Basic, we’re going to look at how much cash it can save you for many who chosen thirty six week car finance

- $30000 The fresh Car finance

- Car or truck Financing

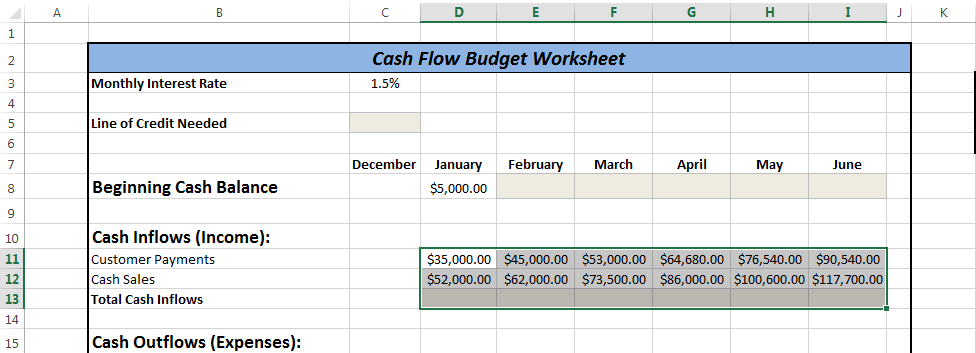

The rate on auto loan together with your credit history is 4.2%, your own payment per month was $. The full paid count might possibly be $step 3. However, when you enhance your borrowing from the bank because of the 50 facts, new Annual percentage rate could be straight down. The reason being people with top borrowing from the bank score fund within lower interest rate. New Annual percentage rate might possibly be step 3.41%, the car monthly payment was $ just like the full reduced matter was equal to $3. Therefore, this shows that one may cut $, by just boosting your credit rating a little bit.

In the sense, if you prefer the fresh new 48 times financing and your credit rating are 700, you get Apr out-of 4.2%. This new monthly payment is actually $ therefore the total cost was $3. Concurrently, for those who have 750 credit score which have Apr 4.2%, the fresh payment would be equal to $. The complete cost could well be $3. Hence, it will be easy to save $.

There are numerous great things about increasing your borrowing from the bank. You will get best rates, you’re going to have to spend reduced into monthly base, and also the total matter paid down might be less as well. So, oftentimes, it can be concluded that increasing your credit because of the fifty points, will allow you to cut plenty on your own car loan. Its well worth boosting your credit score before you apply to your loan, because does not only rescue your finances however, often help have a great profile as well.

Unsecured loan Options

Unsecured loans for folks which have an excellent 700 credit rating will tend so you’re able to start from fifteen to seventeen percent, have a tendency to shedding between 16 and seventeen percent. This will be a tremendously average variety of fico scores, and for that reason, you may not get a hold of incredible costs and you can terms. Yet not, with some work, you might find interest levels head to doing several % subsequently.

Providing Mortgage

With a credit score regarding the selection of 650 so you’re able to 699, you might be eligible for a mortgage. The fresh new tolerance to get home financing often is as much as 620. However, your terminology could be on top of the range, with 700 FICO score financial interest rates between five to help you five per cent. A mere step one% decrease of the interest rate will save you around $one hundred four weeks on the financial, therefore attempting to create your installment loans in Surrey ND with bad credit borrowing is essential.

Provided these items, your credit score is one of the most important number into the your daily life. It does apply to every step you’re taking, on household you reside into the automobile your drive. Delivering methods to change your own FICO score is the best method to save cash and also make your daily life convenient later on. There’s absolutely no justification not to ever alter your credit score!

How can be your credit score determined?

The three major credit reporting agencies believe in five types of guidance in order to calculate your credit score. It gather this article off various supply, and collect it to supply a total rating. This new score is composed of thirty five% percentage records, 30% balance due, 15% credit score, 10% the newest borrowing, and you may 10% credit assortment.

Your own commission records is key component that helps to influence your credit score. On easiest terms and conditions, your commission record lies in how often you pay at minimum minimal fee in your expenses promptly. not, some of the other factors aren’t so simple. The following most important factor ’s the count you borrowed, which is in accordance with the level of borrowing from the bank available for you than the number of personal debt you have got. This is certainly titled the borrowing from the bank utilization ration, therefore matters given that lenders faith you are prone to miss costs in the event your credit cards is actually maxed aside.