Varying Apr: A great $ten,000 mortgage that have a beneficial fifteen-seasons name (180 monthly obligations out-of $) and a keen % ount from $21

Splash Revelation

![]()

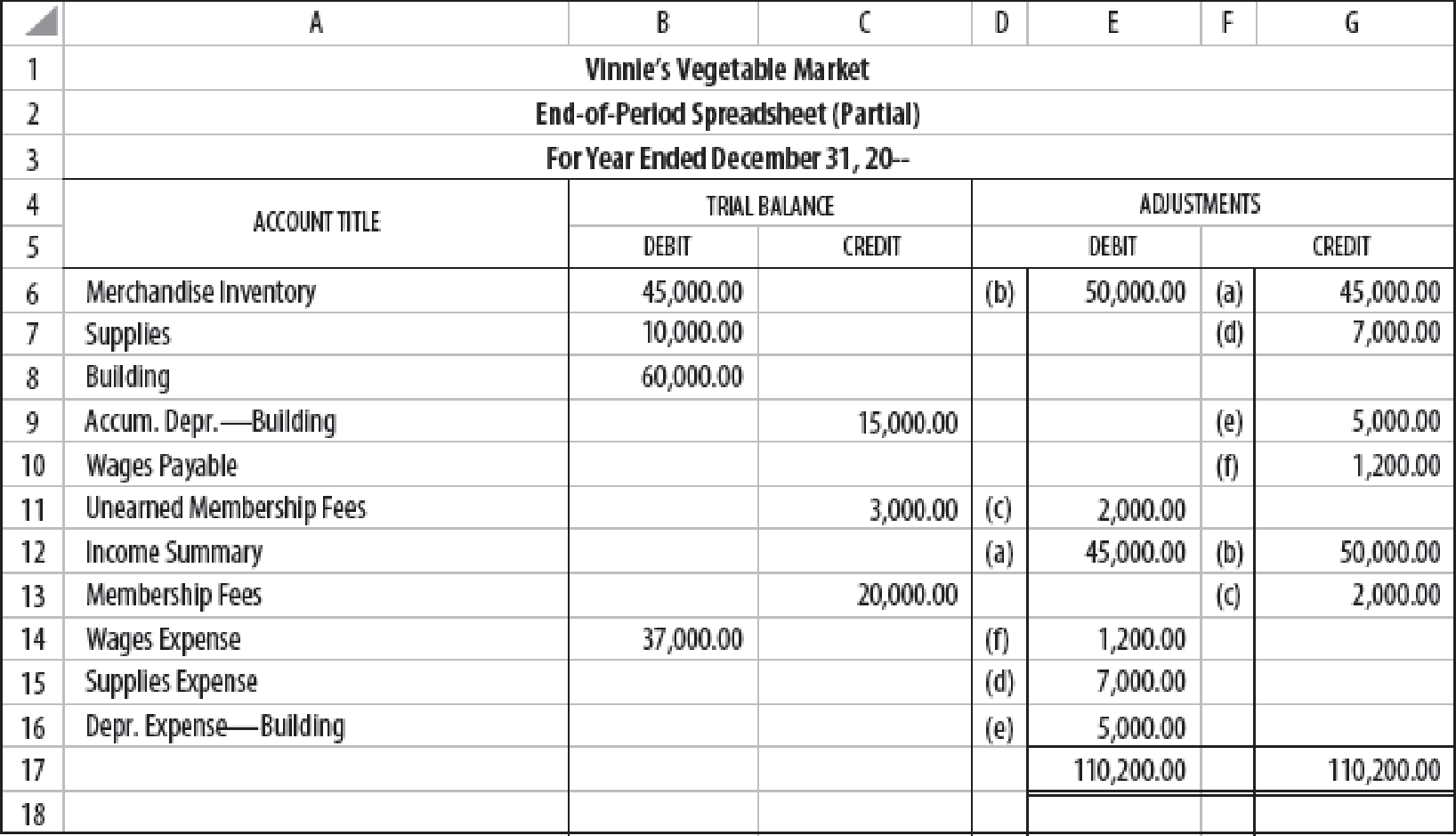

These types of advice bring rates in line with the Deferred Repayment solution, definition you create zero money if you find yourself enrolled in college and you may throughout the the brand new separation ages of nine battery charging periods after that. Getting a variable financing, after your undertaking price is set, your own price will then vary towards sector. Fixed Annual percentage rate: An effective $10,000 mortgage with good fifteen-year name (180 monthly installments off $) and you can an % ount away from $twenty two,. Your real repayment words may vary.

Serious Funds manufactured by Serious Businesses LLC otherwise You to American Lender, Associate FDIC. Earnest Surgery LLC, NMLS #1204917. 535 Objective St., Suite 1663, San francisco, California 94105. California Investment Law License 6054788. linked here Check out serious/permits to own the full selection of authorized says. To possess Ca customers (Student loan Re-finance Just): Money would be set up otherwise produced pursuant in order to a ca Investment Rules Permit.

One to American Lender, 515 S. Minnesota Ave, Sioux Drops, SD 57104. Earnest finance is serviced because of the Serious Procedures LLC, 535 Mission St., Collection 1663 San francisco, California 94105, NMLS #1204917, that have help out-of Advanced schooling Mortgage Authority of Condition away from Missouri (MOHELA) (NMLS# 1442770). One to Western Bank, FinWise Lender, and Earnest LLC and its own subsidiaries, together with Earnest Businesses LLC, commonly paid because of the businesses of your Usa. Weiterlesen