Ways to get An educatonal loan Instead of Good Cosigner

Education loan without good Cosigner

You are a student considering undertaking an integral section in your life in the form of your own college education, regrettably, you will be hindered because of the a diminished funds to have resource they. The simplest way using this conundrum is by using getting educational funding because of the truthfully completing their Free Software to possess Federal College student Help (FAFSA). If your software clearly screens a significance of help, you’ll not be disturb, and you will certainly be awarded federal loans, has, and you may efforts better-known because the government really works-investigation software.

The new federal fund are the most useful method of getting student loans in place of cosigner; more over, you are not required to possess a powerful credit rating so you can get recognition of these funds. Thus, while you are looking additional information for you to rating students mortgage versus good cosigner, then the federal funds could be http://elitecashadvance.com/installment-loans-nj/kingston the perfect answer for your own ask

Checked Apps and you can Schools

The main issue with getting a student-based loan as opposed to an effective cosigner and other different federal school funding is the fact that number may not be adequate for using all of your current school expenditures. You might have to carry out then look on how best to score financing instead an effective cosigner out-of personal groups.

Getting Education loan as opposed to a great Cosigner Individually

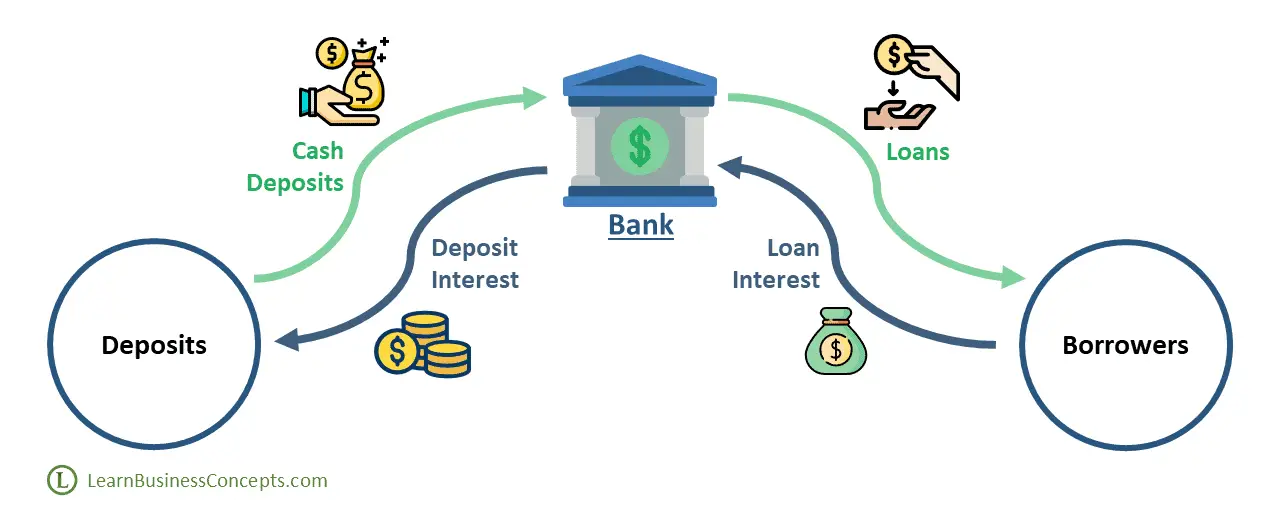

There are some personal financial organizations which can offer detailed information for reacting your own inquire on how best to score a beneficial student loan in the place of an effective cosigner. All of these teams get invest in agree their consult for financing rather than a good cosigner but always at extortionate will cost you out-of money. The eye cost to have fund in the place of cosigner are generally much higher; and that, your repayments after you scholar certainly will be much greater than a loan with good co-signer.

Thus, seeking private money instead cosigner, that is a long, monotonous, and regularly a troubling procedure, shall be done simply since a past resort we.elizabeth. shortly after stressful virtually any alternatives from financing for your school expenses. Should you be able to score that loan versus a beneficial cosigner, it is usually a smart idea to combine your debt after their graduate. You may have improved your credit score throughout your degree, and have even reached a good jobs. Many of these situations reduce steadily the rate of interest toward consolidated financing and work out the brand new cost task quicker challenging.

Most useful Choices for Student education loans

Subsidized Government Fund The us government takes the responsibility off paying the appeal to have particular periods. These funds are available for youngsters from the undergraduate peak.

Unsubsidized Government Fund This type of loans have a bigger umbrella. All of the children, also at the graduate height, can use of these financing.

The thing to remember is that which have these two loan sizes, there’s an annual cover on the count the young try allowed to borrow, which in some instances might not be sufficient to shelter the expenses. Thus, meet up with costs, there are even solutions out-of individual student loans.

Things to consider

- Calculate the loan need.

- Contrast different options.

- Estimate and contrast interest rates.

- Assess brand new period very carefully.

- Make sure to have a very good credit score.

A:Getting an educatonal loan rather than a great cosigner maybe hard nevertheless isnt a hopeless work. To begin with you need a good credit rating, ergo constantly manage strengthening you to. Government financing do not request good cosigner however, private lenders carry out want a great cosigner to make certain that the fresh new fund is repaid. While you are not able to get an effective cosigner then you might become energized large rates as risks into lender and grows.

A:Taking an educatonal loan as opposed to an effective cosigner is not a challenge since the nothing of federal school funding options wanted youngsters to possess an excellent cosigner to stand qualified to receive loan. Pupils can opt for the new Stafford and Perkin loans. They are able to connect with both of these financing of the distribution the fresh FAFSA form.