Eligibility and requires getting VOE Simply Finance

Making use of VOE financial options, new industries out of borrower eligibility widens, inviting a larger spectral range of candidates so you can secure capital due to their family pick. This approach aligns perfectly to the pattern on wider borrower eligibility standards, enabling those with faster antique economic backgrounds an opportunity to achieve homeownership.

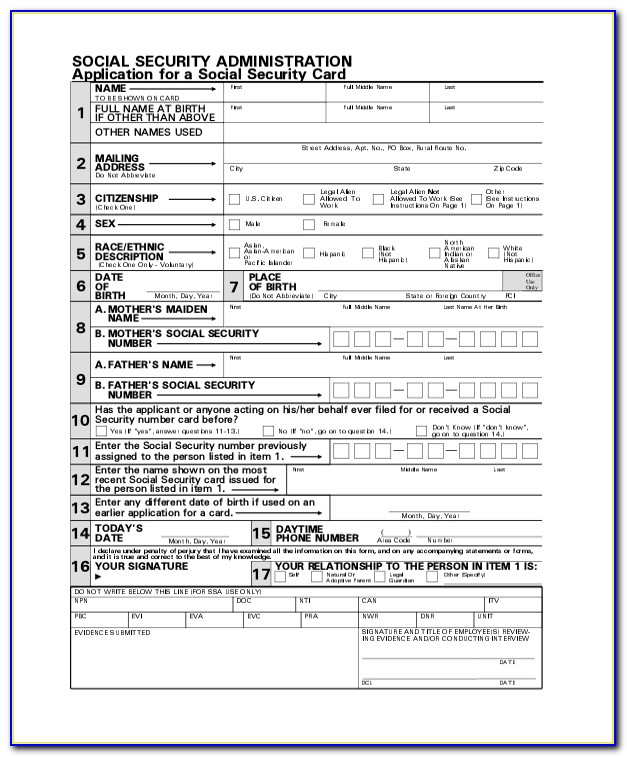

Shorter Paperwork to have Individuals

Generally, getting home financing pertains to gathering large levels of records, that is a frightening task getting individuals. Yet not, VOE mortgage loans are synonymous with lower documentation criteria, streamlining the process and you may easing the burden towards the prospective borrowers.

These persuasive gurus build VOE mortgage loans a option for many ambitious residents, especially in today’s punctual-paced housing market.

For those examining the possibilities of homeownership because of VOE just funds, understanding the particular eligibility criteria and needs is crucial. For every single feature-of credit score toward kind of possessions-performs a serious character within the determining a borrower’s viability because of it streamlined financing techniques. Let us delve into the information, guaranteeing you really have all the info you should carry on this new VOE mortgage excursion.

Credit rating and you may Financing-to-Really worth Percentages

To help you be eligible for a good VOE just mortgage, prospective individuals need certainly to first meet the absolute minimum credit score threshold. Currently, the new standard to own said really stands at the 600, however, highest scores might improve loan requirements. Moreover, the mortgage-to-well worth proportion (LTV) is actually just as pivotal, offering doing 80% LTV to buy and rates/identity refinances and you can a generous 75% for the money-out refinances, therefore enhancing the restriction loan amount available. Weiterlesen