Look at the Qualification To possess Mortgage brokers with assorted Banking institutions

Duration of Loan (Years) Its probably one of the most keys that you should constantly envision before taking a home loan. Prolonged the new tenure, highest is the focus reduced and lower will be the level of EMI and you may vice-a-versa.

Rate of interest (inside the percentage) Presently, there are numerous banking institutions that offer home loans, if or not nationalized, individual otherwise foreign banking companies. All the financial now offers additional rate of interest according to the character of one’s customers. Hence, really it is very important one to before selecting a lender for taking that loan you ought to examine the new rates away from certain banking institutions. It usually is better to see full info ahead to have undertaking a better assessment .

EMI EMI represents similarly month-to-month fees; you have to pay a specific amount on the Home loan you have removed .

Eligible Amount borrowed The web based amount borrowed the place you is eligible for your residence loan is alleged because Eligible Loan amount. The borrowed funds number that a bank is sanction your.

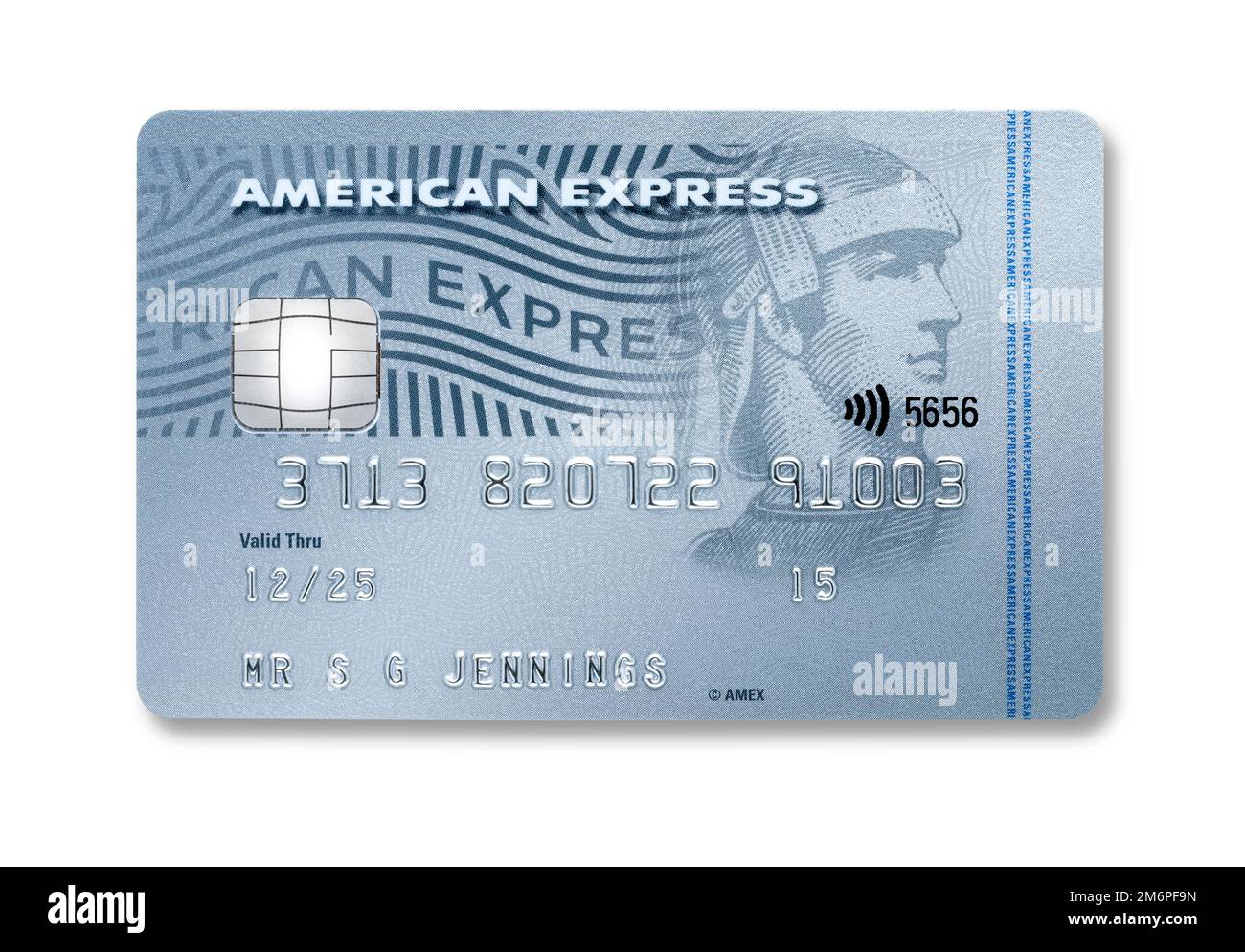

Credit rating The credit reputation of an individual plays a really very important role in the ount of one’s mortgage. Which statement is done by the creditors concerning your an excellent credit rating of individuals. On such basis as this information the individual is provided a good credit history.

Ages Years together with takes on a vital role in the determining the fresh new qualification to have a mortgage. Weiterlesen