*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text-4xl md:text-6xl top-injury font-black“>Minimal credit rating you’ll need for home financing

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text-xl md:text-3xl best-gripped font-bold“>Rounding it up

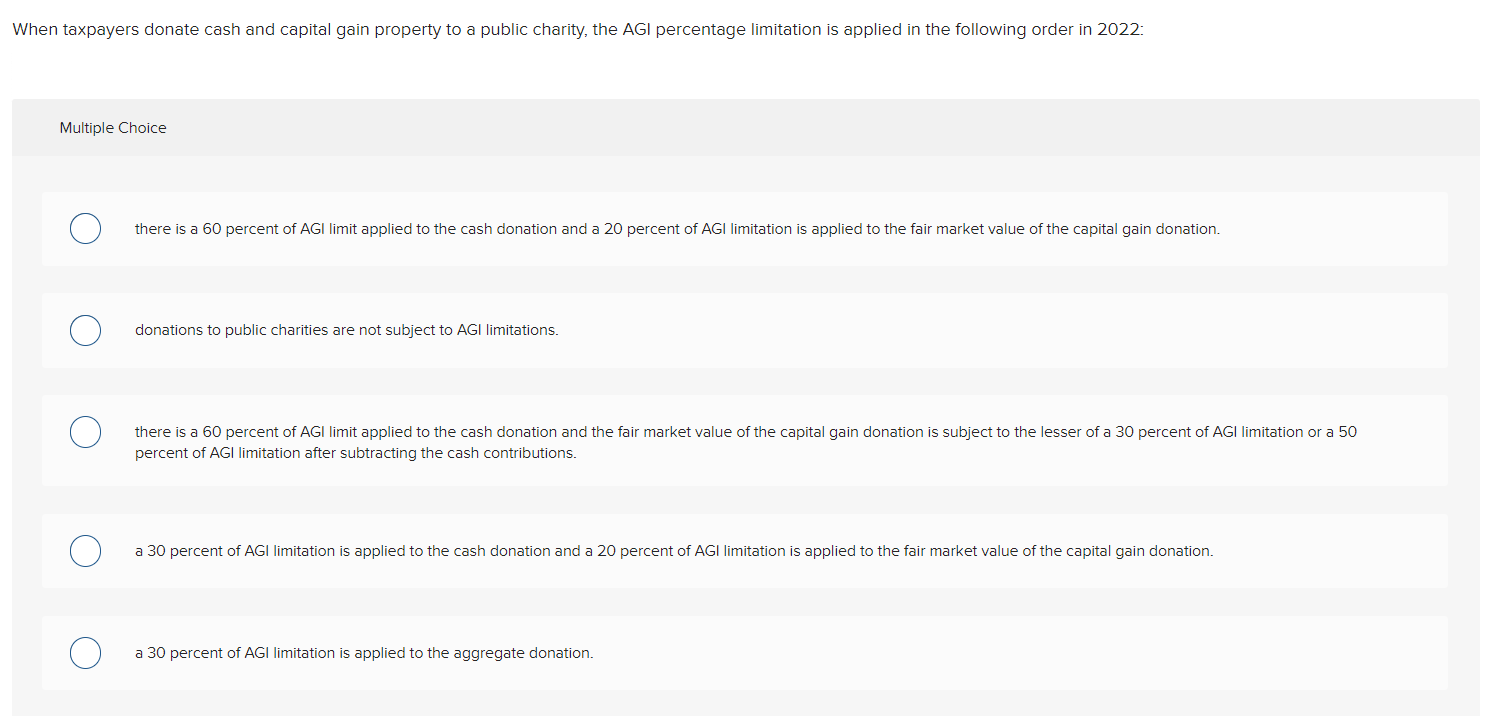

*]:mt-0 [&_a]:text-blue [&_a]:underline cut off text message-md md:text-lg leading-normal minute-h-[step one.5em] font-regular [&>*]:last:mb-0 mb-0″>To be certain you’re accepted getting a mortgage, and also to have the best prices, you need to have good credit

*]:mt-0 [&_a]:text-blue [&_a]:underline take off text-md md:text-lg leading-regular min-h-[step 1.5em] font-typical [&>*]:last:mb-0 mb-0″>Credit history conditions having mortgages disagree anywhere between loan providers and type of mortgages, however, fundamentally you need to have a rating which is experienced good or excellent

*]:mt-0 [&_a]:text-blue [&_a]:underline cut-off text-md md:text-lg top-normal minute-h-[1.5em] font-typical [&>*]:last:mb-0 mb-0″>It is possible to create your get in the event your around three-thumb credit score is sensed poor

*]:mt-0 [&_a]:text-blue [&_a]:underline block text-md md:text-lg best-normal min-h-[step 1.5em] font-regular [&>*]:last:mb-0″>If you are looking to find home during the Canada, chances are you will you desire a home loan. If you do not are actually ludicrously wealthy and certainly will pick a great home with dollars (this web site is not suitable your!), you’ll be able to require some assistance from a lender otherwise lender on the shape of a home loan in order to safe your brand new property.

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text message-md md:text-lg top-regular min-h-[1.5em] font-normal [&>*]:last:mb-0″>While considering mortgages, you are going to need a good credit rating. Your credit rating have a tendency to influence though you are accepted for a home loan and certainly will contribute to the latest costs you obtain. The greater your credit score, the higher your home loan. Weiterlesen