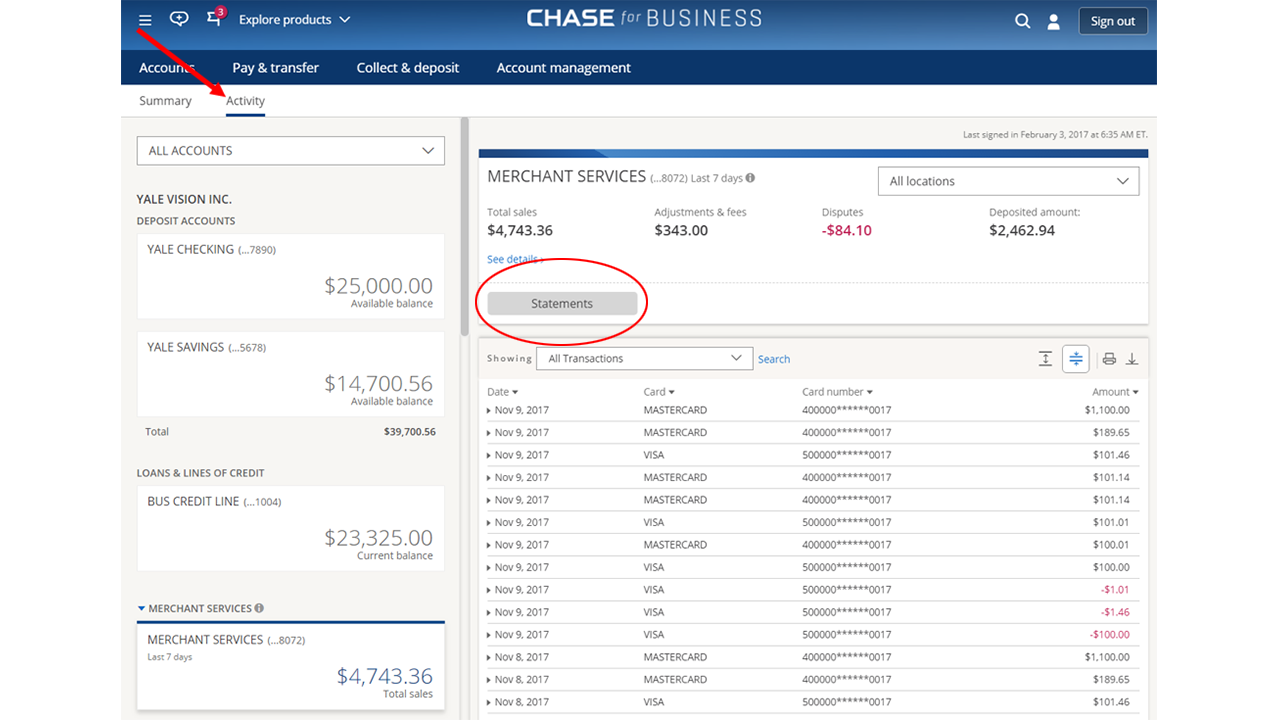

Within Acorn Finance you can check personal loan has the benefit of to possess fence resource no impact on your credit rating. This can be normal of course, if a loan provider will not love the borrowing, discover almost certainly a catch elsewhere. Pay close attention.

Can it be bad so you’re able to obtain to own wall financing which have poor credit?

There are some circumstances the place you will need to money good barrier that have less than perfect credit. Possibly the dog is leaking out and you should create an excellent barrier to keep your beloved buddy safe. In the points along these lines $255 payday loans online same day Maine you truly lack time for you to rebuild your borrowing after which borrow cash. More often than not it is not crappy to help you borrow funds with bad borrowing from the bank, though it might cost your more funds. If you are going so you can borrow funds with poor credit, there’s something you ought to scout having. Financial support that have less than perfect credit makes it furthermore to contrast mortgage also provides. Since you contrast also offers, evaluate more than simply the payment plan. While it is crucial that you could pay the monthly payment, a decreased monthly payment is actually constantly the lowest priced loanpare APRs and you may full financing costs when you compare loan also offers. Pick one having an affordable monthly payment and you will lower overall mortgage will set you back versus other even offers. Try to afford the mortgage regarding as quickly as you’ll be able to because this could actually work with your credit rating.

Fence financial support with less than perfect credit are bad whether your percentage package is just about to make you battle economically. There is certainly methods for you to developed a barrier getting a beneficial lot less cash. Such, you happen to be capable buy used material regarding a neighborhood markets and you will install new barrier oneself. If you’re able to attempt, you will possibly not you desire investment.