What to do if you have feel domestic bad

Household repairs costs are a price which might be difficult to assume. While a rule of thumb is always to booked step one% so you’re able to cuatro% of your own residence’s worthy of every year towards solutions and restoration, you ple, for many who individual a great $400,000 house, 1% of your worthy of would be $4,000, while you are cuatro% would mean putting away $sixteen,000 annually. In case your residence is old, you can deal with highest expenditures, since you may have to change or fix more often.

For people who face a change in your debts, you might be household terrible despite your absolute best perform. Perchance you has just forgotten your job, otherwise your circumstances had been slash. Whereas you’re capable pay for houses costs prior to, the change during the earnings function your be unable to manage actually your mortgage payments. Let’s consider certain steps when deciding to take if that is the place you come across oneself.

When your homeownership hopes and dreams features turned way more for the nightmares since you happen to be family poor otherwise at risk of are very, you can find best practices you might apply. Several immediate implies you are capable of getting to the far more safe financial footing is leverage your coupons and you may looking a way to fit alot more from your own budget.

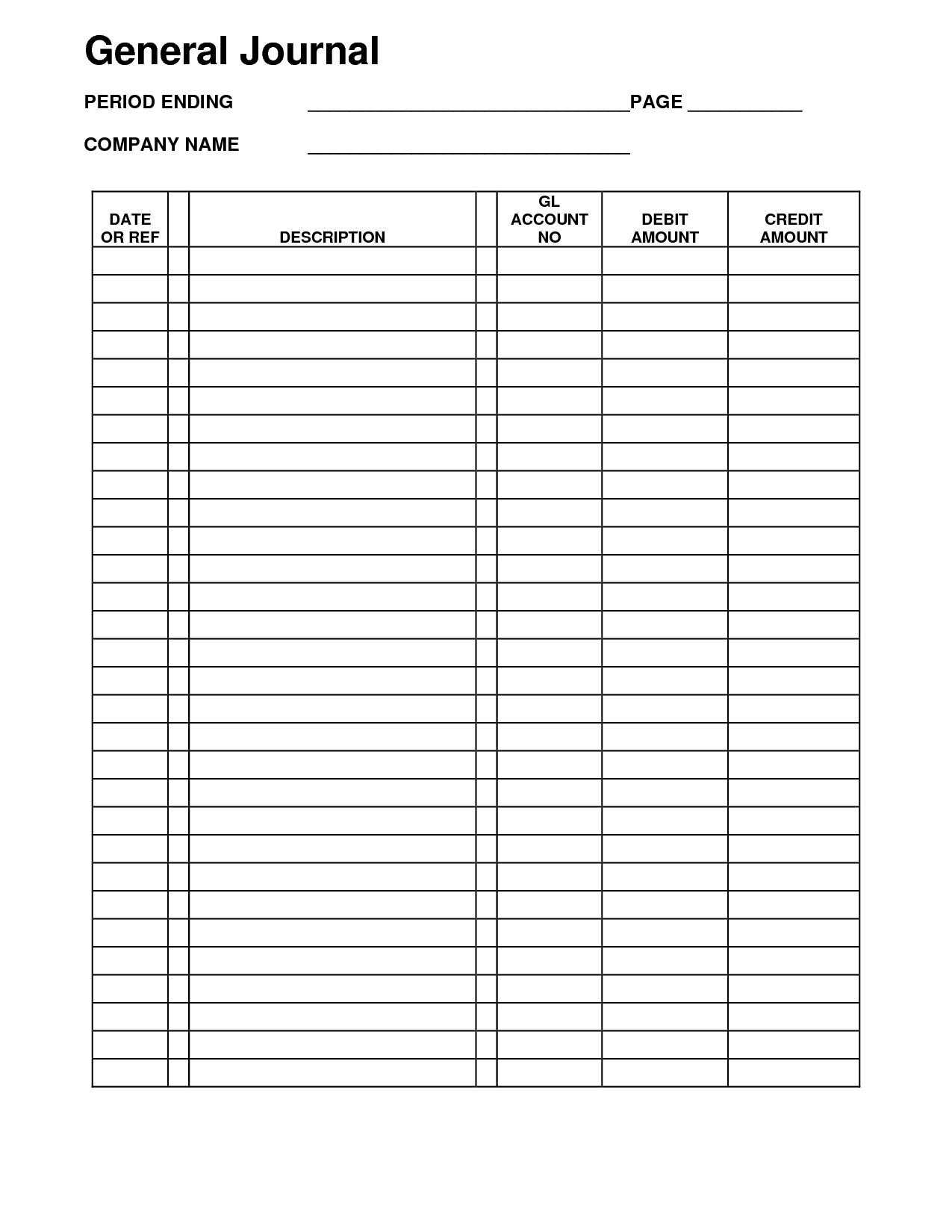

step one. Review your financial allowance

It the most obvious but furthermore the most crucial action. Take a look at your purchasing and see in which you can briefly cut back. Weiterlesen