Would you Get a no-Assessment Family Collateral Credit line?

From the Amanda Dodge

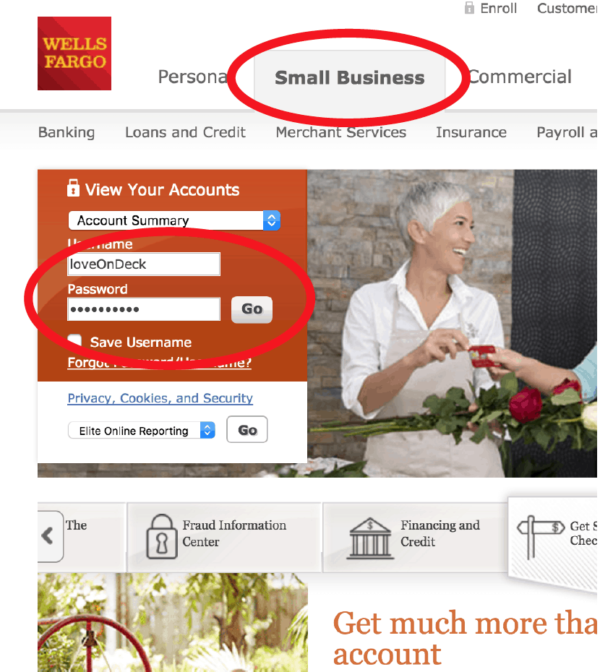

Once you build mortgage payments or your house worthy of increases, their guarantee grows. A house guarantee financing otherwise credit line is when you pull from this guarantee, liquidating their value which means you has money getting household projects, college tuition, and other lives will set you back. Probably one of the most popular standards are acknowledged getting a beneficial house guarantee mortgage is an assessment, that offers a goal estimate of one’s property value your home.

Although not, particular people you are going to choose non-appraisal family equity money and credit lines. These may getting easier, quicker, and a lot more affordable selection. When you’re no-appraisal domestic equity loans can be found, they are not since prominent and you can include constraints. Weiterlesen